C.H. Robinson Worldwide, Inc.

CEO : Mr. Scott P. Anderson

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

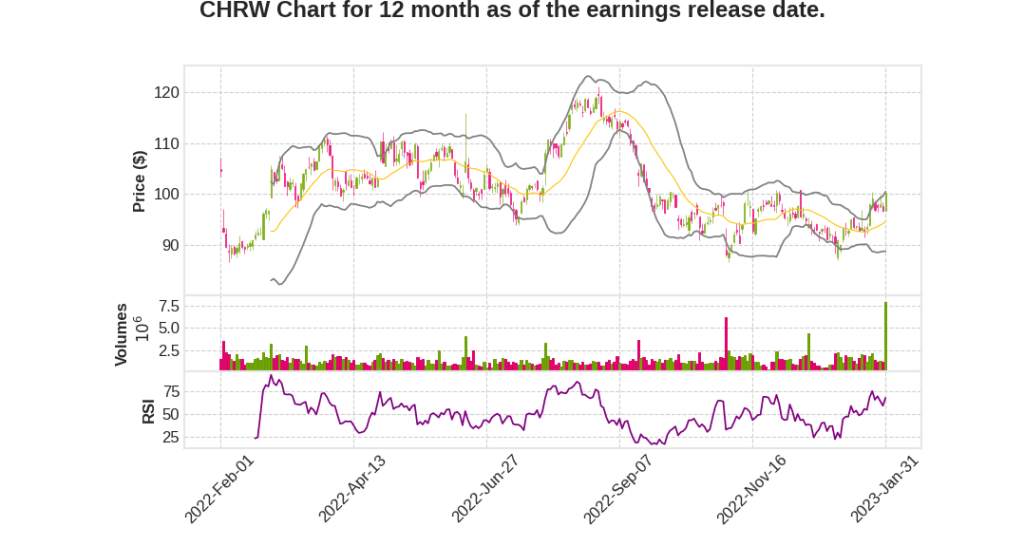

| 2022 Q4 | -22.1% YoY | -42.9% | -54.2% | 2023-02-01 |

Mike Zechmeister says,

Decreased AGP and Volume in Q4 2022

- Q4 adjusted gross profit (AGP) was down $88 million or 10.3% compared to Q4 of 2021.

- The decline was driven by a 39% decrease in Global Forwarding and partially offset by a 5.7% growth in NAST.

- In NAST truckload business, volume declined on a year-over-year basis for the first time in seven quarters with shipments down 4%.

Softening Market Conditions and Decline in Linehaul Cost and Price

- Softening market conditions led to a significant decline in the import prices for ocean and airfreight in Q4 2022.

- In NAST truckload business, the excess carrier capacity combined with slowing demand led to the softening market conditions.

- The average truckload linehaul cost paid to carriers excluding fuel surcharges decreased by 24% year-over-year while the average linehaul rate billed to customers decreased by 21% year-over-year.

Reduction in Personnel Expenses and Headcount

- Q4 personnel expenses were $427.3 million, up 1.7% compared to Q4 last year, including $21.5 million of severance and related charges.

- Over 600 employees had exited the company as of early January due to restructuring.

- For 2023, personnel expenses are expected to be $1.55 billion to $1.65 billion, down approximately 7% at the midpoint compared to 2022, primarily due to reduced headcount.

Expected Reduction in SG&A Expenses

- For 2023, total SG&A expenses are expected to be $575 million to $625 million, compared to $603.4 million in 2022.

- The slight decrease at the midpoint includes an expected decrease in legal settlements in the absence of two onetime items that occurred in 2022.

Record Cash Flow and Shareholder Returns

- Q4 cash flow generated by operations was a record $773.4 million compared to $75.9 million in Q4 of 2021.

- Returned $507 million of cash to shareholders through $438 million of share repurchases and $69 million of cash dividends.

Scott Anderson says,

Leadership Transition

- The Board felt that a change in leadership was needed to accelerate C.H. Robinson’s strategic initiatives and take the company into its next chapter.

- Interim CEO is leveraging relationships with senior leadership to continue delivering superior services to customers and carriers.

- Increasing focus on scalable operating model to lower costs, improve customer and carrier experience, and foster long-term profitable growth through cycles.

Market Conditions

- Elevated inventories amidst slowing economic growth causing unseasonably soft demand for transportation services.

- Prices for ground transportation and global freight forwarding declining due to the changing balance of supply and demand.

- The correction in the freight forwarding market was expected, but the speed and magnitude of the correction in only two quarters was unexpected.

Cost Structure

- Operating costs were misaligned due to unexpected correction in freight forwarding market.

- Structurally reducing overall cost structure to generate net annualized cost savings of $150 million by Q4 2023 as compared to the annualized Q3 2022 run rate.

- Adjusting plans according to growth opportunities or economic conditions.

Global Capabilities

- Uniquely positioned in the marketplace to deliver for shippers, carriers, and shareholders through digital solutions, global suite of services, and network of global logistics experts.

Q4 2022 Results Overview

- Mike will provide a review of the Q4 2022 results on the call.

Q & A sessions,

Cross-Selling Opportunities between NAST and Global Forwarding

- Over half of the revenue in AGP comes from customers who use both NAST and Global Forwarding services.

- Customers who use both NAST and Global Forwarding have a 400 basis points better five-year compound annual growth rate than those who use one or the other.

Cost Structure and Operating Income Margin in Global Forwarding

- Global forwarding operating income margins of over 50% in Q1 and Q2 were not sustainable, and normalization led to a cost structure mismatch.

- The team is right-sizing the cost structure and reducing headcount.

- 30% operating income margin for the long term is still the target.

- Technology, operational uniformity, building scale, and talent acquisition are key to success and improving operating margin.

Challenges in the Contract Business and Truckload Volume

- Soft demand and volume have led to a decline in truckload spot cost per mile and contract pricing.

- Half of the contracts bid on in Q4 were 12 months, and the other half were less than that.

- The commitment to the $150 million net cost reduction by Q4 on a run rate basis annualized will continue.

Capital Allocation Strategy

- Free cash flow resulting from the working capital dollars coming back to the company has led to increased share repurchase.

- Observing prices coming down across ocean, air, and truckload has led to a pullback on share repurchase to maintain targeted leverage.

Cost Savings and Expense Guidance

- The commitment to the $150 million net cost reduction by Q4 on a run rate basis annualized will continue.

- The midpoint of the expense guidance predicts $200 million worth of savings.