Cardinal Health, Inc.

CEO : Mr. Jason M. Hollar

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | 13.2% YoY | -142.2% | -394.1% | 2023-02-02 |

Trish English says,

Consolidated Results

- Total company revenue increased by 13% and gross margin increased by 3%, driven by the Pharma segment.

- Consolidated SG&A increased by 4%, reflecting inflationary supply chain costs, but was offset by enterprise-wide cost savings initiatives.

- Operating earnings were in line with the second quarter of last year, primarily due to Pharma segment growth and anticipated decline in Medical segment profit.

- Interest and others decreased nearly 30% to $18 million driven primarily by increased interest income from cash and equivalents, resulting in a net benefit from rising interest rates.

- Earnings per share growth was 4% to $1.32.

Segment Performance

- Pharma segment revenue increased 15% to $48 billion, driven by brand and Specialty Pharmaceutical sales growth from existing and net new customers.

- Pharma segment profit increased 9% to $464 million, driven by a higher contribution from Branded Specialty Products and Generics program performance, partially offset by inflationary supply chain costs.

- Medical segment revenue decreased 7% to $3.8 billion, driven by lower products and distribution sales, including PPE pricing and volumes.

- Medical segment profit finished in line with prior commentary, decreasing 66% to $17 million, primarily due to lower products and distribution volumes and net inflationary impact, partially offset by an improvement in PPE margin.

Fiscal 2023 Outlook

- EPS guidance was raised to a new range of $5.20 to $5.50, reflecting improved outlooks for the Pharmaceutical segment and for interest in other.

- Pharma segment revenue outlook was raised to a new range of 13% to 15% growth, and profit outlook to a new range of 4% to 6.5% growth, both primarily reflecting strong first half performance.

- Medical segment revenue decline of 3% to 6% and segment profit ranging from flat to a decline of 20% is still expected.

- Net impact of inflation is still expected to be approximately $300 million in fiscal 2023 or a minimal year-over-year impact.

Share Repurchases and Cash Position

- $1.25 billion has been deployed year-to-date for share repurchases, and $1.5 billion to $2 billion is expected to be deployed in fiscal 2023.

- Adjusted free cash flow was $439 million for Q2 and $781 million year-to-date.

- Cash position was $3.7 billion with no outstanding borrowings on the credit facility, and $550 million of March 2023 notes are expected to be paid down with cash on hand.

Jason Hollar says,

Pharma segment’s performance

- The Q2 results demonstrated ongoing stability and growth in the Pharma segment.

- The overall pharmaceutical demand was strong, and the Generics program performed well.

- The Specialty products showed an increase in contributions, which is a key strategic area of focus for the company.

- The company effectively managed through the inflationary headwinds affecting industry supply chains.

Medical segment’s performance

- The Medical segment’s Q2 results were consistent with the prior commentary, and they showed a return to profitability in the quarter.

- The company remains highly focused on its medical improvement plan initiatives to drive more predictable financial performance.

Enterprise-level benefits

- The company saw benefits below the operating line from its capital deployment actions and favorable capital structure.

Revised outlook

- The company raised its full-year EPS guidance and outlook for the Pharmaceutical segment.

Strategic priorities

- The company is executing on the medical improvement plan, building on the growth and resiliency of the Pharmaceutical segment, and maintaining a relentless focus on maximizing shareholder value.

Q & A sessions,

Medical Improvement Plan Initiatives

- 30% of growth impact mitigated in Q2 from inflation and global supply chain constraints

- Temporary price increases across nearly all Cardinal Health brand product categories to offset higher costs

- 50% inflation mitigation expected by end of fiscal 2023

- Investing in Cardinal Health brand portfolio and expanding sustainable technologies manufacturing facility in Florida

- Investing in growth businesses primarily at-home solutions

Pharma Segment

- Focusing on executing in core and accelerating growth areas, particularly specialty

- Double digit growth from manufacturer services in Q2

- Investing in automation to enhance technology across the supply chain

- Collaborating with Palantir to offer customers a solution that connects diagnostic and clinical data with real-time purchasing and consumption data

- Excited about the work in cell and gene therapy across all service offerings

Relentless Focus on Shareholder Value Creation

- Continuing to place strong emphasis on responsible capital deployment and share repurchases

- Business Review Committee working on comprehensive review of company’s strategy, portfolio, capital allocation framework, and operations

- Investor Day on June 8th to provide update on company’s long-term financial outlook and growth strategies

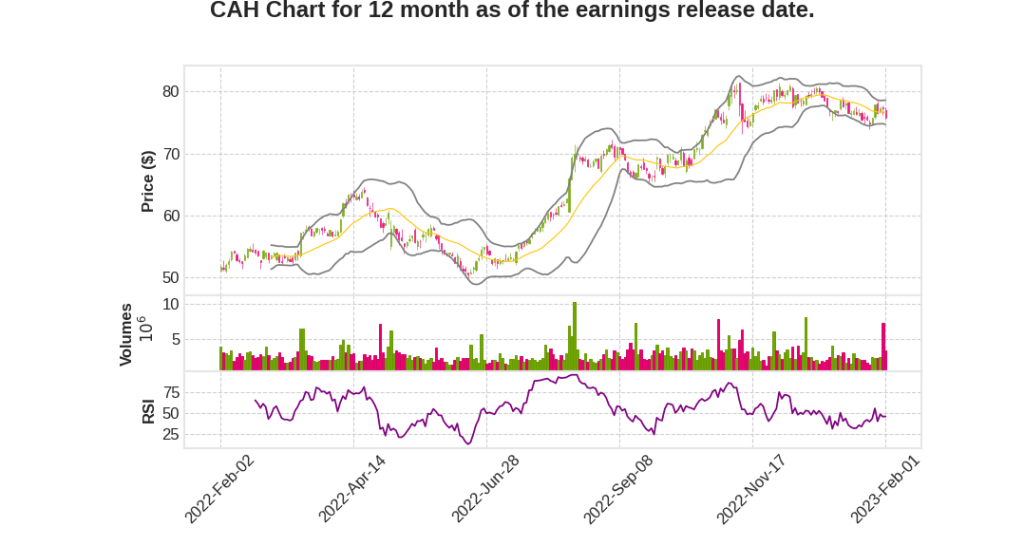

Factors Affecting Stock Movement

- Continued progress in mitigating inflation and global supply chain constraints

- Optimizing and growing Cardinal Health brand portfolio

- Growth in Pharma segment, particularly specialty

- Investments in automation and technology to enhance supply chain

- ESG and diversity, equity and inclusion initiatives