APA Corporation

CEO : Mr. John J. Christmann IV

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

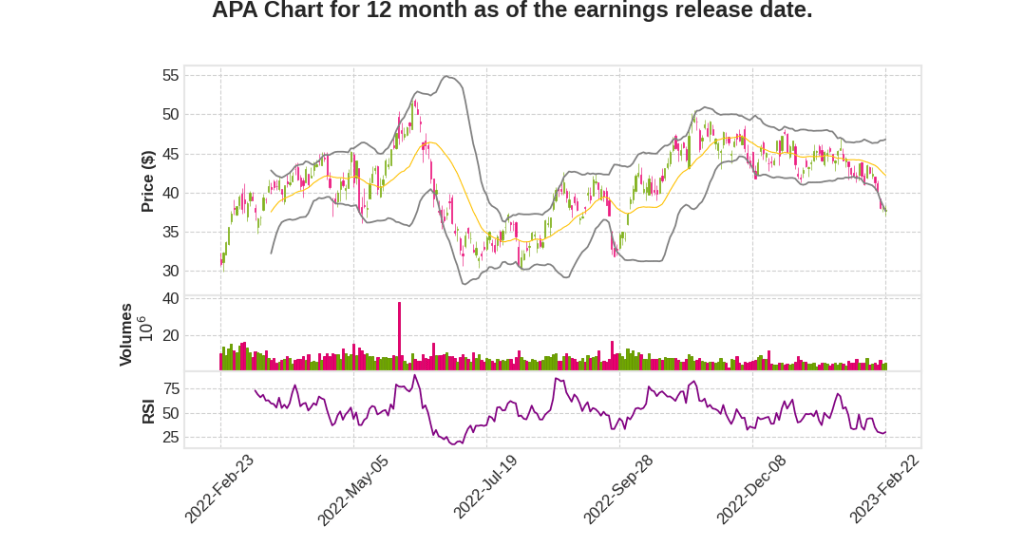

| 2022 Q4 | 7.5% YoY | 13.0% | 30.2% | 2023-02-23 |

John Christmann says,

Key Accomplishments in 2022

- Generated the second-highest annual free cash flow in the company’s 68-year history

- 66% of the free cash flow was returned to shareholders

- Repurchased $1.4 billion of common stock at an average price of less than $40 per share

- Doubled annual dividend

- $1.4 billion or 23% reduction in outstanding bond debt

- Reduced upstream flaring in Egypt by more than 40%

- Appraisal at Sapakara South indicated a combined resource in place of more than 600 million barrels of low GOR oil

Fourth Quarter Performance

- Production and costs were in line with guidance

- U.S. production exceeded guidance on continued strong performance from the Midland and Delaware Basin oil properties

- Oil volumes in Egypt strengthened as drilling efficiencies and project execution improved

- North Sea production benefited from a substantial improvement in facilities runtime

2023 Plans and Objectives

- Growth in 2023 will be entirely driven by oil

- Reiterating capital budget of $2 billion to $2.1 billion

- Anticipate year-over-year adjusted oil growth of more than 10% and BOE growth of 4% to 5%

- Expecting a sequential decrease in U.S. production from Q4 to Q1, but acceleration in the second half of February should lead to significantly higher U.S. oil production in Q2 through Q4

- Anticipate a moderate production rebound in the North Sea with three new wells coming online in the first half

- Gas sales contract with Cheniere expected to bolster free cash flow this year

- Fully committed to returning at least 60% of free cash flow to shareholders through dividends and share buybacks

Stephen Riney says,

Consolidated net income

- Consolidated net income for Q4 2022 was $443 million or $1.38 per diluted common share.

- Adjusted net income for Q4 2022 was $476 million or $1.48 per diluted common share, excluding items outside of core earnings.

Free Cash Flow

- APA generated $360 million of free cash flow in Q4 2022.

- The company plans to generate strong free cash flow in 2023, with continued production growth.

- APA plans to return a minimum of 60% of free cash flow to shareholders through share buybacks and dividends.

Cheniere Gas Sales Contract

- APA’s gas sales contract with Cheniere will commence in the second half of 2023.

- At current strip price levels, APA projects roughly $200 million of free cash flow contribution in the second half of 2023.

- If average prices of $40 LNG and $6 Houston Ship Channel are assumed, annualized free cash flow is expected to increase to approximately $1.25 billion.

Income Taxes

- The UK recently increased its energy profits levy to 35% and extended the effective period through March of 2028.

- APA expects UK current tax expense of $550 million to $575 million in 2023.

- In the US, APA does not expect to be subject to the 15% corporate alternative minimum tax in 2023 and anticipates no current federal income taxes for the year.

Share Repurchases and Deleveraging

- APA plans to continue share repurchases and deleveraging in 2023.

- The company repurchased 10% of the outstanding shares in 2022 at an average price of $39 per share.

Q & A sessions,

Alpine High in Permian Portfolio

- Three wells to come online in Q1 2022, followed by five wells at year-end

- Optionality to allocate capital to Alpine High as part of Delaware Basin

- Will leverage optionality in 2024 and beyond when basin bottlenecks open up

Bolt-on Acquisitions

- Did one tuck-in acquisition in Delaware Basin last year

- Constantly looking at market for attractive acquisitions

- High bar for acquisitions, only done one transaction in the past few years

Sapakara and Krabdagu in Suriname

- Potential development hub with partner for Sapakara and Krabdagu

- Sapakara has high-quality rock with low GOR oil and 1.3 to 1.5 Darcy rock

- Krabdagu has three targets and currently in appraisal process

- Scope and scale of Krabdagu will impact potential value