BorgWarner Inc.

CEO : Mr. Frederic B. Lissalde

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

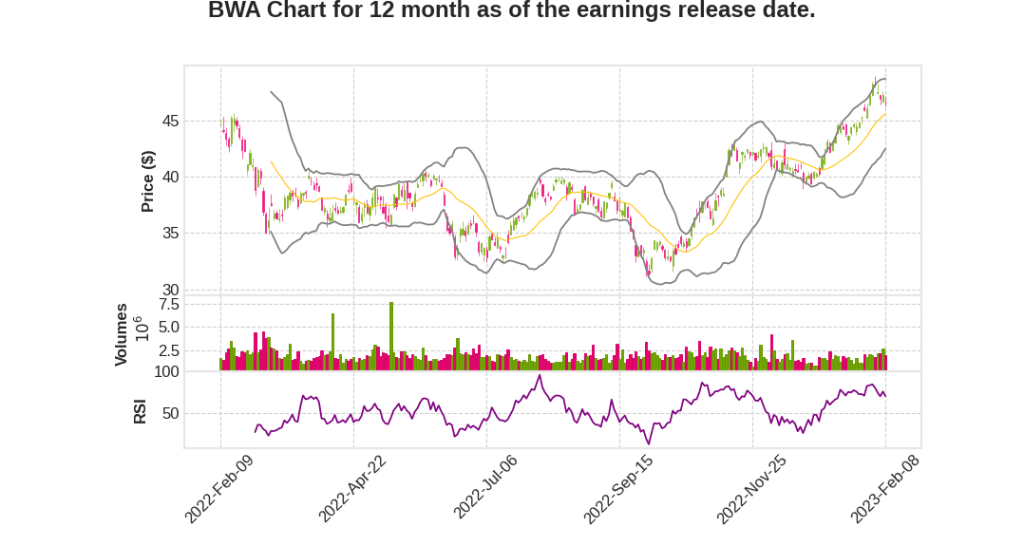

| 2022 Q4 | 12.4% YoY | 102.8% | 100.7% | 2023-02-09 |

Kevin Nowlan says,

Strong Sales Performance

- BorgWarner had $15.8 billion in sales, up 14% compared to overall industry growth of less than 4%.

- Bold: BEV-related sales contributed significantly to growth.

- BorgWarner achieved solid margin performance despite production volatility and inflationary headwinds.

Sustainability Efforts

- BorgWarner announced its commitment to reduce absolute Scope 3 emissions by at least 25% by 2031 from a 2021 baseline.

- Targets aim to achieve a net 0 carbon emission future for all.

- BorgWarner will focus on transitioning the product portfolio to electrification, increasing content of recyclable remanufactured material, reducing product weight and driving sustainable raw material selection.

Planned Separation of Fuel Systems and Aftermarket Segments

- Intended separation will allow each company to pursue its own strategies with an overarching focus on maximizing the value opportunity for shareholders.

- NewCo is positioned well for success as a stand-alone public company in the commercial vehicle and hydrogen injection segments.

- The intended separation will accelerate BorgWarner’s Charging Forward strategy and focus all of their energy towards electrified propulsion.

Progress in Electrification Awards

- BorgWarner will supply a major German vehicle manufacturer with innovative battery cooling plates for the OEM’s next-generation electric vehicles.

- BorgWarner is expanding its silicon carbide inverter business with a top global OEM with an 800-volt award.

- Secure pure BEV programs for about $3 billion of booked sales in 2025.

Full-Year Outlook

- BorgWarner expects total 2023 revenue in the range of $16.7 billion to $17.5 billion, which equates to organic growth of approximately 7% to 12%.

- Bold: BorgWarner is projecting between $1.5 billion and $1.8 billion in EV revenue in 2023, up significantly from the $870 million generated in 2022.

- Full-year adjusted operating margin is expected to be in the range of 10.0% to 10.4%.

- Expectation of a $60 million to $70 million increase in e-products related R&D investment.

Patrick Nolan says,

Introduction

- BorgWarner has issued a press release earlier this morning, which is posted on their website, borgwarner.com

- During the call, forward-looking statements will be made, which involve risks and uncertainties

- Non-GAAP measures will be highlighted for comparison purposes with prior periods

- The presentation is posted on the Investor Relations page of their website

Financial Performance

- BorgWarner’s Q4 2022 revenue is expected to be $4.05 billion to $4.15 billion

- The company’s full-year revenue in 2022 is expected to be $16.2 billion to $16.4 billion

- The adjusted earnings per share (EPS) are expected to be $1.00 to $1.10 for Q4 2022

- The adjusted EPS for the full-year 2022 is expected to be $4.10 to $4.20

Segment Performance

- The company’s drivetrain segment is expected to have a revenue of $2.1 billion to $2.2 billion in Q4 2022

- The engine segment is expected to have a revenue of $1.8 billion to $1.9 billion in Q4 2022

- The electric and hybrid segment is expected to have a revenue of $150 million to $160 million in Q4 2022

Acquisition

- BorgWarner has completed the acquisition of AKASOL AG, a leading provider of high-performance battery systems for commercial vehicles

- The acquisition is expected to strengthen BorgWarner’s commercial vehicle electrification capabilities

Outlook

- BorgWarner is preparing for growth opportunities in the electric and hybrid vehicle market

- The company is focused on developing advanced technologies to improve efficiency and reduce emissions

- BorgWarner is committed to sustainable practices and reducing their environmental impact

Q & A sessions,

Company Sales and Sustainability Efforts

- BWA sales grew by 14% compared to a market growth of less than 4%, with significant contributions from BEV sales.

- The company made significant sustainability efforts and committed to reducing absolute Scope 3 emissions by at least 25% by 2031 from 2021 baseline. The company also aims for an 85% absolute Scope 1 and Scope 2 emissions reduction by 2030.

Planned Separation of Fuel Systems and Aftermarket Segments

- The company has planned the separation of Fuel Systems and Aftermarket Segments to unlock shareholder value and accelerate the Charging Forward strategy.

- The separation accelerates the focus on electrified propulsion and enhances management attention and flexibility to pursue attractive EV investments.

Progress in New Electrification Awards and Charging Forward Targets

- BorgWarner secured multiple new electrification program awards, including supplying a major German vehicle manufacturer with innovative battery cooling plates and expanding its silicon carbide inverter business with a top global OEM with an 800-volt award.

- BorgWarner estimates pure BEV programs that account for around $3 billion of booked sales in 2025 and accomplished $1.3 billion of EV-related sales in 2025 through completed or announced 5 acquisitions since the start of Charging Forward.

Financial Performance in Q4 2022 and Full Year Outlook for 2023

- In Q4 2022, BWA had a year-over-year increase in organic revenue by about 21% despite the impact of a strengthening US dollar on revenue.

- The company expects total 2023 revenue in the range of $16.7 billion to $17.5 billion, which equates to organic growth of approximately 7% to 12%, with an estimated $1.5 billion to $1.8 billion in EV revenue in 2023, up significantly from the $870 million generated in 2022.

- The full year adjusted operating margin is expected to be in the range of 10.0% to 10.4%, and the company anticipates a $60 million to $70 million increase in e products-related R&D investment.