Camden Property Trust

CEO : Mr. Richard J. Campo

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

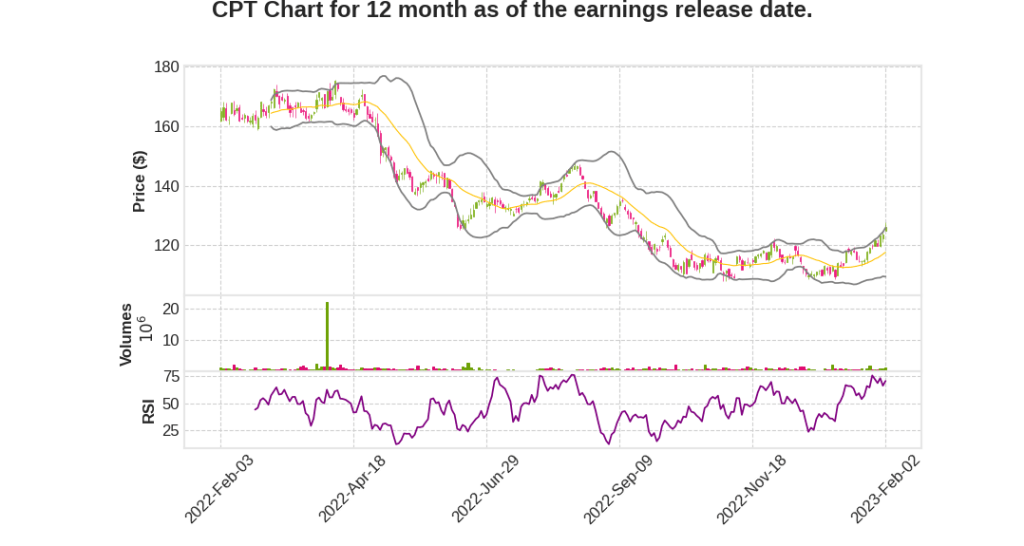

| 2022 Q4 | 23.1% YoY | 20.5% | -79.3% | 2023-02-03 |

Keith Oden says,

Expected Same-Property Revenue Growth in 2023

- Camden’s same-property revenue growth for 2022 exceeded expectations at 11.2%.

- The outlook for 2023 calls for same-property revenue growth of 5.1% at the midpoint of the guidance range.

- The range for same-property revenue growth is expected to be between 4.1% to 6.1% for the portfolio, with most markets falling within that range.

Supply Estimates in Major Markets

- Approximately 200,000 new completions are projected across Camden’s markets during 2023.

- Florida markets of Orlando, Southeast Florida, and Tampa are expected to see 12,000, 11,000, and 6,000 new completions respectively.

- Charlotte, Raleigh, and Nashville are expected to see 11,000, 9,000, and 10,000 new completions respectively.

- Dallas is estimated to deliver around 20,000 units, while Phoenix is likely to see another 15,000 units completed.

- Denver and Austin are expected to see 15,000 and 20,000 new apartments come online respectively.

- San Diego and Inland Empire are expected to have 10,000 and 15,000 new completions respectively, while Washington, DC Metro and Atlanta are expected to have 13,000 completions.

- Both Houston and LA, Orange County are expected to see 15,000 and 20,000 new completions respectively.

Overall Market Grades and Outlooks

- Florida markets of Orlando, Southeast Florida, and Tampa earned A+ ratings with moderating outlooks.

- Charlotte, Raleigh, and Nashville earned A ratings with moderating outlooks.

- Dallas and Phoenix earned A- ratings with stable outlooks.

- Denver and Austin earned A- ratings with moderating outlooks.

- San Diego, Inland Empire, Washington, DC Metro, and Atlanta earned B+ ratings with stable outlooks.

- Houston and LA, Orange County earned B and B- ratings respectively, with Houston having an improving outlook compared to stable in LA, Orange County.

Operating Results for Q4 2022 and January 2023 Trends

- Same-property revenue growth for Q4 2022 was 9.9%, with nine markets experiencing revenue growth exceeding 10% for the quarter.

- Blended rental rates for signed new leases and renewals in Q4 2022 were 6.1%.

- Preliminary January 2023 results indicate a return to more normal seasonal trends with a blended growth of 4.2% on signed leases to date.

- Occupancy averaged 95.8% in Q4 2022, compared to 97.1% in Q4 2021, with January 2023 occupancy averaging 95.4% compared to 97.1% in January 2022.

- Annual net turnover for 2022 was up slightly compared to 2021 at 43%, while move-outs to purchase homes were 13% for Q4 2022 and 13.8% for the full year of 2022, down from 16.4% for the full year of 2021.

Ric Campo says,

Multifamily Asset Valuations

- The bid ask spread for multifamily assets is wide.

- Sellers are hoping for valuations to return to last year’s peak, while buyers reckon value should be lower due to a different macro backdrop.

- The current standoff won’t be resolved until buyers and sellers adjust their views on valuation and meet somewhere in the middle.

Operating Environment and Guidance

- 2022 was the best operating environment in Camden’s 30-year history, exceeding top-end guidance and raising guidance every quarter.

- Operating conditions were driven by being in the right markets with the best product and having the best teams.

2023 Housing Market Outlook

- 2023 will be a return to a more normal housing demand market.

- Consumers still have excess savings and the job market remains strong.

- Despite rising rents, apartments remain more affordable than purchasing homes for many consumers in Camden’s markets.

Revenue Growth Projection

- Camden projects 5.1% revenue growth for 2023.

- Absent from last year’s record-breaking growth, Camden’s 2023 projected revenue growth would be the sixth highest growth rate achieved over the last 20 years.

Recognition to Camden Teams

- Recognition and appreciation for Camden teams across America for a job well done in 2022.

- Thanking them for improving their teammates’ lives, customer’s lives, and stakeholder’s lives, one experience at a time.

Q & A sessions,

Projected migration trends and impact on markets

- Projected migration from Southern California to Texas over the next three years, with almost 0.5 million people leaving Southern California and 350,000 new migrations to Texas expected.

- Continued energy transition jobs and strength in oil and gas market could help Houston.

Effect of COVID measures on real estate market

- Gap between economic occupancy and physical occupancy in Southern California due to COVID measures.

- Restrictions on rent payment in California driving the gap.

Trends in multifamily market in 2021 and 2022

- Industry absorbed 600,000 net new units in 2021 with stimulus and post-pandemic demand.

- In 2022, there was a net absorption of 50,000 units with anemic growth.

- In Q4 2022, there was a net loss of 181,000 apartments, much bigger than ever before.

Construction lending and supply reduction

- Banks have shut down construction lending, and rents are not going up fast enough to offset construction cost increases, resulting in merchant builders dropping construction by 40-50%.

- Expected starts to go down by 50% to 250,000 by the end of 2022.

- Cost pressure moderating and cost reductions expected over the next six months.

Uncertainty in the market

- Capital waiting to see what will happen, merchant builders still betting on high starts, brokers excited about getting back to work.

- Uncertainty due to Fed meeting, 500,000 jobs a day, and 50-year low on unemployment rate.

- Dry powder is available, and sellers will have to blink first.

Impact of Freddie and Fannie guidelines

- Guidelines targeting lower income and not expected to have much effect on Camden’s business.

- Politically expedient to push for rent control, but rent control stifles supply.

- Camden is not at risk of massive government regulations.