Best Buy Co., Inc.

CEO : Ms. Corie Sue Barry

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

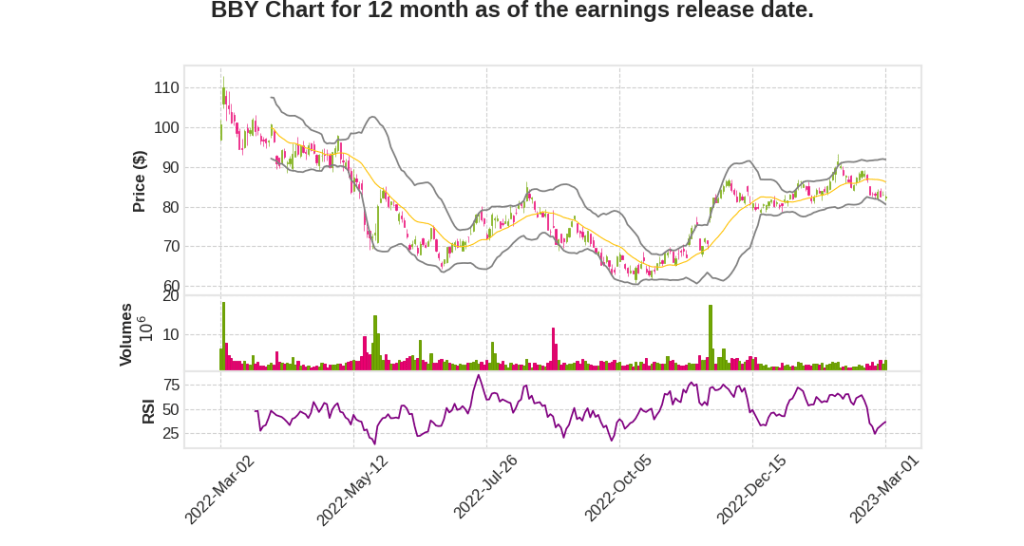

| 2023 Q4 | -10.0% YoY | -15.5% | -15.5% | 2023-03-02 |

Corie Barry says,

Q4 2023 Earnings Call Highlights

- Q4 sales results in line with expectations and better-than-expected profitability

- Q4 comparable sales were down 9.3% YoY, but non-GAAP operating income rate of 4.8% was higher than expected

- Promotional environment in Q4 was more intense than last year, but related financial pressure was less than expected

- Largest impacts to domestic comparable sales decline came from computing, home theater, appliances, and mobile phones, partially offset by growth in gaming and tablets

- Expecting continued volatility and another down year for the CE industry in fiscal 2024 due to macroeconomic headwinds

- Expecting a return of industry growth in calendar 2023 due to incremental growth during the pandemic, natural upgrade and replacement cycles for tech, and constant innovation

- Strategically focused on evolving omnichannel retail model, building customer relationships through membership, incubating and growing Best Buy Health, removing costs and improving efficiency and effectiveness, and unlocking reverse secondary market opportunities

- Closing an average of 15 to 20 traditional large-format stores per year and scaling experienced store remodels

- Shifting selling square footage of core medium-sized stores into larger backrooms to better support in-store pickup of online orders and help vendor community fulfill direct-to-consumer channel

Corie Barry says,

Membership and Engagement

- Best Buy has around 100 million My Best Buy members, out of which 40-45 million are active, and 5.8 million Totaltech members.

- There is a high percentage of sales from these two membership pools.

- The company is looking to engage more with these members and tailoring to their preferences for personalized approach.

- Best Buy is working on improving the onboarding process for new members and leveraging existing vehicles for consultations, services, trade-ins, and other offers.

- The Best Buy Ads model helps in tailoring advertising to specific audiences based on their preferences and knowledge about them.

Q & A sessions,

Consumer Indicators

- Uneven and unsettled consumer who is still not confident about the future

- Sustainable high inflation in basics like food, fuel, and lodging might make customers make trade-off decisions

- Spending continues mostly on services over goods

Vendor Partnerships

- Continued evolution of vendor partnerships

- Interesting partnerships around membership offerings, Best Buy Ads, and services

- Real opportunity in supply chain and fulfillment

Employee Investments

- Average hourly wage is up 25% vs. 2019

- Continuous investments in workforce, including wages and benefits over the last 3 years

- Low turnover rates compared to industry averages

- Laser-focused on balancing pay, benefits, and work-life balance and flexibility

Cost Reduction Efforts

- Finding flaws in the experience and making opportunity out of those flows instead of solely expense reduction

- Outlets as a unique and differentiated customer experience that pulls new customers in at 2 times the recovery rate

- Ongoing assessment of the model and creatively finding flaws in the system

Customer Experience Changes

- Changes made to meet the changing customer and create experiences that customers love

- Investing more in frontline associates

- Balance between acquisition and retention of members and figuring out experiences that keep customers sticky

- Potential for another tiered membership program