Becton, Dickinson and Company

CEO : Mr. Thomas E. Polen Jr.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

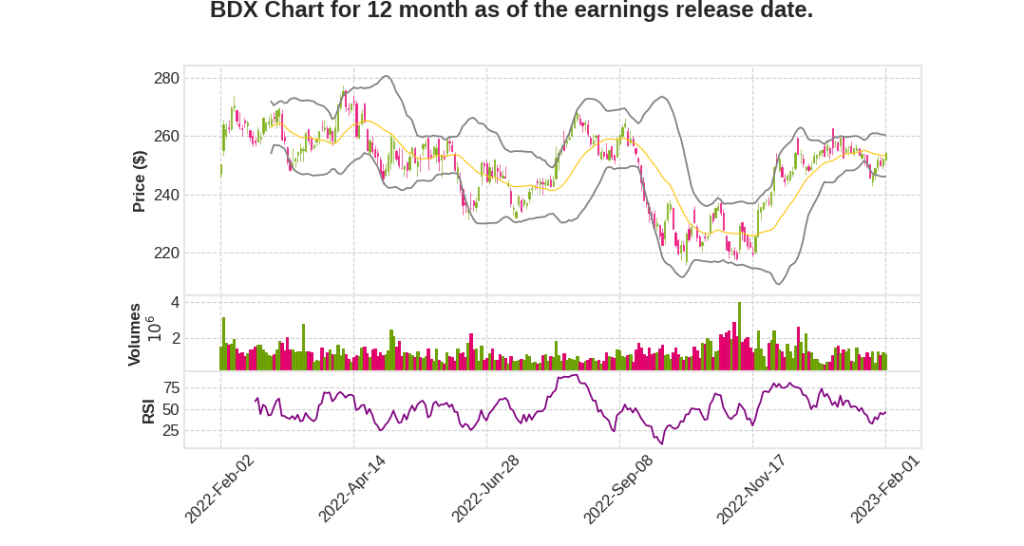

| 2023 Q1 | -8.2% YoY | -28.2% | -22.6% | 2023-02-02 |

Chris DelOrefice says,

Revenue Performance

- Exceeded expectations for Q1 with $4.6 billion in revenue and 5.2% base business growth.

- COVID-only testing revenues declined from $185 million to $32 million YoY.

- Total company base business growth was strong across BD Medical and BD Interventional with approximately 6% growth.

- Base revenue growth in BD Life Sciences of 3.3% reflects the comparison to licensing revenues that impacted growth by almost 400 basis points.

- Base business revenue performance continues to be supported by durable core portfolio and increasing contribution from transformative solutions in innovation pipeline.

Segment Performance

- BD Medical revenue totaled $2.2 billion in Q1, growing 6.1% driven by strong growth in both Medication Management Solutions and Pharm Systems.

- BD Life Sciences revenue totaled $1.3 billion in Q1, declining 7.3% YoY due to lower COVID-only testing revenues. Base revenues grew over 7% excluding licensing growth.

- BD Interventional revenues totaled $1.1 billion in Q1, growing 5.6% driven by surgery and peripheral intervention growth.

Profit and Loss

- Reported Q1 adjusted diluted EPS of $2.98 with gross margin of 54.7% and operating margin of 22.9% that were consistent with expectations.

- Base margins were up slightly YoY despite around 350 basis points of outsized inflation, driven by selling through inventory that included peak inflation impacts from FY 2022 and the impact of labor inflation and elevated shipping.

- Q1 R&D of 6.4% of sales reflects innovation investments aligned to long-term growth outlook.

Guidance for Fiscal 2023

- Increasing base revenue guidance from 5.25% to 6.25% to 5.75% to 6.75% driven by Q1 revenue outperformance and consistent durable growth profile.

- Base revenue guidance includes planned strategic portfolio exits impacting growth by approximately 100 basis points while being accretive to margin and a positive contribution of approximately 100 basis points from recent acquisitions.

- Operating margins expected to improve by at least 100 basis points, absorbing decline in COVID-only revenue, which has higher margin profile.

- Over 80% of improvement in operating margin expected to come from SSG&A driven by internal cost containment and leverage.

Tom Polen says,

Q1 2023 Earnings Highlights

- Revenue growth of 5.2%

- Adjusted diluted EPS of $2.98

- Strong performance despite market disruption in China

BD2025 Strategy

- Driving all three pillars of strategy: accelerating growth, simplifying the company, and empowering associates

- Investing approximately 60% of R&D in smart connected care, enabling new care settings, and improving chronic disease outcomes

- Exciting innovation pipeline and systematically increasing WAMGR supporting strong growth profile

Medical Segment

- Investments in R&D and tuck-in M&A focused on medication management solutions, pharmacy automation, pharma and biotech drug delivery and vascular access management

- Launch of PosiFlush SafeScrub to enhance compliance with infection prevention guidelines

BD Life Sciences Segment

- Providing solutions from sample collection and discovery to diagnosis

- Advancing strategy of menu expansion with initial sales outside the U.S. of BD MAX respiratory viral panel (RVP)

- Progressing strategy in blood collection at the point-of-care with BD MiniDraw capillary blood collection system

BD Interventional Segment

- Provides solutions for chronic disease management, serving end markets such as oncology, incontinence, advanced repair and reconstruction, and the $5 billion peripheral vascular disease market

- Global launch of Venovo venous stent in China, the first stent designed for iliofemoral venous disease in this market

- Achieved significant milestone completing safety testing for a multimodality vacuum-assisted biopsy system

BD2025 Financial Performance

- Disciplined and balanced capital deployment strategy supporting strong flexible balance sheet

- Simplification programs across manufacturing network, portfolio, and operating model to drive supply chain excellence and make BD more agile

- Long-term targeted base revenue growth of 5.5% plus and double-digit EPS growth

- Updated guidance for FY 2023 reinforces confidence in ability to achieve targets

Q & A sessions,

Increased guidance and broad-based growth

- Increased 50 basis points of growth on base business

- Despite COVID-only testing revenue being down, absorbed it as well

- Margin improvement with at least 100 basis points commitment

Inflationary pressures and cost improvement initiatives

- Inflationary headwinds of over 200 basis points for the third year in a row

- Significantly weighted towards the first half of the year

- 350 basis points of outsized inflation in Q1

- Focus on cost improvement initiatives and driving portfolio mix to offset costs

China performance and recovery

- China declined slightly in Q1 due to COVID impact, but starting to see recovery in January

- Expecting double-digit growth for 2023 with four-pronged strategy and local presence strengthening in China

Exciting pipeline and focus on higher-growth markets

- 25 new product launches in FY2022, including HealthSight diversion management and Core high-throughput platform

- Focusing on shifting portfolio into higher-growth markets and achieving WAMGR goals

- Systematically executing R&D and delivering milestones more effectively

Margin and performance outlook

- Feel confident about meeting guidance and delivering at least 100 basis points of margin improvement for the year

- Timing differences in R&D and SSG&A, lack of reinvestment, and abatement of inflationary pressures will positively impact margins