Ceridian HCM Holding Inc.

CEO : Mr. David D. Ossip

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

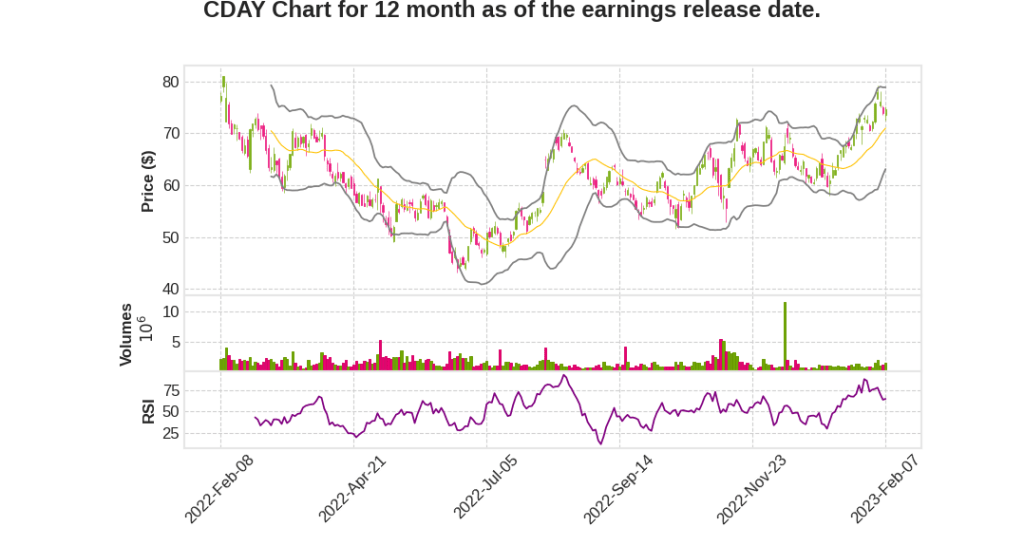

| 2022 Q4 | 19.1% YoY | -104.5% | -50.0% | 2023-02-08 |

Leagh Turner says,

Ceridian’s Performance in Q4 2022

- Total revenue grew by 24% in constant currency while adjusted EBITDA was 20.1%

- Continued investment in sales, marketing and engineering to drive innovation and sales results

- Increase in customer NPS scores and decrease in support tickets logged by 13%

- Partner ecosystem grew significantly with more than 170 partners globally supporting more than 40% of global bookings

Customer Wins and Go-Lives

- Several notable companies, including a global auto parts manufacturer, a multinational hotel and restaurant company, a US consumer goods manufacturer, and a major global airline, selected Dayforce for their HCM platform needs

- Global professional services firm, one of the world’s largest express transportation and shipping companies, a leading global retailer, and a major American cargo and passenger airline went live with Dayforce for payroll and workforce management solutions

- Most customers mentioned have employees in excess of 10,000, signaling Ceridian’s focus on scaling the business

Organizational Changes

- Promotion of Steve Holdridge to President, Global Customer and Revenue Operations to lead the entire global field operations

- Additional resources allocated to marketing to support brand and go-to-market efforts

- Rocky Subramanian, who led Ceridian’s revenue organization, will leave the business on March 3

Guidance for 2023

- Continued improvement on the Rule of 40

- Technology budgets growing in 2023 with SaaS spend increasing by approximately 15% YoY

- Strong pipeline coverage with high level of qualification

- Focus on durable growth over the medium term with seasoned and efficient sales organization and strong customer retention rates

Noemie Heuland says,

Fourth Quarter Performance

- Exceeded guidance across all revenue and profitability metrics despite persistent FX headwinds

- Dayforce recurring revenue grew 35% at constant currency

- Total revenue grew 23% at constant currency

- Adjusted EBITDA margin of 20.1% exceeded the high end of guidance range

- Cloud recurring gross margin was 76.2%, an increase of 250 basis points YoY

Deferred Commissions Amortization Period Change

- Deferred commissions now to be amortized over a 10-year period instead of five-year reflecting higher customer retention rates

- This change is also incorporated in the FY ’23 guidance

- Benefited from a $3 million change in estimate of sales commission amortization period in December

Fiscal Year ’23 Guidance

- Expect about 85 basis points of FX headwinds to Dayforce recurring revenue ex float for the full year

- Dayforce recurring revenue excluding float is expected to be in the range of $936 million to $946 million, growing 26% at the midpoint at constant currency

- Modernization effort in tech business expected to contribute approximately 460 basis points of Dayforce recurring ex float revenue growth

- Adjusted EBITDA is expected to be in the range of $360 million to $375 million or margins of 25% at the midpoint

- Expect mid-50s adjusted EBITDA conversion ratio for the full year 2023

Float Revenue Guidance

- Largest enterprise deals take over 12 months to achieve full run rate total revenue

- Float revenue guidance reflects a more normalized interest environment

- Expect less upward variability as compared to fiscal year 2022 as the pace of rate increases moderates

Medium-term Goals

- Committed to medium-term goals as implied by 2023 guidance

Q & A sessions,

Transition to a New Structure

- The company has moved towards a new structure to achieve complete visibility and alignment throughout the entire customer life cycle.

- The new structure will allow the company to be a transformation partner, not just a sales, services, or support partner.

- The team has been well-aligned and there will be little to no disruption during the transition.

Competitive Landscape

- The company has seen great growth in the emerging market and relatively the same competitive landscape in the mid-market.

- In the top end, the company typically competes against three large ERPs, but the deals are pre-qualified and the sales cycles are accelerating.

- The company won deals against competitors such as UKG Workday SAP and ADP.

Employment Assumptions

- The company is expecting employment trends to normalize with a slight decline in Q1 and then picking back up again, which is reflected in the PEPM guidance for 2023.

Tax Migration

- The company has modernized its existing infrastructure to migrate tax customers from on-premise to cloud-based delivery.

- The revenue from tax migration is classified as cloud and Dayforce recurring.

- The company has an aggressive marketing plan and branding activities to grow the tax migration business.