Micron Technology, Inc.

CEO : Mr. Sanjay Mehrotra

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

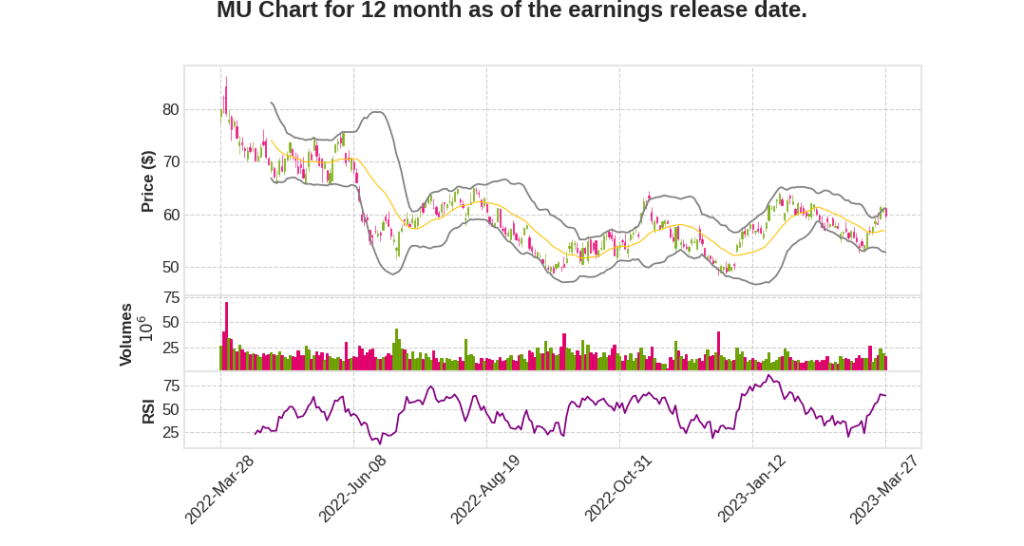

| 2023 Q1 | -46.9% YoY | -107.9% | -108.7% | 2023-03-28 |

Sanjay Mehrotra says,

Revenue, Margins, and EPS

- Micron delivered fiscal Q2 revenue within the guidance range, but margins and EPS were impacted by weak pricing environment.

- We have taken substantial supply reduction and austerity measures, including executing a company-wide reduction in force.

- Excluding the impact of inventory write-downs, we believe our balance sheet DIO has peaked in fiscal Q2, and we are close to our transition to sequential revenue growth in our quarterly results.

Industry Challenges and Micron’s Positioning

- The semiconductor memory and storage industry is facing its worst downturn in the last 13 years with an exceptionally weak pricing environment that is significantly impacting financial performance.

- Micron continues to lead the industry in both DRAM and NAND technology and investing prudently to maintain technology competitiveness while managing node ramps to reduce bit supply and align it with demand.

- Recent developments in AI provide an exciting prelude to the transformational capabilities of large language models, or LLMs, such as ChatGPT, which requires significant amounts of memory and storage to operate.

End Markets

- All end markets experienced a year-over-year decline in revenue due to inventory adjustments, slowing demand growth, and challenging pricing environment.

- Data center customer inventories should reach relatively healthy levels by the end of calendar 2023, and AI is seen as a secular driver of demand growth in the data center.

- Predicted declining calendar 2023 PC unit volume, but with strong product lineup, Micron is well-positioned for ongoing industry transition to D5.

- The auto market showed growth, while the industrial market continued to soften.

Market Outlook and Micron’s Actions

- The expectations for calendar 2023 industry bit demand growth have moderated, but improving customer inventories will support sequential bit demand growth for DRAM and NAND through the calendar year.

- Micron has taken a number of decisive actions in fiscal 2023, including reducing supply, operating expenses, and maintaining flat annual bit share in both DRAM and NAND to weather the industry downturn while ensuring product and technology competitiveness.

- Strong liquidity will enable Micron to weather this downturn while ensuring its product and technology competitiveness.

Mark Murphy says,

Revenue and Business Unit Performance

- Total fiscal Q2 revenue was approximately $3.7 billion, down 10% sequentially and 53% year-over-year.

- DRAM revenue, representing 74% of total revenue, declined 4% sequentially with bit shipments increasing in the mid-teens percentage range and prices declining by approximately 20%.

- NAND revenue, representing 24% of total revenue, declined 20% sequentially with bit shipments increasing in the mid- to high-single-digit percentage range and prices declining in the mid-20s percentage range.

- Revenue for the Compute and Networking Business Unit was $1.4 billion, down 21% sequentially while Mobile Business Unit revenue was $945 million, up 44% sequentially and Embedded Business Unit revenue was $865 million, down 14% sequentially.

Gross Margin and Operating Expenses

- Consolidated gross margin for fiscal Q2 was negative 31.4%. This result was negatively impacted by approximately $1.4 billion or 38.7 percentage points of inventory write-down recorded in the quarter.

- We had an operating loss of roughly $2.1 billion in fiscal Q2, resulting in an operating margin of negative 56%, down from negative 2% in the prior quarter and positive 35% in the prior year.

- Operating expenses in fiscal Q2 were $916 million, down roughly $80 million sequentially. Management expects them to decline sequentially in both fiscal Q3 and fiscal Q4.

Cash Flows and Capital Spending

- We generated $343 million in cash from operations in fiscal Q2, representing approximately 9% of revenue. Free cash flow was negative $1.8 billion in the quarter.

- Capital expenditures were $2.2 billion during the quarter. Management expects fiscal 2023 CapEx to be 2/3 front-half weighted, with a higher mix of construction spend in the second half.

- At quarter end, we held cash and investments of $12.1 billion and had total liquidity of $14.6 billion when considering our untapped credit facility.

Guidance for Fiscal Q3 and Beyond

- Management expects DRAM and NAND bit shipments to continue to increase and supply-demand balance to gradually improve for the rest of this calendar year.

- Fiscal Q3 gross margins are expected to be negatively impacted by pricing, write-down of inventory, cost of underutilization, and a higher mix of NAND.

- Management increased the headcount reduction target to approach 15% from the previous target of approximately 10% and expects OpEx to fall below $850 million in the fiscal fourth quarter of 2023.

- Fiscal 2023 taxes are projected to be less than $140 million. Profitability is expected to remain significantly negative through the fiscal year, though management forecasts a slight improvement in free cash flow driven by reduced capital spend.

- Non-GAAP guidance for fiscal Q3 is as follows: revenue of $3.7 billion, plus or minus $200 million; gross margin in the range of negative 21%, plus or minus 250 basis points; operating expenses of approximately $900 million, plus or minus $15 million; and EPS of a loss of $1.58, plus or minus $0.07.

Q & A sessions,

Positive Industry Trends

- Customer inventories improving

- Volume of shipments for DRAM and NAND expected to increase

- CapEx reductions and underutilization in industry taking out supply

- Expectation for demand and supply balance to gradually improve through the year

- Expectation for trajectory of pricing to improve

Micron’s Actions

- Managing CapEx, underutilization in fab, and OpEx

- Focus on supply growth

- Taking decisive actions to navigate through challenging environment

- Negative DRAM and NAND supply growth for the year to bring balance to the market

- Well positioned with technology and product roadmap

Market Opportunities

- Strong demand trends in AI and generative AI

- NAND-displacing HDDs in data center

- Micron has right products to grow opportunities in SSDs in data center

Gross Margins and Effective Utilization

- Charges and period costs impacting gross margins

- Underutilization effects creating higher costs and additional period costs

- Expectation for $1.1 billion underutilization impact in FY ’23, most hitting P&L this year

- Lowering carrying value of on-hand inventories and realizing more income in future quarters