ConocoPhillips

CEO : Mr. Ryan M. Lance

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

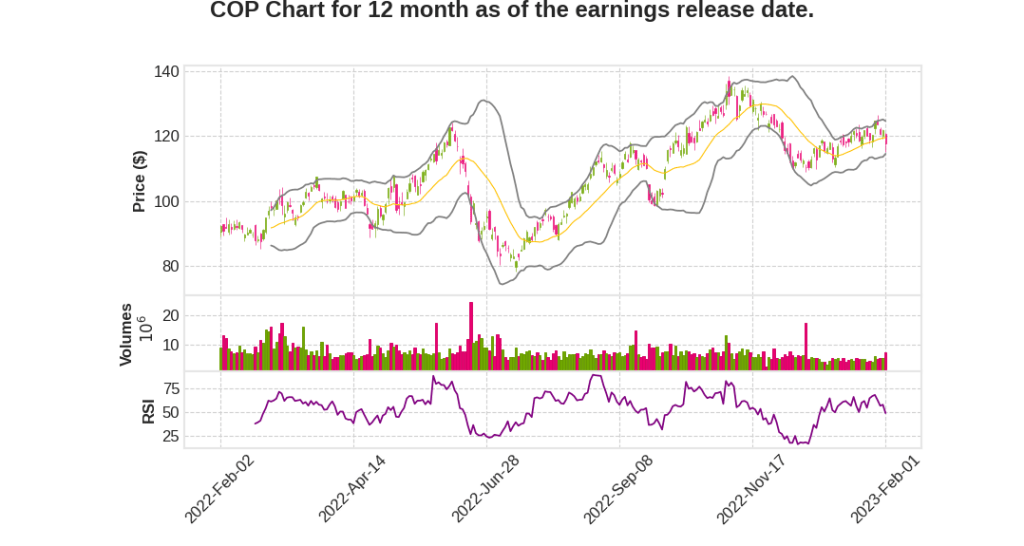

| 2022 Q4 | 22.7% YoY | 6.2% | 31.2% | 2023-02-02 |

Ryan Lance says,

Demand and Supply Outlook

- Expect growth in 2023 aided by normalization in China mobility

- Continued producer discipline and expected impacts of Russian oil and product sanctions likely to keep balances tight

Energy Transition

- Successful energy transition must meet society’s fundamental need for secure, reliable, and affordable energy while progressing toward a lower carbon future

- All-the-above approach required to develop lower emission energy sources and oil and gas resources

- Policies should include efforts aimed at fiscal stability, streamlining of the permitting process, increased transparency on timelines and supporting critical infrastructure

2022 Performance

- Generated a trailing 12-month return on capital employed of 27%, the highest since the spin

- Delivered on plan to return $15 billion of capital to shareholders, representing 53% of CFO

- Advanced net zero operational emissions ambition with a new medium-term methane intensity target consistent with commitment to joining OGMP 2.0

2023 Capital Allocation

- Plan to return $11 billion of capital to shareholders, representing about 50% of forecasted CFO at $80 WTI

- Other half of cash flow dedicated to reinvesting in the business

- Deep and well-diversified asset base well-positioned to generate solid cash flow growth for decades to come

LNG Opportunities

- Enthusiastic about new LNG opportunities in Qatar and the United States, which are highly complementary to existing LNG business

Nick Olds says,

Well Performance Exceeding Curve Expectations

- 2022 development wells performing slightly above curve expectations across all four basins, including the Permian Basin.

- The strong performance validates the focus on maximizing returns and recovery while minimizing future interference.

Accelerated Learning Curve

- COP has drilled the most horizontal wells in the Delaware and Midland Basin, more than any other company.

- Combining data from significant operated by others portfolio and learnings in mature development in the Eagle Ford and the Bakken has helped COP refine the best development approach.

Production Performance and Development Strategy

- COP is confident in the long-term outlook for their assets based on production performance meeting or slightly exceeding type curve expectations combined with their development strategy.

Q & A sessions,

Projected Exit Rates for 2022 and Annual Year-Over-Year Increase

- Exit rates from 2022 going into 2023 are expected to be in low single digits.

- Mid-single digits are predicted as the annual year-over-year increase

- Inflation is expected across the global portfolio, slightly higher in the Permian

Plateauing and Roll Over of Key Spend Categories

- Categories like OCTG and raw materials that go into them are starting to come down slightly

- Rate of increase in the onshore rig market is also starting to lessen

- Annual year-over-year inflation is predicted to be in the mid-single digits

Constructive View for the Future

- The company has a global diversified portfolio with opportunities in Alaska, Norway, Far East, and the Middle East.

- Constructive on gas and moving forward with LNG projects

- Low GHG emission production requested by the administration is the company’s focus

- Prepared to use cash on balance sheet to fund projects

Lower 48 Plan for 2023

- Assumed level-loaded steady-state program for 2023

- Modest growth in partner activity expected

- Majority of growth weighted to Permian

- Production in mid-single digits predicted

- Profile shape mid to back-end weighted in 2023

Cash Return Target

- Cash return target established at $80 WTI, $85 Brent, and 3.25 Henry Hub

- Resilient across a broad range of prices

- Prepared to use cash on balance sheet to fund projects