The Clorox Company

CEO : Ms. Linda Rendle

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

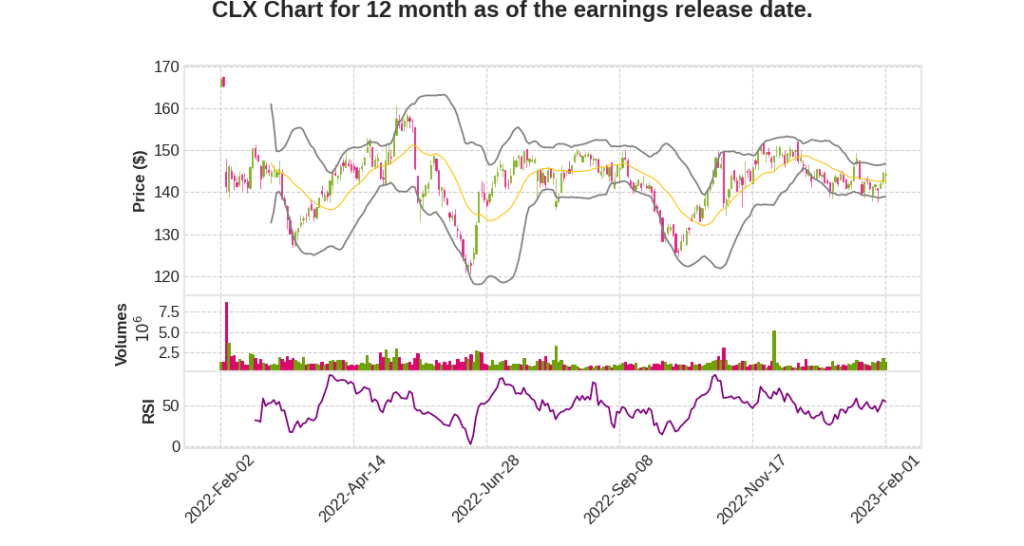

| 2023 Q2 | 1.4% YoY | 32.7% | 37.3% | 2023-02-02 |

Kevin Jacobsen says,

Consumption and Share

- Consumption increased by 6%.

- The company held share in track channels in the U.S.

- The company continues to grow shares internationally.

Record Cost Savings

- The company delivered a record cost savings for the quarter.

- This is the strongest quarter the company has had in the last 10 years.

Supply Chain Operations

- The company made very good progress improving its supply chain operations in spite of the ongoing disruptions.

- The company hit a record case fill rate since the pandemic has begun.

Timing Shifts

- Cold and flu season started earlier than anticipated and peaked in Q2, which pulled forward some of the shipments for cleaning and disinfecting products.

- Merchant timing shifts provided some benefit to the quarter.

Cost Savings

- The team was able to pull forward some of the benefit of the record cost savings.

- The company is on track for the full year to have a very strong year.

Linda Rendle says,

Q2 Results

- Organic sales growth in three of four segments

- Gross margin expansion

- Double-digit earnings growth

Updated Full Year Outlook

- Good progress through building margin

- Driving top-line momentum

- Executing against Ignite strategy for long-term growth

- Advancing innovation pipeline

- Delivering cost savings

- Taking additional cost-justified pricing actions

- Confident in leading product portfolio in essential categories

- Using levers to recover margin and drive long-term growth

Operating Environment

- Expect volatility and challenges to remain

- Continuing to invest in brands, categories and capabilities

- Protecting value proposition of products

Q & A sessions,

Gross Margin Expansion

- Returned to gross margin expansion in Q2

- Expected to build on it in Q3 and Q4 with additional 200-300 basis points of expansion

- Rebuilding margins will take some time

Top Line Momentum and Investments

- Continuing to maintain top line momentum and prioritize investments in digital transformation and streamlined operating model

- Expecting acceleration in back half of the year for organic sales growth

Pricing and Cost Savings

- Fourth round of pricing in effect, still uncertain about how it will play out

- Expecting more volume deleveraging in Q3 with the impact of the fourth round of pricing

- Continuing to drive pricing and cost savings to rebuild gross profit and margin

Supply Chain Normalization

- Seeing improvements from supply chain disruptions and normalizing supply chain

- Reducing safety stock levels as supply chain normalizes

- Dealing with intermittent supply chain disruptions, but seeing less disruptions than before

Inflation and Cost Environment

- Anticipating a moderating cost increase, but still seeing inflationary environment all year long

- Resin is a cost tailwind, but most other key buys are seeing cost increases on a year-over-year basis

- Expecting declining impact from commodity costs as we move through the year