Charles River Laboratories International, Inc.

CEO : Mr. James C. Foster J.D.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

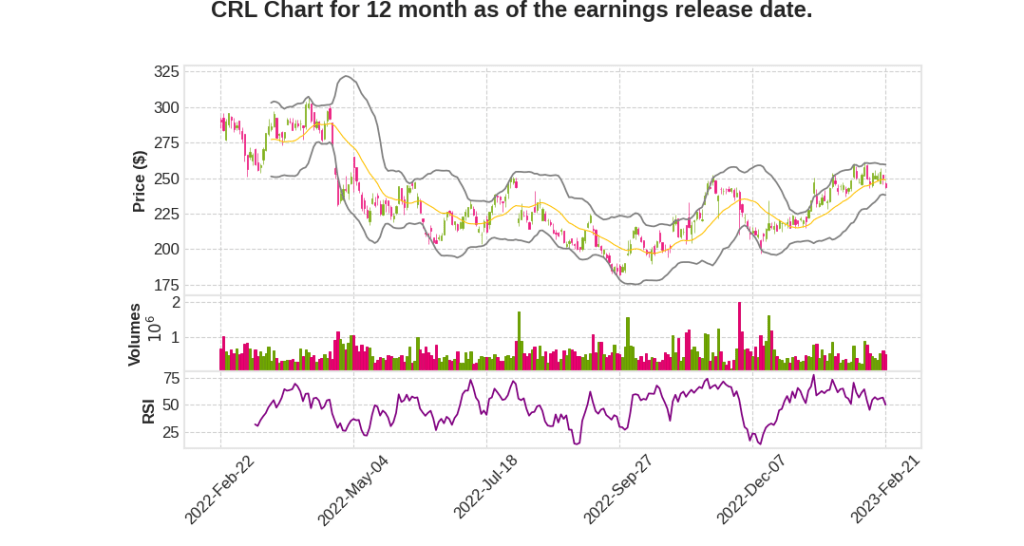

| 2022 Q4 | 21.5% YoY | -5.2% | 34.8% | 2023-02-22 |

Jim Foster says,

NHP Supply Situation Impact

- The NHP supply situation may result in study delays in the Safety Assessment business.

- The current Cambodian NHP supply constraints and corresponding impact on business are expected to reduce consolidated revenue growth forecast by approximately 200 basis points to 400 basis points this year.

- The non-GAAP earnings per share are expected to be in a range of $9.70 to $10.90 in 2023 with the wider ranges encompassing a number of scenarios related to the timing of the resumption of Cambodian NHP imports this year.

Fourth Quarter and Full Year Performance

- Record quarterly revenue of $1.1 billion in the fourth quarter of 2022, exceeding the $1 billion mark for the first time and representing an increase of 21.5% on a reported basis.

- Organic revenue growth of 18.8% was driven by increases from all three business segments with the most significant contribution from the Safety Assessment business.

- For 2022, revenue was $3.98 billion with a reported growth rate of 12.3% and an organic growth rate of 13.4%.

Segment Performance

- The Safety Assessment business continued to be the principal driver of DSA revenue growth with significant contributions from study volume, pricing, and NHP pass-throughs in order of magnitude.

- Discovery Services business had a good quarter with improvement in the revenue growth rate from the third quarter level.

- RMS organic revenue growth was 9%, squarely in line with our outlook of high single-digit growth in 2022.

Outlook

- The current NHP supply situation may restrict the revenue growth rate and margin expansion in 2023, but the underlying strength and resilience of demand environment and pricing should afford us healthy DSO growth opportunities.

- Expect similar trends to drive high single-digit organic growth again in 2023.

Non-Operating Items

- Higher interest expense, a higher tax rate, and the divestiture of our Avian Vaccine business will generate a combined earnings per share headwind of $1.20 to $1.40 in 2023, partially offset by up to a $0.25 benefit from foreign exchange.

Flavia Pease says,

Financial Guidance for 2023

- Expect reported revenue growth of 1.5% to 4.5% and organic revenue growth of 4.5% to 7.5% in 2023

- Expect non-GAAP earnings per share between $9.70 and $10.90, reflecting headwinds associated with NHP supply and non-operating items

- Avian Vaccine divestiture will reduce 2023 revenue by approximately $80 million and non-GAAP earnings per share by approximately $0.25 net of the interest expense benefit

- Non-GAAP tax rate is expected to move to the top of the long-term low 20% range to 22.5% to 23.5% in 2023 due to the reduction in excess tax benefit related to stock compensation and is expected to reduce earnings per share by $0.50 to $0.65

- Total adjusted net interest expense in 2023 is expected to increase to a range of $133 million to $137 million compared to $105 million last year, resulting in earnings per share headwind of $0.45 to $0.50

Segment Outlook

- RMS segment is expected to achieve high single-digit organic revenue growth

- DSA segment organic growth rate will be low to mid-single digits based on NHP supply assumptions

- Manufacturing segment is expected to generate low double-digit organic revenue growth

Operating Margin Outlook

- Expect the 2023 operating margin to be flat to down 150 basis points depending on the timing of the resumption of Cambodia NHP shipment

- Expect moderate margin improvement in 2023 without an NHP supply impact

Free Cash Flow and Capital Expenditure

- Will not provide free cash flow or capital expenditure outlooks at this time because these metrics could vary based on the level of NHP supply impact that is incurred

- Targeted level for CapEx remains at approximately 9% of revenue as the company expects to continue to invest in capacity to keep pace with a sustained underlying demand environment and support long-term growth forecast

First Quarter 2023 Expectations

- Expect year-over-year revenue growth will be in the high single-digit range on a reported basis and at or above the 10% level on an organic basis

- Expect earnings per share will decline at a mid-single-digit rate

- Higher tax rate and increased interest expense will have a greater impact to earnings per share in the first quarter, resulting in a combined earnings headwind of approximately $0.40 per share

- Manufacturing segment will face a difficult comparison versus the first quarter of last year

Q & A sessions,

Supply Chain Challenge in Cambodia

- 60% of NHPs come from Cambodia and new animals cannot be brought in due to parentage concerns from Fish and Wildlife

- Work with Fish and Wildlife to come up with a collaborative methodology to show parentage and get animals into the US

- Cambodia may not open up for fiscal 2023 and it may cause an insufficient number of monkeys for the whole industry

DOJ Investigation

- A subpoena is recent, and they want to get information from Charles River

- They are looking at all of the suppliers in Cambodia, one of whom Charles River gets the monkeys from

- Working closely with DOJ and being transparent to show any concerns they have with Charles River are without merit

CDMO Business

- $100 million of new business came in last year and Memphis facility is doing well with new clients and commercial quantities

- Integration has been complicated, but the demand is great across the board

- Growth rates should be nice in fiscal 2023

NHP Supply

- Charles River has some supply from other suppliers for the US and Europe

- Some supply is sufficient for a while, but it begins to wind a little bit

- Continuing to take orders and book orders into 2024, hoping to resolve the supply problem soon