Carnival Corporation & plc

CEO : Mr. Josh Weinstein

Quarterly earnings growth(YoY,%)

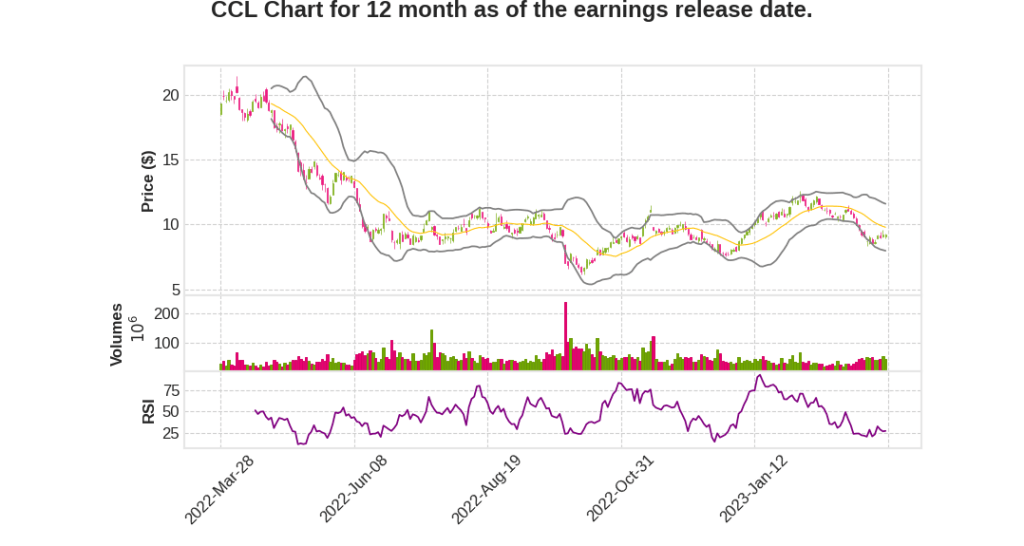

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q1 | -100.0% YoY | -88.5% | -66.9% | 2023-03-27 |

Josh Weinstein says,

Record Wave Season with Strong Demand Generation

- Experiencing a record wave season that started early and has extended later into the year

- Outperformed guidance on all measures in Q1

- Expect favorable trends to continue based on the traction from ongoing efforts to drive demand globally

- Had sequential improvement in occupancy gap to 2019 and anticipate being just 7 points or less away from 2019 occupancies in Q2

- Successfully drove ticket prices higher and throttled back on opaque channel while maintaining outsized onboard revenue growth

Cost Guidance Update and Expected Adjusted EBITDA

- Updated cost guidance to reflect decisions taken during the quarter but still expects greater EBITDA and adjusted free cash flow

- Expect adjusted EBITDA of $4 billion at midpoint for the year

- Gap to 2019’s record $5.5 billion of adjusted EBITDA primarily driven by 2023 occupancy gap to 2019 and drag due to fuel prices and currency changes compared to 2019

- Expect to be 2/3 of the way back to levels that rival 2019 in Q2

Strong Demand Generation and Market Recovery

- Capitalizing on pent-up demand for cruise vacations and building on large base of loyal guests while increasing awareness and consideration among new-to-cruise guests

- North American brands running in excess of record 2019 levels for last 6 months with booking lead times now back to peak levels

- European brands catching up to the U.S. market in the recovery cycle with strong close-in demand and continued lengthening in booking curve

- Successfully resumed operations in Asia and actively working to right-size the Costa brands

- Trade showing a fantastic rebound in its recovery with the company’s brands exceeding 2019 levels

Brand Strategies and Road Maps to Drive Revenue Generation

- Refreshing segmentation research across all major source markets and fine-tuning each brand’s positioning and marketing efforts to attract new-to-cruise guests and increase loyalty

- Developing new brand affinity partnerships to drive new-to-cruise demand to a brand that will resonate with its target guests

- Bolstering sales and service support to address increased volume and reduce call times resulting from increased advertising and sales support

- Sharpening revenue management tools to drive incremental revenues through increased bundled package offers and new upgrade programs

- Actively reducing already low cancellation levels through changes to deposit policies and new fare structures

Monetizing Industry-Leading Land-Based Assets

- Meaningful expansion of Half Moon Cay, consistently voted best private island, and developing largest Caribbean destination yet, Grand Bahama port, to deliver wow fact tailored to Carnival Cruise Line guests to drive higher revenue yields and margins

David Bernstein says,

Q1 2023 Results

- Adjusted EBITDA of $382 million, $82 million above the midpoint of December guidance

- Favorability in ticket prices and adjusted cruise costs without fuel

- Onboard and other revenue continued at an elevated pace demonstrating strength in consumer

Cumulative Book Position

- Cumulative advanced booked position at higher ticket prices normalized for future cruise credits compared to strong 2019 pricing

- Total customer deposits achieving a Q1 record of $5.7 billion, a 16% increase compared to the previous year

2023 Full Year March Guidance

- Capacity growth for the full year 2023 expected to be 4.5% compared to 2019

- Full year 2023 occupancy expected to be 100% or higher

- Net per diems expected to be up 3% to 4% compared to 2019

- Adjusted cruise costs without fuel per ALBD for the full year 2023 versus 2019 expected to be up 8.5% to 9.5%

- European brands onboard and other revenue per diems expected to be up significantly versus 2019

Financial Position

- Adjusted free cash flow turned positive in Q1 2023 and expected to be positive for the full year 2023

- Total debt peaked at over $35 billion in Q1 2023 and expected to be down to approximately $33.5 billion by year-end

- Debt maturity towers well managed through 2024

- No intention to issue equity

Q & A sessions,

Positive Trends

- Experiencing a record wave season which started early and gained strength, expected to continue based on the traction in driving demand globally

- Outperformed guidance on all measures: Revenue, costs, adjusted EBITDA and earnings

- Sequential improvement in occupancy gap to 2019 from 19 points in Q4 to 13 points in Q1 on increasing capacity, which is now above 2019 levels

- Driving ticket prices higher and continue to throttle back on opaque channel while maintaining outsized onboard revenue growth

- Booking volumes have been running in excess of record 2019 levels for the last 6 months in North America

Financials

- Expecting adjusted EBITDA of $4 billion at the midpoint for the year

- Per ALBD basis and holding fuel price and currency constant to 2019 levels, roughly 60% back to 2019 EBITDA in the first quarter

- Gap to 2019’s record $5.5 billion of adjusted EBITDA is being driven primarily by 2023 occupancy gap to 2019 and fuel prices and currency changes compared to 2019

- Each point of net yield improvement results in $170 million to the bottom line in 2024

Demand Generation

- Capturing incremental demand given high satisfaction and low penetration levels; positioned to continue driving ticket prices higher and more than offset the drag from fuel price and currency over time

- Capitalizing on pent-up demand for cruise vacations, building on a large base of loyal guests as they increase awareness and consideration among new to cruise guests

- Investment in advertising and sales support is paying off; trade activity exceeding 2019 levels as they support trade partners with increased training and engagement

- Redesigning websites, refining digital performance marketing efforts, and opening deployments further in advance to increase online traffic and improve conversion

- Sharpening revenue management tools to drive incremental revenues through increased bundled package offers and new upgrade programs

Brand Strategies

- Refreshed segmentation research across all major source markets to confirm and resize target audiences by brand post-pause

- Developed new brand affinity partnerships and launched new marketing campaigns across multiple media channels, including new national and homeport-driven regional television in most major markets to increase awareness

- Refining onboard apps to increase communication and engagement as well as capturing incremental onboard revenue

- Reducing low cancellation levels through changes to deposit policies and new fare structures

- Using guest insights and sharing cross-brand learnings to aid in everything they do