Akamai Technologies, Inc.

CEO : Dr. F. Thomson Leighton

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

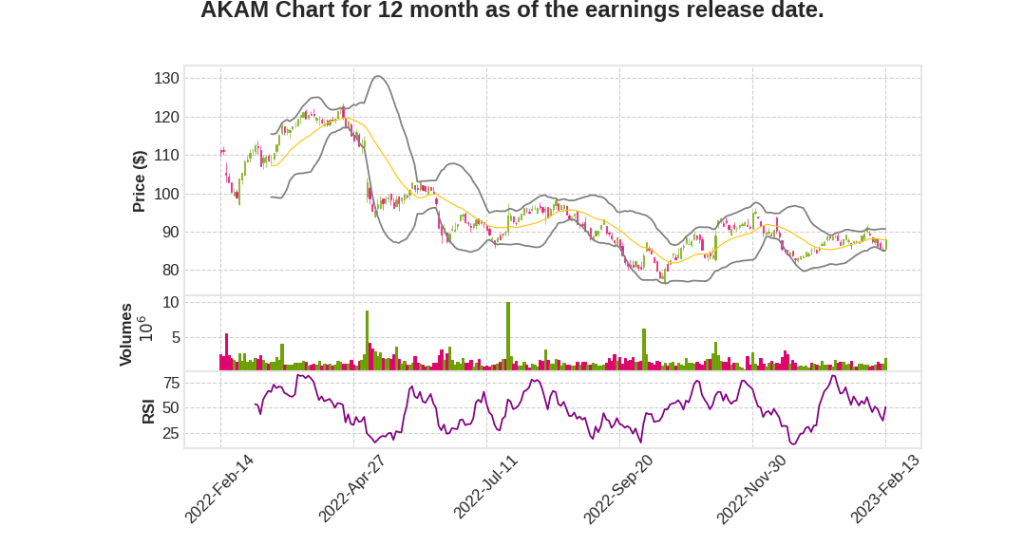

| 2022 Q4 | 2.5% YoY | -12.2% | -17.2% | 2023-02-14 |

Ed McGowan says,

Q4 2022 Highlights

- Q4 revenue was $928 million, up 2% YoY or 6% in constant currency

- Compute business revenue was $112 million, growing 61% YoY as reported and 65% in constant currency

- Security revenue was $400 million, up 10% YoY and up 14% in constant currency

- Delivery revenue was $415 million, which declined 12% YoY and 8% in constant currency, but with better-than-expected traffic

- Non-GAAP net income was $216 million or $1.37 of earnings per diluted share, down 8% YoY and down 2% in constant currency, but $0.07 above the high end of guidance range

Capital Allocation and Useful Life Policy

- The company spent approximately $178 million to buy back 2.1 million shares in Q4 and spent approximately $608 million to buy back 6.4 million shares in the full year 2022. It ended 2022 with approximately $1.2 billion remaining on its current repurchase authorization

- The company extended the useful lives of its servers from 5 years to 6 years, resulting in a depreciation benefit of roughly $56 million in 2023 and approximately $31 million in 2024

Guidance and Growth Prospects

- For 2023, the company expects revenue of $3.7 billion to $3.78 billion, up 2% to 4% YoY, both in as reported and in constant currency

- The company expects security revenue growth to be in the low double digits for the full year 2023

- The company expects non-GAAP operating margin of approximately 27% to 28% and full year CapEx is expected to be approximately 21% of total revenue

- The company expects non-GAAP earnings per diluted share of $5.40 to $5.60

- The company is prioritizing retasking approximately 1,000 positions from other parts of the business to its compute business, and reducing its real estate costs by approximately $20 million in 2023 and achieving further savings in 2024

Tom Leighton says,

Media and Gaming are early adopters of Akamai Connected Cloud

- Media companies are concerned about performance and have already started using Akamai Connected Cloud

- Gaming industry requires low latency and back and forth communication with users, making Akamai Connected Cloud a good fit

Commerce companies are signing up for Akamai Connected Cloud

- Commerce companies require better performance at a competitive price point, making Akamai Connected Cloud a good fit

- Akamai’s strong connections with big companies in media and commerce are attracting interest in Akamai Connected Cloud

Financial vertical is a potential future market for Akamai Connected Cloud

- Security products from Akamai make it a good fit for the financial industry

- Certifications are required for adoption in the financial industry, but it is expected to follow media and commerce in adopting Akamai Connected Cloud

Q & A sessions,

Shift towards Cloud Computing and Security

- Resources are being shifted towards higher growth areas, especially in cloud computing and security.

- Akamai is turning down some delivery deals due to lower traffic growth rates and better ROI from investing in cloud computing.

Building out Linode for Mission-Critical Applications

- Akamai is making Linode more distributed, available in more cities, and integrating it with the Akamai platform to sell it at a higher scale to major enterprises.

- Early adopters are being targeted, and Akamai plans to take on more business with better performance, closer to end users, and at a more competitive price point.

Distributed Cloud Architecture and Multi-Cloud Approach

- Akamai is building out a distributed compute layer with containers as a service, Kubernetes, and VMs as a service for better performance and proximity to end users.

- Akamai believes in a multi-cloud approach and partnering with hyperscalers depending on the application and what customers are looking to do.

Akamai Connected Cloud Architecture for Large-Scale Business

- Akamai customers are spending a ton on third-party cloud and looking to shift business to Akamai for at least as good, better performance at a lower price point.

- Akamai has credibility with its customers and is in a position to provide services that will work for them.

Growth and Monetization of Compute Business

- Akamai expects to do about $0.5 billion in compute this year, but the real growth and monetization of what is being built out now comes in ’24 and ’25.

- CapEx will be elevated for the next 1.5 years to 2 years related to the compute business, and Akamai will start to scale into it.