Xcel Energy Inc.

CEO : Mr. Robert C. Frenzel

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

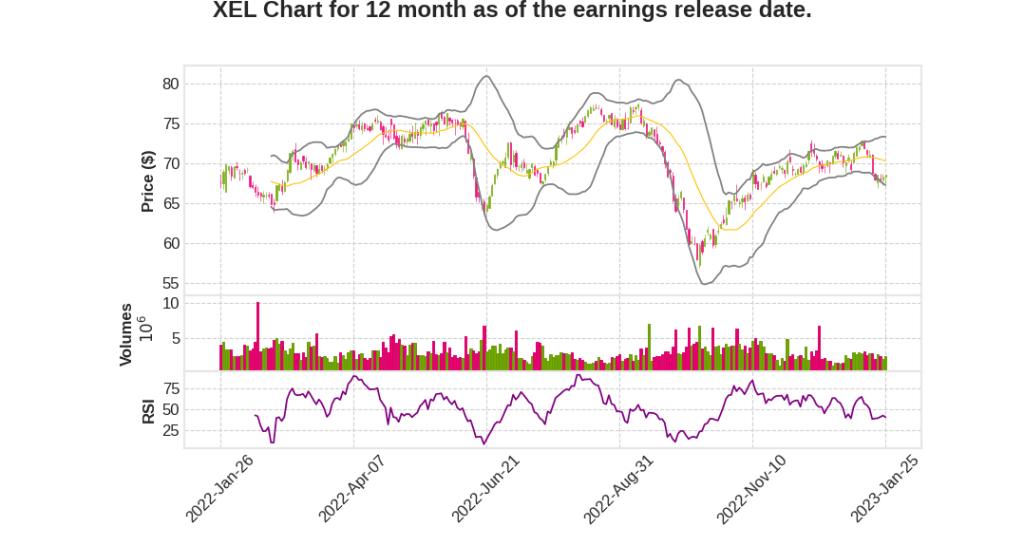

| 2022 Q4 | 20.8% YoY | 21.2% | 19.0% | 2023-01-26 |

Brian Van Abel says,

XEL Q4 2022 Earnings Summary

- The company recorded earnings of $3.17 per share in 2022, representing EPS growth of 7.1%.

- The higher electric and natural gas margins increased earnings by $1.05 per share, primarily driven by regulatory outcomes and riders to recover capital investments.

- The O&M expenses increased by $170 million, driven by costs related to technology and customer programs, storms, vegetation management inflation, and additional actions due to weather.

- The company anticipates O&M expenses will decline approximately 2% in 2023.

- The Inflation Reduction Act provides significant customer benefits with tax credit transferability providing $1.8 billion of liquidity, increasing cash flow and reducing equity needs.

- The company reaffirms 2023 earnings guidance range of $3.30 to $3.40 per share.

BobFrenzel says,

Clean Heat Plan Opportunity

- Aligning vision for net zero future with commissions in a formal way

- No significant new investment opportunities, but an opportunity to align on multi-pronged strategy to decarbonize the gas business

Multi-Pronged Strategy

- Working with upstream providers to reduce methane on purchase gas

- Continued work on methane leak reduction in their own system

- Customer programs to encourage energy efficiency, fuel switching, and beneficial electrification

Clean Fuel Opportunity

- Working on a Rocky Mountain hydrogen hub project with multiple parties in Colorado jurisdiction

- Attractive project with a multistate MOU signed and Western state governors and energy officers working together

- Clean fuel is a real opportunity to advance clean energy transition and realize a net zero future in the gas business

Q & A sessions,

Expected impact of XEL Q4 2022 Earnings Call Transcript

- O&M guidance for 2023 will depend on actuals of 2022, but the company has invested significantly in technology for more efficient operations, and the shutdown of coal plants will provide a tailwind for the clean energy transition.

- The electric side of the business is well-positioned with a modest impact on customer bills despite inflationary pressures, and the wind build-out acts as a hedge for rising commodity costs. However, the natural gas LDC side has seen bill impacts due to fewer levers and assets. The company has proactively lowered gas commodity costs, and longer-term, they feel good about delivering bills at or below the inflation level.

- The company looks for settlements to keep financially healthy utilities, preserve credit metrics, raise capital cost advantageously, and deliver on the capital investment profile. They have a long track record of settling cases and are encouraged to continue to do so.