CDW Corporation

CEO : Ms. Christine A. Leahy

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

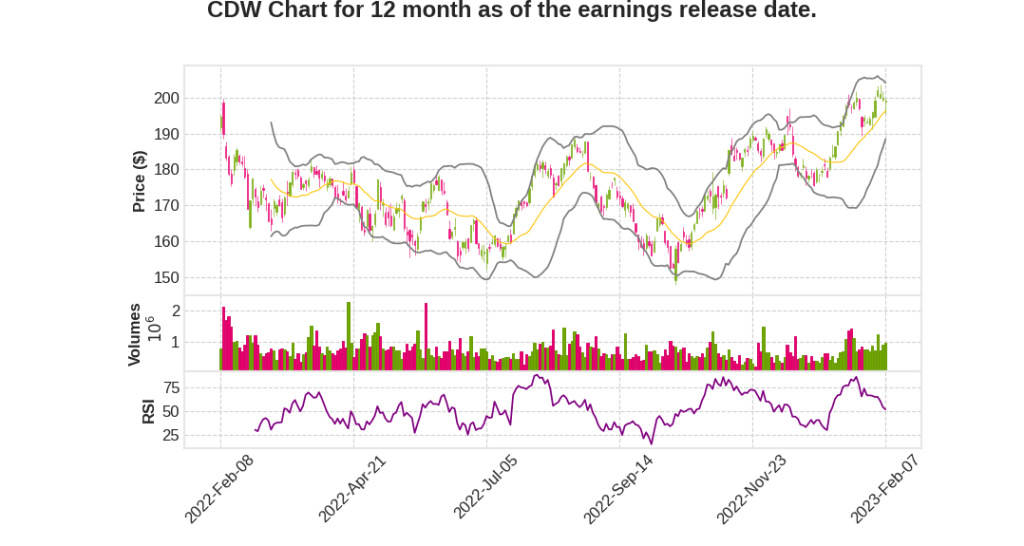

| 2022 Q4 | -1.8% YoY | 31.6% | 32.5% | 2023-02-08 |

Chris Leahy says,

Financial Performance Overview

- Record profitability in Q4 despite a decline in client device sales

- Net sales for Q4 were $5.4 billion, approximately flat on a constant currency basis

- Non-GAAP operating income was $523 million, up 23% YoY

- Non-GAAP net income per share was $2.50, up 21% YoY

Client Device Sales Decline

- The K-12 market represented roughly half of the decline in client device sales

- The decline was steeper than anticipated due to economic uncertainty

Full-Year Financial Performance

- Constant currency net sales grew 15% in 2022

- Each profit category down the P&L statement was up 20% or more

- Acquisitions have accelerated services breadth and depth

Customer End Market Performance

- Corporate sales increased by 7%

- Small business declined by 13%

- Healthcare sales were up by 8%

- Government grew by 13.5%

- K-12 client device sales declined by more than 68%

- UK increased low-double-digits in local currency and Canada increased high-single-digits in local currency

Portfolio Performance

- Network modernization upgrades drove double-digit increases in NetComm

- U.S. hardware sales declined mid-teens

- Broad and deep portfolio allowed for high-single-digit growth across solutions portfolio

Al Miralles says,

Net Sales

- Consolidated net sales were $5.4 billion, down 1.8% on a reported and an average daily sales basis.

- Net sales were impacted by the significant change in client device demand during the quarter.

- Sales decreased 12.5% versus the third quarter, with two-thirds of lower net sales related to the public sector and driven primarily by K-12.

Gross Profit Margin

- Gross profit margin was a record 21.7%, up 410 basis points versus last year and 190 basis points above the prior year quarter record.

- The year-over-year expansion in gross profit margin was driven by several factors, including mix into complex hybrid cloud solutions and lower mix of transactional products.

- Net sales contribution from high-margin services increased 28% in Q4 2022 compared to the prior year quarter.

Operating Income and Net Income

- GAAP operating income was $447 million, up 31.6% compared to the prior year. Non-GAAP operating income was $523 million, up 23.2%.

- Our non-GAAP net income was $343 million in the quarter, up 20% on a year-over-year basis. Non-GAAP net income per diluted share was $2.50, up 21%.

Capital Allocation

- They reduced borrowings under their senior unsecured term loan by $200 million to reduce leverage.

- For 2023, they will target returning 50% to 75% of free cash flow to investors through dividends and share repurchases.

- Their targeted net leverage ratio will be 2x to 3x, a range that is consistent with their commitment to an investment-grade capital structure.

2023 Outlook

- They maintain their long-held expectation to outgrow the market by 200 basis points to 300 basis points per year.

- They expect netted-down revenues will grow faster than other product and solution categories.

- Currency is expected to be neutral for the full-year, with modest headwinds in the first half and modest tailwinds in the second half.

Q & A sessions,

CDW Q4 2022 Earnings Call Highlights

- The company has seen a pivot in the market towards the end of November and into December.

- CDW still views 200 basis points to 300 basis points as their target go-to.

- In 2023, stronger growth in cloud and Software-as-a-Service and security will lead to more significant customer spend than the 2.5% figure.

- The company raised its rule of thumb for free cash flow reflecting an effective working capital management and a countercyclical nature of the business.

- Netted-down revenues will increase the DSO and DPO from a cash conversion cycle perspective but are managed dynamically alongside investments in inventory and management of AR and AP.