Microsoft Corporation

CEO : Mr. Satya Nadella

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

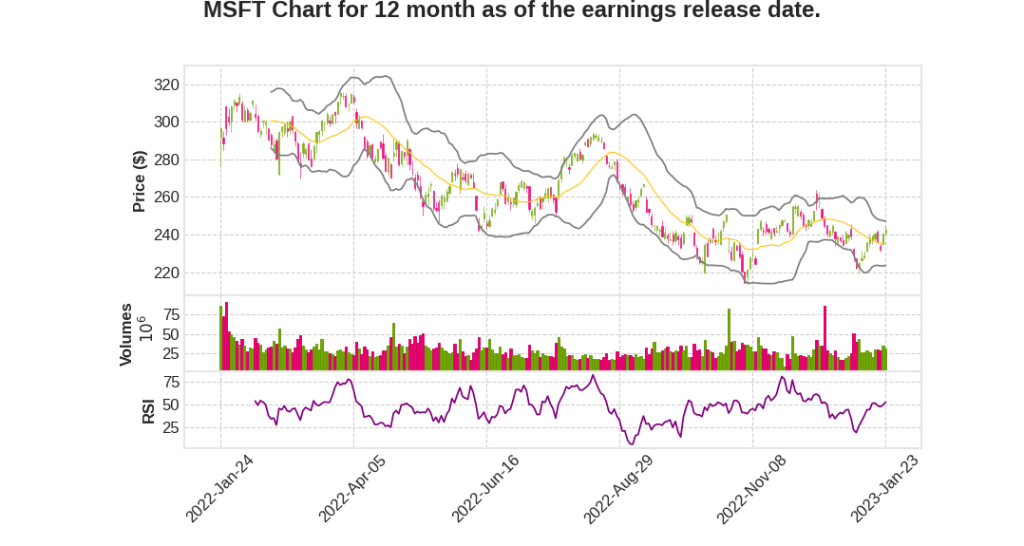

| 2023 Q2 | 2.0% YoY | -8.3% | -12.0% | 2023-01-24 |

Amy Hood says,

Revenue and Earnings

- Q2 revenue was $52.7 billion, up 2% and 7% in constant currency.

- The Q2 charge resulted in a negative impact on gross margin by $152 million, operating income by $1.2 billion, and earnings per share by $0.12.

- Excluding the charge, gross margin dollars increased 2% and 8% in constant currency, operating income decreased 3% and increased 6% in constant currency, and earnings per share was $2.32, which decreased 6% and increased 2% in constant currency.

Commercial Business Performance

- Commercial bookings increased 7% and 4% in constant currency, lower than expected.

- Modulated consumption growth in Azure and lower-than-expected growth in new business across standalone Office 365, EMS and Windows commercial products sold outside Microsoft 365 suite.

- Performance in the U.S. was weaker than expected.

- Continued to see share gains in data and AI, Dynamics, Teams, Security, and Edge.

Microsoft Cloud and Gross Margins

- Microsoft Cloud revenue was $27.1 billion and grew 22% and 29% in constant currency, ahead of expectations.

- Microsoft Cloud gross margin percentage increased roughly 2 points year-over-year to 72%, a point better than expected, driven by lower energy costs.

- Gross margin percentage decreased roughly 2 points, excluding the impact of the change in accounting estimate.

Intelligent Cloud and Azure Growth

- Revenue for the Intelligent Cloud segment was $21.5 billion, increasing 18% and 24% in constant currency in line with expectations.

- Growth in Azure continued to moderate, particularly in December, and we exited the quarter with Azure constant currency growth in the mid-30s.

More Personal Computing and Revenue Decline

- Revenue for More Personal Computing was $14.2 billion, decreasing 19% and 16% in constant currency, below expectations driven by Surface, Windows Commercial and search.

- Windows OEM revenue decreased 39%, year-over-year, in line with expectations.

Satya Nadella says,

Microsoft Cloud Exceeded $27 Billion in Quarterly Revenue

- Revenue for Microsoft Cloud exceeded $27 billion in Q2 2023, up 22% and 29% in constant currency.

Innovation in Azure

- Enterprises have moved millions of calls to Azure with twice as many calls being run on the cloud today than two years ago.

- Azure Arc doubled its customers to more than 12,000, including Citrix, Northern Trust, and PayPal.

AI is the New Computing Platform

- Microsoft is leading in AI with the most powerful AI supercomputing infrastructure in the cloud being used by customers and partners like OpenAI to train state-of-the-art models and services.

- Azure ML revenue alone has increased more than 100% for five consecutive quarters with companies like AXA, FedEx, and H&R Block choosing the service to deploy, manage and govern their models.

Microsoft 365 and Teams

- Teams surpassed 280 million monthly active users in Q2 2023, showing durable momentum since the pandemic and is the market leader in cloud calling.

- Microsoft Viva has created a new market category for employee experience and organizational productivity.

- Windows 11 adoption continues to grow because of its differentiated security and productivity value proposition.

Security and LinkedIn

- Over the past 12 months, Microsoft’s security business surpassed $20 billion in revenue as the company helps customers protect their digital estate across clouds and endpoint platforms.

- LinkedIn once again saw record engagement among its more than 900 million members.

Q & A sessions,

Strong Renewal Rates and Suite Performance

- High renewal rates and good suite performance at renewal, leading to recapture.

- Challenges observed in standalone sales of new products.

- Strong E5 and ARPU growth consistency observed.

OpenAI Partnership

- Investing in AI as the next big platform wave.

- Working on building training supercomputers and inference infrastructure to transform Azure services for the core infrastructure business.

- Expected incorporation of AI in every layer of the stack, including productivity and consumer services.

- Commercial partnership with OpenAI to drive innovation and competitive differentiation in all Microsoft solutions.