Catalent, Inc.

CEO : Mr. Alessandro Maselli

Quarterly earnings growth(YoY,%)

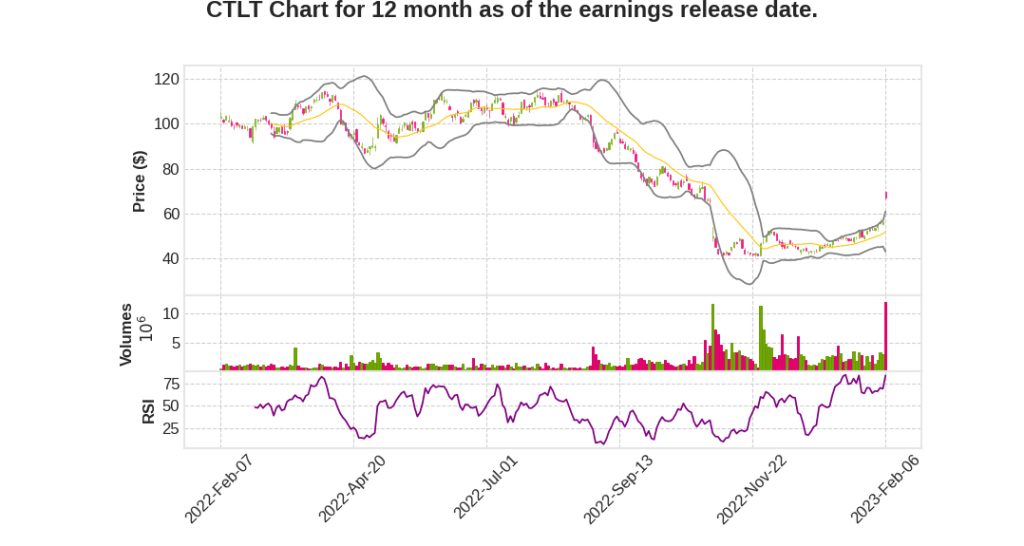

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q2 | -5.6% YoY | -14.3% | -15.1% | 2023-02-07 |

Tom Castellano says,

Restructuring and Cost Savings Measures

- Restructuring plan reduced headcount by approximately 700 employees and incurred cumulative employee charges between $14 million and $20 million.

- Annualized run rate savings in the range of $75 million to $85 million over calendar 2023, with approximately half of the savings to be realized in the second half of fiscal ’23.

- Expected to generate additional annualized savings of tens of millions of dollars from other cost efficiency and procurement programs above and beyond the reduction of approximately 700 staff.

Biologics Segment Performance

- Q2 net revenue of $580 million decreased 7% compared to the second quarter of 2022 primarily driven by lower year-on-year COVID-related demand.

- Total non-COVID revenue growth for the Biologics segment was more than 10%, down from Q1.

- The non-COVID revenue growth rate in Biologics is expected to return to the higher levels of growth seen in the first quarter driven by increased demand in the gene therapy offering, easier comparisons in Brussels, and uptake in demand for several drug product programs.

- Segment’s EBITDA margin of 31.3% was slightly higher than the 31.1% reported in the second quarter of fiscal 2022.

Pharma and Consumer Health Segment Performance

- Generated net revenue of $570 million, an increase of 3% compared to the second quarter of fiscal 2022 with segment EBITDA down 3% over the same period last fiscal year.

- The segment’s revenue growth was primarily driven by the recently acquired Metrics business.

- Expect the PCH segment organic growth rate to modestly increase in the back half of the year, particularly in the fourth quarter, due to continued demand for clinical supply services and increased volume for prescription products, most notably in the Zydis delivery platform.

Consolidated Adjusted EBITDA and Financial Outlook

- Second-quarter adjusted EBITDA decreased 9% to $283 million or 24.6% of net revenue.

- Full year revenue expected to be above $600 million compared to the previous estimate of approximately $550 million due to COVID business tracking ahead of expectations.

- Projections for consumer health products, including gummies, negatively impacted and now anticipated to be down when compared to prior year levels.

- Non-COVID growth expected to be in the high teens for the full year.

- Expect Q3 revenue to be roughly in line with the reported Q2 results but margin to be sequentially down from Q2 to Q3 and then expanding in the fourth quarter.

Alessandro Maselli says,

483s and Quality Management

- 483s are not uncommon in the industry

- Catalent works hard to prevent 483s through quality management, leadership, and operational excellence

- Thorough and extensive response to 483s is important with a commitment to corrective actions

- Corrective actions can lead to improved operations

Regular Inspections

- Catalent receives regular inspections all the time

- Recent inspections happen to be more visible, but inspections are ongoing

- Track record of inspections is good in terms of share and ratio of 483s and number of observations

Confidence in Quality Management System and Operational Excellence

- Given recent inspections and ongoing track record, Catalent feels confident in quality management system and operational excellence

Q & A sessions,

Organic Growth Expectations

- Non-COVID organic growth in 1H FY2023 was at 12%

- Expecting non-COVID growth in 2H to be in line with 1H, around 20%, bringing full year non-COVID-related growth to be in the mid-teens

- Gene therapy programs and drug product side of the business are expected to contribute to the change in organic non-COVID-related growth

Guidance and Execution

- Guidance range for FY2023 comes down to execution

- Strong visibility to the demand profile for the remaining five or six months of the fiscal year

- Built in natural hedge due to normal execution-related hiccups in the business

Sarepta Relationship and Revenue Recognition

- Little downside risk associated with Sarepta

- Revenue recognition for Sarepta product is being looked at internally to ensure best possible scenario

- Impact to FY2023 minimal, if any

Q4 Revenue Contributions

- COVID-related revenue will be sizable and gene therapy contribution is expected to be strongest ever seen in Q4

- Normal level of seasonality around PCH side of the business in Q4

- Brussels dynamic will also factor in as a natural lift for Q4

Fill and Finish under Isolator Position

- Catalent is one of the top players in this market and has a competitive advantage due to state-of-the-art technology

- Positive trends include pipeline lending towards fill and finish and increased movement of critical products to under isolator technology