Ameren Corporation

CEO : Mr. Martin J. Lyons Jr.

Quarterly earnings growth(YoY,%)

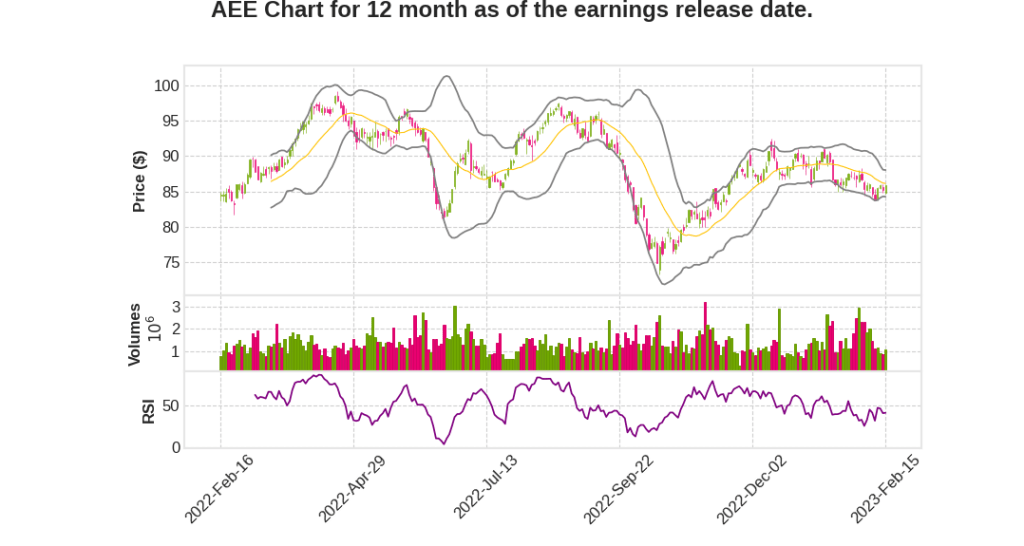

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 32.4% YoY | 40.1% | 31.2% | 2023-02-16 |

Marty Lyons says,

Infrastructure Investments and Achievements

- $3.4 billion infrastructure investments in 2022 resulted in a more reliable, resilient, secure, and cleaner energy grid

- Ameren Missouri installed over 400 smart switches, upgraded or built 34 substations, and installed over 300,000 smart meters, contributing towards better energy usage visibility

- Ameren Illinois replaced over 3,000 electric poles, 64 miles of coupled steel distribution pipelines, and 24 miles of gas transmission pipelines

- Transmission business placed in service 19 new or upgraded transmission substations and approximately 200 miles of new or upgraded transmission lines in 2022

- Most recent system average interruption frequency reliability scores ranked in the top quartile of the industry

Regulatory and Legislative Progress

- New Ameren Missouri Electric Service rates took effect in February as a result of the 2021 rate review, which was constructively settled

- Ameren filed a change to its integrated resource plan in June, accelerating the planned clean energy investments, carbon emission reduction goals, and plan to achieve net-zero by 2045 while considering customer affordability and energy grid reliability

- Midwest independent system operator approved a portfolio of long-range transmission projects in Ameren’s operating footprint in July 2022

- Senate Bill 745 was enacted in Missouri in August, extending the constructive smart energy plan legislation that became law in 2018 out through 2028, with possible extension to 2033, which led to increase 10-year investment opportunity pipeline from $40 billion to $48 billion in 2022

- Illinois Commerce Commission approved constructive performance metrics for Ameren Illinois Electric Distribution business, allowing for multiyear rate plan filing in January 2023

Earnings and Guidance

- 2022 earnings per share of $4.14, which was at the high end of the guidance range

- 2023 earnings per share guidance range of $4.25 to $4.45, representing 7% earnings per share growth compared to the midpoint of the original 2022 guidance range

- 6% to 8% compound annual earnings per share growth from 2023 through 2027 using the midpoint of 2023 guidance, $4.35 per share, as the base

- Quarterly dividend increase of approximately 7%, resulting in an annualized dividend rate of $2.52 per share, representing the third consecutive year of approximately 7% dividend growth

Sustainability and Social Responsibility

- Ameren announced an acceleration of its transformational generation resource plan, aiming to achieve net-zero Scope 1 and 2 carbon emissions by 2045 and across all of its operations in Missouri and Illinois, which is consistent with the objectives of the Paris Agreement and limiting global temperature rise to 1.5 degrees Celsius

- Ameren demonstrated its commitment to diverse suppliers, spending approximately $1.1 billion with minority, women, and veteran-owned businesses in 2022

- Ameren was recognized as the number one on the nation’s top utilities list for diversity, equity, and inclusion by Diversity Inc. for the 14th consecutive year

- Ameren was named a top company for ESG for the third consecutive year

Michael Moehn says,

2022 Earnings and 2023 Guidance

- 2022 earnings of $4.14 per share compared to earnings of $3.84 per share in 2021

- Expect 2023 diluted earnings per share to be in the range of $4.25 per share to $4.45 per share

Planned Capital Expenditures

- $19.7 billion of planned capital expenditures for the 2023 through 2027 period to support the approximately 8% projected compound annual rate base growth

- Allocating capital consistent with the allowed return on equity under each regulatory framework

Expected Funding Sources for Infrastructure Investments

- Expect continued growth in cash from operations as investments are reflected in customer rates

- Expect to generate significant tax deferrals driven primarily by the timing differences between financial statement depreciation reflected in customer rates and accelerated depreciation for tax purposes

- Expect to issue long-term debt to fund a portion of our cash requirements and continue to use newly issued shares from our dividend reinvestment and employee benefit plans over the five-year guidance period

- Expect incremental equity issuances of approximately $300 million in 2023 and $500 million each year from 2024 through 2027

2023 Earnings Drivers and Assumptions By Segment

- Ameren Missouri: New electric service rates expected to increase earnings, higher investments in infrastructure eligible for PISA, return to normal weather expected to decrease earnings by approximately $0.14 compared to 2022 results, higher interest expense largely driven by higher long-term debt outstanding.

- FERC-regulated Electric Transmission: Expected to benefit from additional investments in Ameren Illinois and ATXI projects made under forward-looking formula ratemaking

- Ameren Illinois Electric Distribution: Expected to benefit from additional infrastructure investments made under Illinois performance-based ratemaking and higher allowed return on equity due to the expected higher 30-year treasury rates

- Ameren Illinois Natural Gas: Earnings will benefit from infrastructure investments qualifying for rider treatment which are expected to be partially offset by higher depreciation expense.

Regulatory Matters

- Missouri: Filed for a $316 million electric revenue increase with the Missouri Public Service Commission, request includes a 10.2% return on equity, a 51.9% equity ratio, and a December 31, 2022 estimated rate base of $11.6 billion, evidentiary hearings are scheduled to begin in April, and the decision from the Missouri PSC is expected by June 2023 with rates effective by July 1, 2023

- Illinois: Filed its first multiyear rate plan (MYRP) with the ICC, request for $175 million revenue increase in 2024 is based on an average rate base of $4.3 billion, a return on equity of 10.5% and an equity ratio of just under 54%, expect the ICC decision on the MYRP by December 2023 with new rates effective in January 2024

Q & A sessions,

Incremental Capital

- The company will require $2.4 billion of incremental capital, and they will be issuing $800 million of equity and some retained earnings to target a capitalization ratio of close to 45%.

- The ATM is an efficient way for the company to issue capital, and they have already taken care of their needs for 2023 by selling forward into 2024.

Planned Capital Expenditures

- The company plans to invest $19.7 billion in capital expenditures for the 2023 through 2027 period, which supports the projected compound annual rate base growth of 8%.

- The plan includes investments in long-range transmission projects and renewable energy generation aligned with the Missouri Integrated Resource Plan.

- The company expects to generate significant tax deferrals, and they will issue long-term debt to fund a portion of the cash requirements.

2023 Earnings Guidance

- The company expects 2023 diluted earnings per share to be in the range of $4.25 to $4.45 per share, and they have listed key earnings drivers and assumptions for each segment.

- Earnings from FERC-regulated electric transmission activities are expected to benefit from additional investments in Ameren Illinois and ATXI projects made under forward-looking formula ratemaking.

- Earnings from Ameren Illinois Electric Distribution are expected to benefit from additional infrastructure investments made under Illinois performance-based ratemaking.

Missouri Regulatory Matters

- The company filed for a $316 million electric revenue increase with the Missouri Public Service Commission, which includes a 10.2% return on equity, a 51.9% equity ratio, and a December 31, 2022, estimated rate base of $11.6 billion.

- The Missouri PSC staff recommended a $199 million revenue increase, including a return on equity range of 9.34% to 9.84% and an equity ratio of 51.84% based on the Ameren Missouri capital structure at September 30, 2022.

- Evidentiary hearings are scheduled to begin in April, and the decision from the Missouri PSC is expected by June 2023 with rates effective by July 1, 2023.

Illinois Electric Matters

- Ameren Illinois Electric Distribution filed its first multiyear rate plan, or MYRP, with the ICC, which includes a great plan that supports their annual revenue increase request for the next four years.

- Their request for $175 million revenue increase in 2024 is based on an average rate base of $4.3 billion, a return on equity of 10.5%, and an equity ratio of just under 54%.