Applied Materials, Inc.

CEO : Mr. Gary E. Dickerson

Quarterly earnings growth(YoY,%)

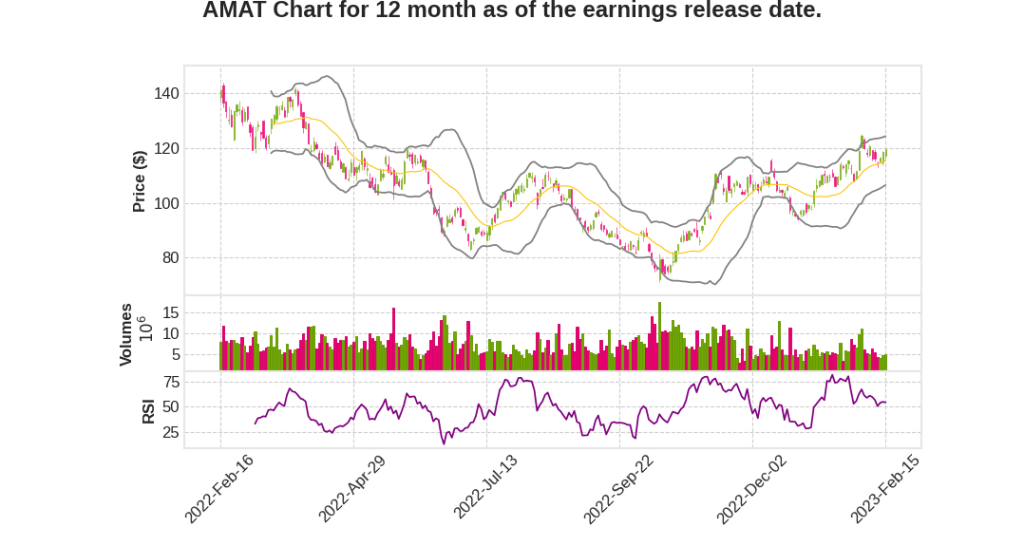

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | 7.5% YoY | -0.3% | 0.5% | 2023-02-16 |

Gary Dickerson says,

Backlog and Second Quarter Guidance

- Backlog growth for the ninth consecutive quarter

- Expect backlog to start declining as move through 2023

- Major supplier disruption impacting second quarter shipments

Near-term Market Perspective

- Consumer-driven markets, including PCs and smartphones are weaker

- Inflection-driven markets remain more resilient, especially high-performance computing and AI, automotive, industrial automation, and clean energy

- 2023 will be a down year for memory spending as customers rebalance inventories and defer capacity additions in both NAND and DRAM

- Leading-edge foundry-logic spending slightly down year-on-year

- ICAPS, chips for IoT, Communications, Auto, Power and Sensor applications, spending incrementally more positive

Applied Materials’ Position and Long-term Outlook

- Applied Materials well positioned to outperform the market in 2023

- Resilience driven by balanced market exposure, position with technology leaders, record backlog, and service business

- Semiconductor industry on track to grow from approximately $600 billion in 2022 to a $1 trillion or more by the end of this decade

- Technology complexity of chips is increasing significantly

- Applied Materials has deep pipeline of solutions to enable new wiring innovations, Gate-All-Around transistors, backside power delivery, heterogeneous integration and hybrid bonding

Strategic Investments

- Making strategic investments in new manufacturing, logistics, and R&D infrastructure

- Infrastructure investments seen as a catalyst to change the way Applied Materials collaborates with customers, suppliers, and research partners

- Investments in R&D and infrastructure, while driving improvements in productivity and speed across the organization

Service Business

- Service business on track to grow in 2023, even after the impact of current U.S. export control regulations

- More than 60% of service revenue generated from subscriptions in the form of long-term agreements

- Agreements have an average tenure of 2.6 years and a high renewal rate of more than 90%

Brice Hill says,

Industry and Company Context

- Applied has become more efficient and resilient over the years, generating high returns and growing free cash flow at a CAGR of 30% from 2013-2022, with a 35% return on invested capital.

- The company is investing to scale the business to support customers in what is believed to be a trillion-dollar semiconductor market.

- The company has committed to returning 80-100% of free cash flow to shareholders and has repurchased 40% of shares outstanding since 2013.

- Applied’s quarterly dividend per share has increased at a 14% CAGR over the past 17 years.

- The company is increasingly focused on improving productivity, making portfolio decisions to maximize returns from R&D investments and making manufacturing more efficient.

Q1 2023 Financials

- Applied delivered net sales of nearly $6.74 billion and non-GAAP EPS of $2.03, primarily driven by improved manufacturing and logistics costs along with pricing adjustments.

- Semi Systems revenue grew by 13% YoY to $5.16 billion, with ICAPS making up for reductions in memory and advanced foundry-logic.

- AGS revenue grew nearly 4% YoY to approximately $1.37 billion, absorbing a full quarter of revenue impact from U.S. trade regulations and performing better than expected.

- Display revenue declined to $167 million.

- Operational cash flow was $2.27 billion (34% of revenue), and $470 million was returned to shareholders.

Q2 2023 Guidance

- Applied expects revenue to be nearly $6.4 billion, up over 2% YoY.

- Non-GAAP EPS is expected to be $1.84, plus or minus $0.18.

- Semi Systems is expected to generate $4.84 billion in revenue, up over 8% YoY.

- AGS revenue is expected to be around $1.34 billion, down around 3% YoY due to the negative impact of recent U.S. trade regulations.

- Display revenue should be around $160 million.

- Applied’s non-GAAP gross margin is expected to be approximately 46.5%, lower quarter-over-quarter due to lower volumes and higher near-term supply chain logistics costs.

- The company is looking to expand global R&D and manufacturing infrastructure.

Q & A sessions,

ICAPS growth and acceleration

- Significant growth in the past year

- Accelerating into this year

China driving ICAPS

- China is the largest region and country driving ICAPS

- Not concerned about trade regulations affecting ICAPS in China

Capacity and investments

- Leading ICAPS manufacturers are adding capacity

- Capital intensity for these companies is increasing due to little used factories and equipment available in the market

- Investments are sustainable and being driven by government incentives in some cases, but not concerned about companies installing equipment and not using it

Underlying demand

- Confident in underlying demand for electrification, electric vehicles, and sustainable power

- All these markets are sustainable

Future outlook

- Seeing acceleration in ICAPS for their business and expecting it to continue