A. O. Smith Corporation

CEO : Mr. Kevin J. Wheeler

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

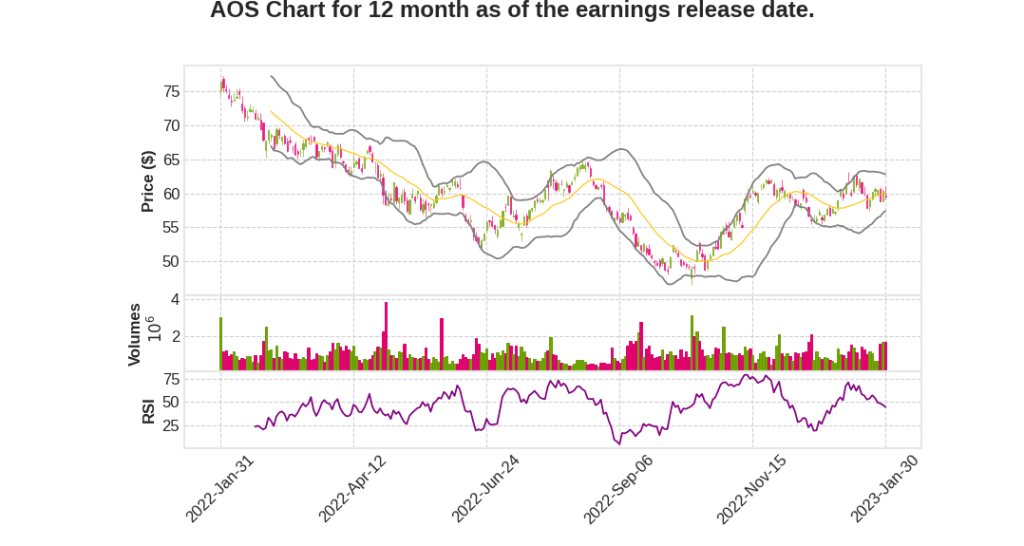

| 2022 Q4 | -6.0% YoY | 1.9% | -188.8% | 2023-01-31 |

Chuck Lauber says,

North America Segment

- Full-year sales increased by 11% to $2.8 billion compared to the previous year.

- Adjusted earnings increased by 5% compared to 2021, totaling $611 million.

- Adjusted operating margin declined 120 basis points year-over-year to 21.7% due to inflationary headwinds and volume-related production inefficiencies.

- Adjusted segment operating margin in Q4 2022 improved to 23.3% compared to 23% in the previous year.

Rest of the World Segment

- Full-year sales decreased by 7% year-over-year to $966 million due to lower sales in China.

- India sales grew 28% in local currency compared to 2021.

- Segment earnings increased by 5% compared to the previous year, totaling $96 million.

- Segment operating margin improved to 10%, an increase of 120 basis points compared to 2021, primarily as a result of improved management of discretionary spending in China.

Q4 2022 Performance

- Q4 2022 sales decreased by 6% year-over-year, driven by lower residential water heater volumes in North America and lower consumer demand in China.

- North America segment Q4 2022 sales decreased by 3%, but earnings remained stable, with an adjusted operating margin of 23.3%.

- Rest of the world segment Q4 2022 sales decreased by 13%, but earnings were slightly higher than in Q4 2021, with a segment operating margin of 12.7%.

2023 Earnings Guidance and Outlook

- Expected EPS range of $3.15 and $3.45 per share, representing a 5% increase compared to 2022 adjusted EPS.

- Guidance assumes steel prices on an annual basis will improve approximately 40% to 45% compared to 2022.

- Expects to generate strong free cash flows between $550 million and $600 million.

- Corporate and other expenses are expected to be approximately $55 million.

- Effective tax rate is estimated to be approximately 24%.

- Expects to repurchase approximately $200 million of its shares of stock resulting in outstanding diluted shares of 150 million at the end of 2023.

Kevin Wheeler says,

Record-Setting Sales and Earnings Despite Headwinds

- Record-setting sales and year-over-year improvement in earnings despite supply chain headwinds, inflation, and inventory destocking activity

- North America sales up 11% compared to 2021 primarily due to inflationary pricing and strong demand for commercial and residential boilers and water treatment products

- Residential industry volumes increased 15% in Q4 compared to Q3 despite inventory destocking activity

- Rest of World segment delivered consistent performance in 2022 despite headwinds in the economy and currency exchange

Settlement of Pension Liabilities and Capital Return to Shareholders

- Settlement of majority of pension liabilities in December 2022 resulting in non-cash pre-tax expense of $417 million

- Excluded from adjusted earnings and adjusted EPS

- Returned $581 million of capital to shareholders through dividends and share repurchases

Global A. O. Smith Team’s Record Performance in 2022

- Record sales of $3.8 billion and adjusted EPS of $3.14, a 6% increase over 2021

- North America water heater sales grew 10% in 2022 due to pricing actions and acquisition-related revenue partially offset by lower residential volumes

- Residential unit industry demand decreased approximately 12% compared to 2021 primarily due to wholesale channel inventory destocking

- Commercial industry units decreased approximately 17% year-over-year due to regulatory change and continued weakness in electric products greater than 55 gallons

- North America boiler sales grew 28% driven by higher volumes and price increases to offset higher costs

- North America water treatment sales grew 10% due to pricing actions and higher volumes, particularly in dealer and specialty wholesale channel

China’s Performance and Operating Margins

- Full-year sales decreased 5% in local currency compared to 2021 due to COVID-19-related disruptions

- Core water heating products performed well in a down market

- Water treatment business grew nearly 4% in local currency and represents almost 40% of overall business

- Repeatable consumable filter sales represent over 25% of overall water treatment sales

- Operating margins in China were 10.7% for the year due to right-sizing business and managing discretionary spending

Commitment to ESG

- Progress towards GHG emission reduction goal of 10% by 2025

- Prevented almost 500,000 metric tons of carbon emissions in 2021 through sales of highly efficient water heaters and boilers

- Worked towards improving water stewardship performance through WAVE verification process developed by The Water Council

- ESG concepts embedded within company’s values and demonstrated commitment to being a good citizen, a good place to work, emphasizing innovation, and achieving profitable growth

Q & A sessions,

Projected Sales in 2023

- Flat to 2022 at the midpoint with a range of plus or minus 3%

- Residential industry unit volumes will be down approximately 2% to 5%

- Commercial water heater industry volumes to be flat to slightly up

- Sales in China will go 3% to 5% of local currency in 2023

- North America boiler sales will increase approximately 10% to 12%

- Sales of North America water treatment products to grow by approximately 5% to 7%

Strategic Priorities

- Expand and enhance high-efficiency product portfolio

- Expand global water treatment capabilities

- Deploy capital effectively by investing in themselves, acquisitions, and returning capital to shareholders

Factors Affecting Stock Movement

- Improved economic environment in China

- Normal inventory levels in 2023

- Transition to higher energy efficient boilers

- Mega trends of healthy and safe drinking water

- Sequential improvement in sales volumes in China

- Positive trend in growth rate of heat pumps