NXP Semiconductors N.V.

CEO : Mr. Kurt Sievers

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

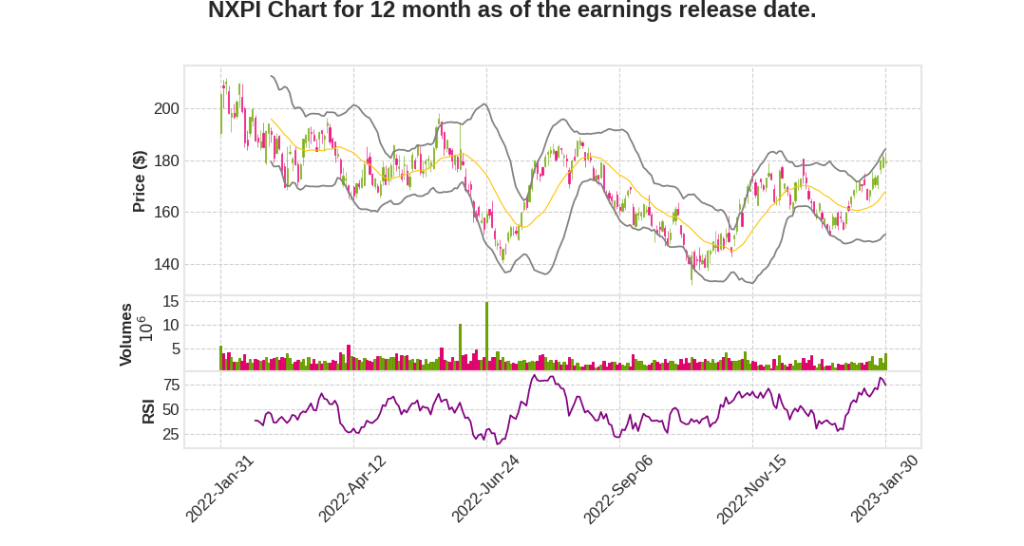

| 2022 Q4 | 9.0% YoY | 21.4% | 22.5% | 2023-01-31 |

Kurt Sievers says,

Quarter Four 2022 Performance

- Revenue was $3.31 billion, a 9% YoY increase, $12 million better than the midpoint of the guidance.

- Non-GAAP operating margin in Quarter Four was a strong 36.5%, 160 basis points better than the year ago period.

- Automotive revenue was $1.81 billion, up 17% YoY, in line with guidance.

- Industrial and IoT revenue was $605 billion, down 8% YoY but better than guidance.

- Mobile revenue was $408 million, up 9% YoY and better than guidance.

- Communication Infrastructure and Other revenue was $494 million, up 8% YoY but below guidance.

Full Year 2022 Performance

- Revenue was a record $13.21 billion, a 19% YoY increase.

- Automotive revenue was $6.88 billion, up 25% YoY.

- Industrial and IoT revenue was $2.71 billion, up 13% YoY.

- Mobile revenue was $1.61 billion, up 14% YoY.

- Communication Infrastructure and Other revenue was $2 billion, up 15% YoY.

Guidance for Quarter One 2023

- Guiding quarter one revenue to $3 billion, down about 4% versus the first quarter of ’22.

- Automotive is expected to be up in the mid-teens percent range versus quarter one ’22 and flat versus quarter four ’22.

- Industrial and IoT is expected to be down in the low 30% range YoY and down in the low 20% range versus quarter four ’22.

- Mobile is expected to be down about in the mid-40% range, both on a YoY and sequential basis.

- Communication Infrastructure and Other is expected to be about flat, both on a YoY and sequential basis.

Accelerated Growth Drivers

- The accelerated growth drivers are 77 gigahertz radar, electrification and the S32 domain and solar processes, all of which are tracking ahead of plan within Automotive.

- Within Industrial and IoT, we are in line with our expected growth range of about 25% 3 year CAGR for our accelerated growth drivers.

- For Mobile, we are below our expected revenue growth range for the accelerated growth driver of ultra-wideband due to the well-documented weakness in the Android handset market.

- Within Communications and Infrastructure, we are in line with our expected revenue growth range for RF power amplifiers.

Bill Betz says,

Financial Performance

- Full year revenue for 2022 was $13.21 billion, up 19% YoY.

- Non-GAAP gross margin of 57.9%, up 180 basis points YoY.

- Total non-GAAP operating expenses were $2.86 billion or 21.6% of revenue.

- Non-GAAP operating profit was $4.79 billion, up 32% YoY, reflecting a non-GAAP operating margin of 36.3%.

- Repurchased 8.33 million shares for $1.43 billion and paid cash dividends of $815 million or 21% of cash flow from operations.

Q4 Highlights

- Total revenue was $3.31 billion, up 9% YoY.

- Total non-GAAP operating expenses were $713 million or 21.5% of revenue.

- Non-GAAP operating profit was $1.21 billion, and non-GAAP operating margin was 36.5%.

- Ending cash position was $3.85 billion, up $86 million sequentially.

- Paid $221 million in cash dividends and repurchased $475 million of our shares.

Working Capital Metrics

- Days of inventory was 116 days, an increase of 17 days sequentially.

- Days receivable were 26 days, down one day sequentially and days payable were 105 days.

- Cash conversion cycle was 37 days, an increase of 7 days versus the prior quarter.

Q1 Expectations

- Anticipate Q1 revenue to be $3 billion, plus or minus about $100 million.

- Expect non-GAAP gross margin to be about 58% plus or minus 50 basis points.

- Operating expenses are expected to be about $710 million, plus or minus about $10 million.

- Non-GAAP operating margin to be 34.3% at the midpoint.

- Implying a non-GAAP earnings per share of $3.01.

Focus Areas for NXP in 2023

- Plan to execute and drive six company-specific accelerated growth drivers.

- Manage internal and channel inventory thoughtfully based on market conditions.

- Continue to be disciplined with operating expenses, while protecting long-term R&D investments.

Q & A sessions,

NXPI Q4 2022 Earnings Call Transcript in its entirety, there are a few key points that are expected to have a significant impact on the stock’s movement:

China Weakness and Inventory Management

- NXPI is being very vigilant in managing channel inventory due to weakness in China, specifically related to a change in corporate policy and a spike in infection rates.

- This weakness is seen across all segments and is related to distribution, rather than a specific segment.

- As soon as signs of a consistent rebound in China are seen, NXPI has the orders and product at hand to fill back the channel.

Q4, Q1, and Full-Year Outlook

- Q4 saw flat growth from a quarter-on-quarter perspective due to supply constraints. Q1 is expected to be a mixed bag, with Automotive distribution in China experiencing a decline while the rest of the business is going up.

- For the full year, NXPI is optimistic, with the total car production expected to increase by 3.5% to about 85 million, and a continued increase in xEV penetration.

- NXPI expects to have most of the shortages behind them by the end of calendar year ’23.

- Pricing continues to play a role, with continued pressure on supply leading to pricing tailwinds, especially in Automotive and Core Industrial.

Communication Infrastructure and Other Segments

- NXPI sees a cautious outlook for the radio power part of the business due to build-outs in network infrastructure in India and the fast shift towards gallium nitride over LDMOS.

- RFID tagging, secure and access cards, and government identity products are expected to generate growth this year due to pent-up demand.

Supply Capability and NCNRs

- NXPI expects to serve about 90% to 95% of risk-adjusted backlog for ’23, up from 85% for ’22.

- The auto part of the business has a low DIO, and product specific to the lease in Automotive is well below target.

- NCNRs are executed strictly for products that are customized and cannot be moved around to other customers, and are flexible for fungible products and overriding commercial agreements.