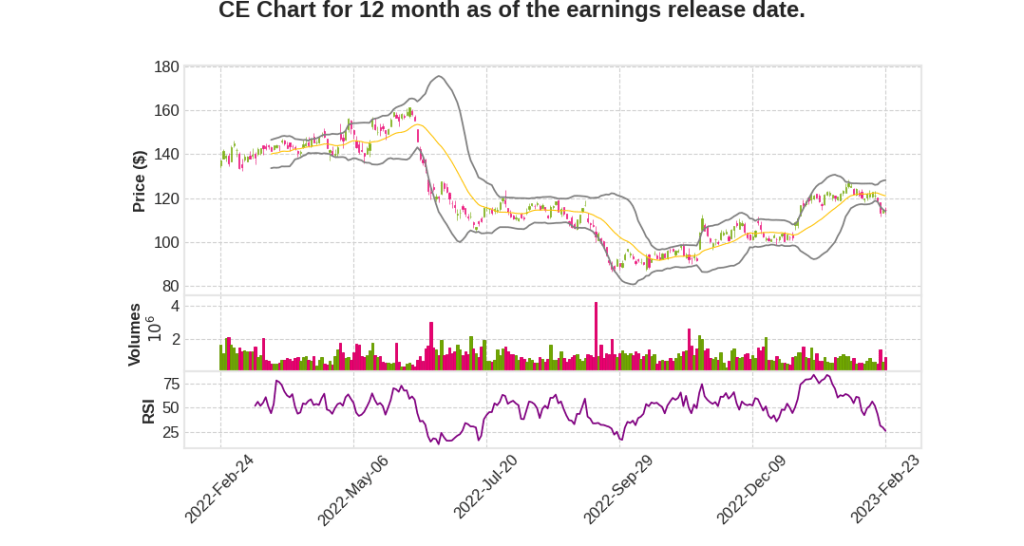

Celanese Corporation

CEO : Ms. Lori J. Ryerkerk BS

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 3.2% YoY | -90.8% | 46.7% | 2023-02-24 |

Lori Ryerkerk says,

Expected Increase in Acetyls

- Projected $50 million to $100 million increase in Q2 off of Q1

- Lower natural gas pricing in the U.S. benefits margins for U.S.-based production

- Frankfurt VAM restart and quicker recovery in construction paints and coatings in Europe

- Volume rebound and productivity improvements

Expected Increase in Engineered Materials and M&M

- Projected $40 million lift in Q2 due to lower raw material costs

- Destocking finished and strong improvement in order books in March

- Modest improvement in automotive production

- Additional synergies from M&M acquisition

- Continued productivity improvements

Overall Comfort With Q2 Guidance

- Projected numbers are not unknown territory for the company

- Positive trends in energy pricing, raw material costs, and demand recovery

- Confidence in reaching $12 to $13 guidance by delivering about 350 for the last three quarters of the year

Brandon Ayache says,

Financial Performance

- Fantastic Q4 2022 earnings performance with a net sales revenue of $1.8 billion, exceeding the guidance range provided in Q3 2022.

- Adjusted earnings per share was $3.15, reflecting a 44% increase compared to the previous year.

- The company generated a record $480 million of free cash flow in Q4 2022.

Business Outlook

- The company is confident in its ability to deliver strong financial performance in 2023, supported by strong demand across all businesses and geographies.

- Celanese anticipates a continued strong demand for its products, and the company plans to expand its production capacities to meet this demand.

Dividend and Share Repurchase

- Celanese announced a 30% increase in its quarterly dividend to $0.72 per share.

- The company also plans to repurchase $1 billion of shares over the next 12 months.

Capital Expenditures

- In 2023, Celanese plans to invest $600 million in capital expenditures to support business growth and productivity improvements.

COVID-19 Impact

- The company has experienced some supply chain disruptions and inflationary pressures due to the ongoing COVID-19 pandemic.

- Celanese expects these challenges to continue in the near term, but the company is actively managing the situation to minimize the impact on its operations and financial performance.

Q & A sessions,

Factors Expected to Impact Supply Demand Dynamics

- Lower demand for shipping raw materials from Asia to Europe

- Low-energy prices resulting in better pricing for European customers

- Higher demand in China making it less attractive to ship across

Projected EBITDA for M&M Assets

- Expected EBITDA for 2022 was $500 million, but lower year-end challenges resulted in a $700 million projection for next year

- Team is working on pricing, product pipeline, and cross-selling to achieve a $800 million EBITDA run rate by the end of 2023

Factors Contributing to Synergy Capture and Volume Recovery

- Synergy uplift expected to be $120 million for next three quarters

- Volume recovery in M&M assets, particularly from Vital and Asia

- Pricing on differentiated products

- Productivity at M&M plant expected to generate an additional $40-$50 million

Expected Benefits and Debt Reduction from Food Ingredient Joint Venture

- Joint venture with Mitsui expected to generate $400 million to $450 million for debt reduction from food ingredient’s deal

- Joint venture structure considered beneficial for both companies

- Western company providing sweeteners creating positive movement in demand and pricing

Comparison of Fourth Quarter 2021 and 2022 Dynamics

- Similar to 2021, end-of-year destocking and anticipation of lower prices contributed to slower start in Q1 2022

- Supply chain issues resolved, leading to increased confidence in buying material and a return to more normal trajectory

Expected Contributions and Foundational Earnings for Next Few Years

- Expect EM and acetyls to contribute roughly evenly for next few years, with acetyls possibly showing more volatility due to market reactions

- Foundational level of earnings before Tow acquisition is $1 billion to $1.1 billion