Apple Inc.

CEO : Mr. Timothy D. Cook

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

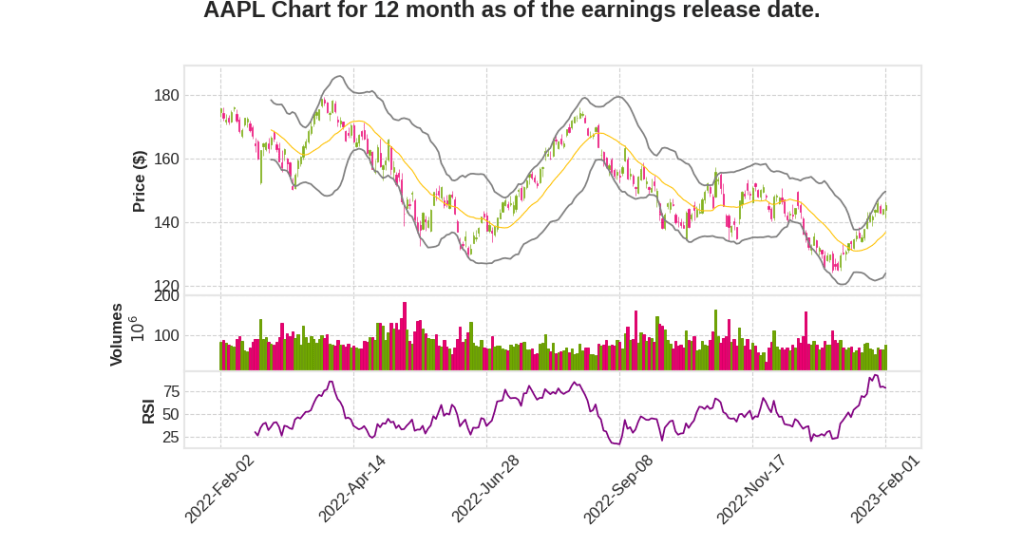

| 2023 Q1 | -5.5% YoY | -13.2% | -10.4% | 2023-02-02 |

Timothy Cook says,

Revenue Performance

- Revenue of $117.2 billion for the December quarter, down 5% YoY due to foreign exchange headwinds and a challenging macroeconomic environment

- iPhone revenue came in at $65.8 billion, down 8% YoY on weak supply of iPhone 14 Pro and iPhone 14 Pro Max

- Mac revenue was $7.7 billion, in line with expectations despite foreign exchange headwinds

- iPad revenue grew 30% to $9.4 billion, driven by the new iPad Pro and iPad 10th Generation

- Wearables, Home and Accessories revenue was $13.5 billion, down 8% YoY due to foreign exchange headwinds and a challenging macroeconomic environment

Product Updates

- New MacBook Pro models powered by M2 Pro and M2 Max chips were introduced, providing unprecedented performance with longer battery life

- Next-generation HomePod was announced, featuring advanced computational audio and sound recognition for smoke and carbon monoxide alarms

- Apple Watch Series 8 and Apple Watch Ultra with health and safety features for extreme athletes were praised by customers

- Freeform, a new app for real-time collaboration, was released for iPhone, iPad, and Mac

Services

- Set all-time revenue record of $20.8 billion in services, achieving double-digit revenue growth from App Store subscriptions

- More than 935 million paid subscriptions now active

- Launched historic 10-year partnership with Major League Soccer and MLS Season Pass

- Apple TV+ showcased hit movie Spirited and upcoming series Sharper and Tetris, along with Emmy Award winner Ted Lasso returning this spring

- Fitness+ expanded catalog of workouts and meditations, featuring artist spotlight series with Beyonce

- Apple Business Connect launched, giving businesses more control over how customers engage with their products and services on Apple apps

Environmental and Social Responsibility

- Strengthened commitment to privacy and security with new tools to protect sensitive data

- Using 100% recycled aluminum and rare earth elements in new Mac mini and MacBook Pro models

- Released Black Unity collection for Black History Month and expanding support of 5 organizations focused on lifting up communities of color through technology

- Donated more than $880 million to humanitarian efforts, disaster relief, childhood education, and more since inception of Giving program 11 years ago

- RED-supported grants have helped more than 11 million people get the care and support services they need

Luca Maestri says,

Revenue Performance

- Revenue for the December quarter was $117.2 billion, down 5% from last year mainly due to foreign exchange headwinds, supply constraints, and a challenging macroeconomic environment.

- Products revenue was $96.4 billion, down 8% from last year.

- While services set an all-time revenue record of $20.8 billion, up 6% over a year ago.

- For the March quarter, Apple expects its year-over-year revenue performance to be similar to the December quarter, with a negative year-over-year impact of 5 percentage points due to foreign exchange headwinds.

Product Performance

- iPhone revenue was $65.8 billion, despite significant headwinds, supply constraints, and a challenging macroeconomic environment, iPhone’s installed base of active devices grew double digits and achieved all-time records in each geographic segment and in each major product category, reaching over 2 billion active devices.

- Mac revenue was $7.7 billion, down 29% YoY, and the installed base of active Macs reached an all-time high across all geographic segments.

- iPad revenue was $9.4 billion, up 30% YoY, with the installed base of active iPads reaching a new all-time high due to incredible customer loyalty and a high number of new customers.

- Wearables, Home, and Accessories revenue was $13.5 billion, down 8% YoY, with the installed base of devices in the category setting a new all-time record.

Services Performance

- Services revenue reached an all-time revenue record of $20.8 billion, up 6% over a year ago, despite a difficult foreign exchange environment, and macroeconomic headwinds impacting certain categories.

- Apple Pay is now available to millions of merchants in nearly 70 countries and regions, and a record-breaking number of purchases made using Apple Pay were observed globally during the holiday shopping season.

- Paid subscriptions grew, with more than 935 million paid subscriptions across the services on the platform.

Gross Margin and Operating Expenses

- Company gross margin was 43%, up 70 basis points from last quarter due to leverage and favorable mix, partially offset by foreign exchange.

- Products gross margin was 37%, up 240 basis points sequentially, and Services gross margin was 70.8%, up 30 basis points sequentially.

- Operating expenses of $14.3 billion were significantly below the guidance range provided at the beginning of the quarter.

- Apple expects gross margin to be between 43.5% and 44.5%, while operating expenses are expected to be between $13.7 billion and $13.9 billion for the March quarter.

Capital Return Program and Cash Position

- Apple returned over $25 billion to shareholders during the December quarter to become net cash-neutral over time.

- Net cash was $54 billion at the end of the quarter, with $165 billion in cash and marketable securities.

Q & A sessions,

Supply Chain Optimization and Resilience

- Production disruption from early November to most of December but now resolved

- Apple builds products everywhere and continues to optimize the supply chain over time to improve

- Last 3 years have been difficult due to COVID and silicon shortages, but Apple has a resilient supply chain in the aggregate

Supply Availability and Margins

- Decent supply on most products for the current quarter

- Good margin for the December quarter at 43% with favorable mix

- Foreign exchange is an issue with negative impact on margins, -110 basis points sequentially and -300 basis points YoY

- March quarter expected to have margin expansion from 43.5% to 44.5%

- Cost structure optimization is paying off and mix will continue to help with margin improvement

- Foreign exchange is still a negative, about 50 basis points sequentially, but it’s mitigating