Alexandria Real Estate Equities, Inc.

CEO : Mr. Peter M. Moglia

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

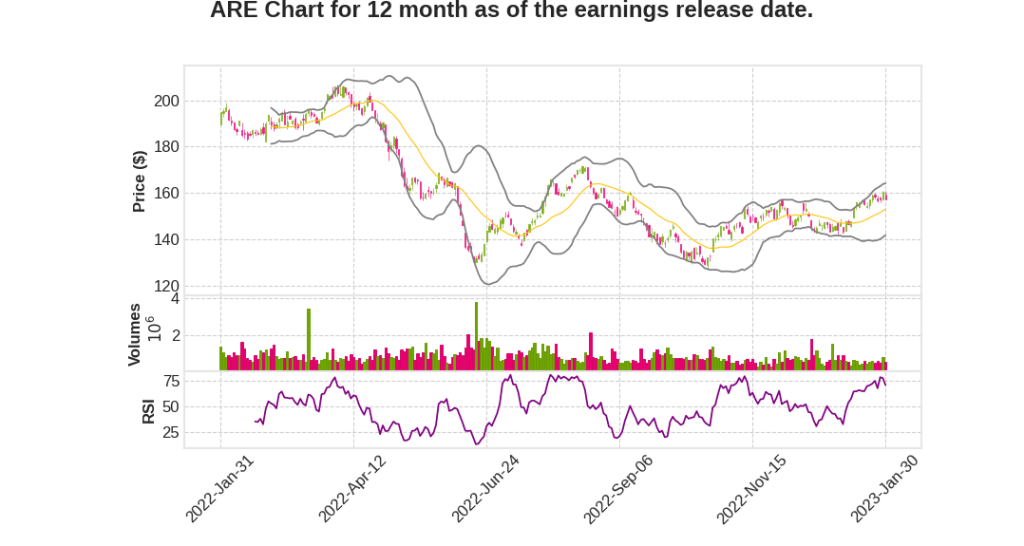

| 2022 Q4 | 16.2% YoY | 31.7% | -34.0% | 2023-01-31 |

Peter Moglia says,

Construction Pipeline and Leasing

- Delivered just shy of 500,000 square feet, with $28 million in annual NOI commencing during the quarter

- Projects under construction and near-term projects expected to commence construction over the next four quarters totaled 7.6 million square feet and are 72% leased

- Expected to add $655 million in annual incremental NOI with deliveries primarily commencing from first quarter of ’23 through the fourth quarter

- Leasing volume of 2,322 square feet leased in the quarter, the fourth highest total in company history

- 8,405,587 square feet leased for the year is the second highest annual total in company history

- Guidance for strong mark-to-market growth remains unchanged from Investor Day with a range of 27% to 32% on a GAAP basis and 11% to 16% on cash

Value Harvesting and Asset Recycling

- Completed $2.2 billion of value harvesting, achieving a weighted average cap rate of 4.4%, realizing a total gain of $1.2 billion and a value creation margin of 107%

- Started working on and making good progress on 2023 value harvesting and asset recycling

- Despite the Fed pulling levers to battle inflation, cap rates are expected to move up but much less on a relative basis to other product types, keeping the company well-positioned to fund its value creation pipeline efficiently

Construction Cost Trends

- Construction industry is on the cusp of slowing down, with fewer clients expressing interest in starting new projects

- Continued pressure on costs and labor expected due to the $2.3 trillion infrastructure spend over the next eight years

- Expect cost escalations to reduce from the range of 9% to 10% experienced in 2022 to 4% to 6% in 2023

Life Science Real Estate Market

- Demand for Alexandria facilities and mega campuses remains healthy as the facilities are A+, and operational excellence is highly sought after

- Successful conversion of early innovation to commercialization reflected in the 37 FDA approvals in 2022 will incentivize continued investment in new and existing companies that have sound business models and underlying science

- Strong demand for life science real estate product illustrated by three notable non-Alexandria sales

Joel Marcus says,

Strong Financial Performance

- 8.5% FFO per share earnings growth in Q4 2022

- Strengthened balance sheet, the strongest in company history

- Continued stable, increasing, long duration cash flows and increasing dividend

Strong Leasing Performance

- Two million square feet leased in Q4 2022, over eight million for the year, and almost 18 million for the last two years

- Rental rate increases of about 22% on a cash basis

- Almost 95% occupancy rate

Value Harvesting and Capital Recycling

- $2.2 billion successfully harvested and reinvested in a highly disciplined manner in 2022

- Excellent and steady progress made in 2023 business plan for value harvesting and capital recycling

National Imperative for Innovation in Medicine

- Continued need for innovation in medicine to address neurodegenerative diseases, cancer, mental illness, and drug overdoses

- Calls for governments at all levels to double down on resources and focus on mental health issue

Total Shareholder Return

- Total shareholder return from IPO through December 31, 2022 of 1673%, compared to MSCI read index of 684%, S&P 500 of 628%, and NASDAQ 838%

Q & A sessions,

Impact of M&A on Biotech Industry

- Platform technologies have made M&A more beneficial for growth in clusters.

- Teams acquired were found to be more valuable than just the pipelines.

- 75% of products that reached the market were from external innovation that ended up in pharma’s hands.

Rents for Lab Space

- Rents for lab space have held well and are still fairly strong.

- Concessions have not regressed at all and remain constant.

Predictions for Future Biotech M&A

- M&A will involve partnering and bolt-on acquisitions.

- Historic big mega mergers are not relevant to today’s biotech industry.

- The key to the industry’s success in 2023 will be the velocity, depth, and focus of the large cash hoard of $300 billion, which could be leveraged up to $500-600 billion.