Meta Platforms, Inc.

CEO : Mr. Mark Elliot Zuckerberg

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

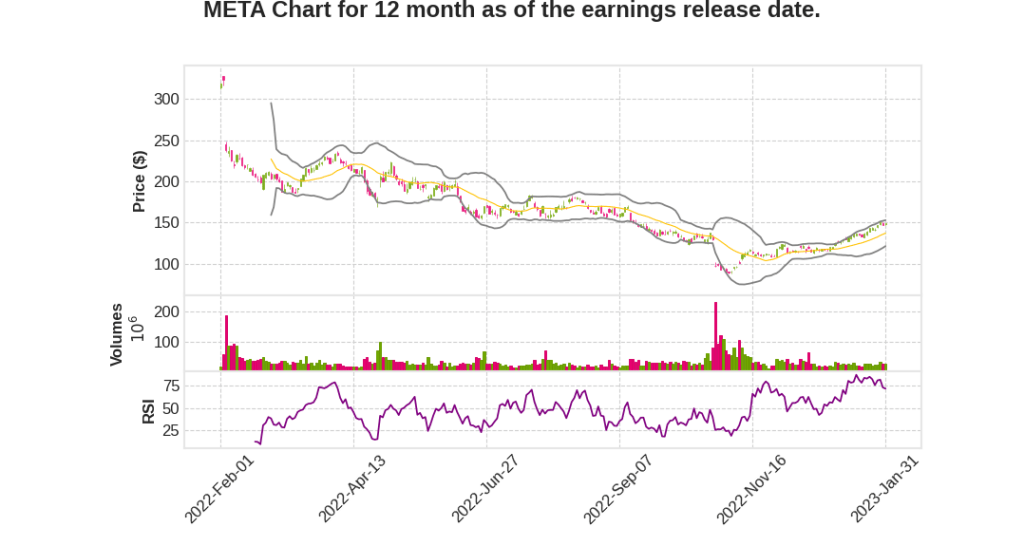

| 2022 Q4 | -4.5% YoY | -49.2% | -52.7% | 2023-02-01 |

Susan Li says,

Revenue

- Total Q4 revenue was $32.2 billion, down 4% YoY, or up 2% YoY on a constant currency basis.

- Q4 revenue would have been approximately $2 billion higher if foreign exchange rates had remained constant with the previous year.

- Q4 total Family of Apps revenue was $31.4 billion, down 4% YoY.

- Q4 Family of Apps ad revenue was $31.3 billion, down 4%, but up 2% on a constant currency basis.

- The financial services and technology verticals were the largest negative contributors to the YoY decline in Q4 revenue.

Expenses

- Total Q4 expenses were $25.8 billion, up 22% compared to last year.

- Cost of revenue increased 31%, driven mostly by a write-down of certain data center assets as well as growth in infrastructure-related costs.

- R&D increased 39%, marketing and sales increased 4%, and G&A decreased 7%.

Operating Income

- Q4 operating income was $6.4 billion, representing a 20% operating margin.

- Family of Apps’ operating income was $10.7 billion, representing a 34% operating margin.

- Reality Labs operating loss was $4.3 billion.

Headcount and Layoffs

- Facebook ended the fourth quarter with over 86,400 employees, including a substantial majority of about 11,000 employees impacted by previously announced layoffs who remained on payroll as of December 31, 2022.

- The vast majority of the impacted employees will no longer be captured in reported headcount figures by the end of Q1 2023.

- In Q4 2022, Facebook recorded $4.2 billion of total restructuring costs in connection with its efficiency efforts.

Outlook

- Facebook expects Q1 2023 total revenue to be in the range of $26 billion to $28.5 billion.

- Facebook anticipates its full year 2023 total expenses will be in the range of $89 billion to $95 billion, lowered from the previous outlook of $94 billion to $100 billion due to slower anticipated growth in payroll expenses and cost of revenue.

- Facebook now expects to record an estimated $1 billion in restructuring charges in 2023 related to consolidating its office facilities footprint.

- Capital expenditures for 2023 are expected to be in the range of $30 billion to $33 billion, lowered from the previous estimate of $34 billion to $37 billion.

Mark Zuckerberg says,

Efficiency as Management Theme for 2023

- Management theme for 2023 is the Year of Efficiency

- Focusing on increasing efficiency of executing top priorities through sustained period to build stronger tech company and become more profitable

- Working on flattening org structure, removing layers of middle management, and deploying AI tools to help engineers be more productive

- More proactive about cutting projects that aren’t performing or may no longer be as crucial

Product Priorities

- Two major technological waves driving roadmap are AI and over the longer term, the Metaverse

- Facebook and Instagram shifting from being organized solely around people and accounts to showing more relevant content recommended by AI systems

- Reels plays across Facebook and Instagram have more than doubled over the last year, while the social component of people resharing Reels has grown even faster

- Improving monetization efficiency of Reels is the key to unlocking growth

- Ads business continuing to invest in AI resulting in higher returns on ad spend

- Business Messaging as the next pillar with click-to-message ads and paid messaging

- Generative AI is an extremely exciting new area with many different applications

- Shipped Quest Pro at the end of last year, the first mainstream mixed reality device, and launching next-generation consumer headset later this year

Financial Results

- Focused on delivering better financial results than what has been reported recently

- Meeting expectation of delivering compounding earnings growth while investing aggressively in future technology

Q & A sessions,

Lower CapEx Outlook

- Shifting to a new data center architecture that can efficiently support both AI and non-AI workloads

- Expecting the new design to be cheaper and faster to build than previous data center architecture

- Optimizing approach to building data centers with a new phased approach

- Intention to bring CapEx as a percent of revenue down over the longer term

Generative AI

- Efficiency is a focus for this year

- Working on using large language models and diffusion models for generating images, videos, avatars, 3D assets, etc.

- Expecting to launch a number of different things this year

- Challenges include scaling and making it more efficient