Dominion Energy, Inc.

CEO : Mr. Robert M. Blue

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

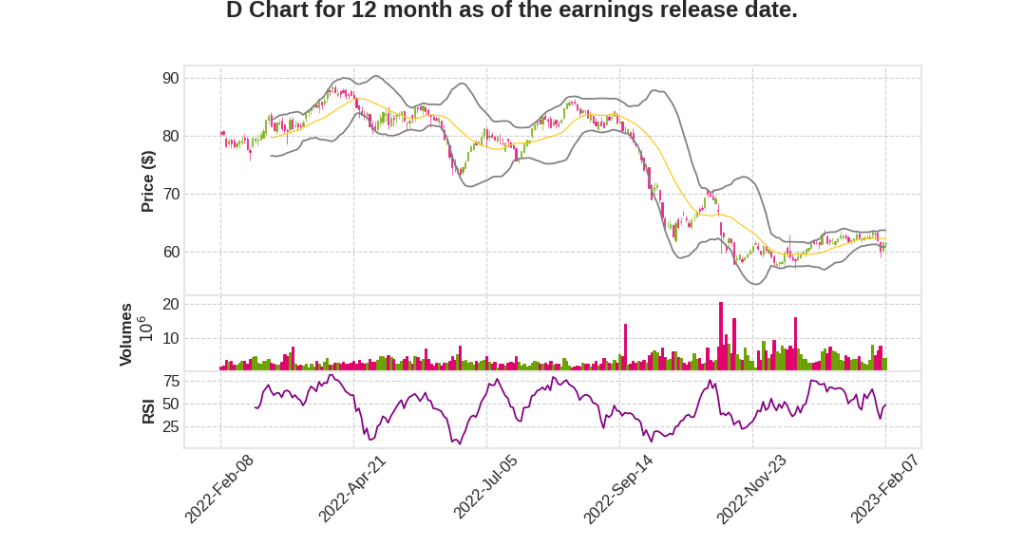

| 2022 Q4 | 26.6% YoY | 43.9% | -103.0% | 2023-02-08 |

Bob Blue says,

Safety, Reliability, and Affordability

- The employee injury recordable rate has been favorable and the ultimate goal is to have no injuries.

- Customers in Virginia, South Carolina, and North Carolina had power 99.9% of the time, excluding major storms.

- Virginia reached record summer and all-time peak demand, but there were no major or extended service disruptions.

- Our rates continue to be lower than national and regional averages.

Regulated Decarbonization and Resiliency Strategy

- Virginia approved several rider-eligible investment programs, including offshore wind projects, license renewals, and Phase 2 of our grid transformation program.

- South Carolina achieved its second-best year for service reliability, and Moody’s upgraded Dominion Energy South Carolina’s credit rating.

- We invested over $300 million in modernizing infrastructure that is safer, more reliable, and better for the environment.

- Reduced Scope 1 carbon and methane emissions.

Business Review Principles

- Focused on delivering durable, high-quality, and predictable long-term earnings growth profile.

- Position regulated utilities to earn a fair and competitive return on investment.

- Constantly looking for ways to optimize the efficiency of our operations while meeting high customer service standards.

- Financial credit metric performance needs strengthening.

- Affirm our commitment to the dividend.

Virginia Legislative Session

- There is legislation pending that revises our regulatory model and would provide for a passive equity partner in our offshore wind project.

- The outcome of any legislation is uncertain, and the timing will influence the cadence at which we’re able to share more details about the business review in the future.

Steven Ridge says,

Q4 2022 Operating Earnings

- Earnings per share were $1.06, which is at the midpoint of quarterly guidance range.

- Full year 2022 operating earnings per share were $4.11 per share, slightly above the midpoint of the guidance range.

- The business review resulted in the impairment of the unregulated solar portfolio in the Q4, leading to a noncash charge of $1.5 billion.

Guidance for Q1 2023

- Operating earnings are expected to be between $0.97 and $1.12 per share.

- Positive changes include growth in regulated investment, higher sales, and higher Millstone margins.

- Negative changes include higher interest expenses, lower DEV margins, hurt from pension and OPEB, higher depreciation, the absence of solar investment tax credits, and O&M and tax timing.

Electric Sales Trends

- Weather-normalized sales increased 3.4% in 2022 compared to 2021.

- For 2023, the company expects to remain above the long-term demand growth assumption of 1% to 1.5% per year.

Financing

- The company issued $850 million in long-term debt and closed a 364-day term loan facility of $2.5 billion to address first-quarter maturities and provide incremental flexibility.

- The financing plans will be refreshed after the business review.

Interest Rates and Fuel Costs

- The company has seen its borrowing costs on floating-rate debt increased by about 400 basis points since last year.

- The company has an under-collected balance of approximately $2.5 billion in fuel costs across the company, but they are working with regulators to employ mitigation measures to keep any increase to customer bills as muted as possible.

Credit

- The company targets high BBB range credit ratings for its parent company and single-A range ratings for its regulated operating companies.

- Moody’s published CFO pre-working capital to debt, one of the primary quantitative metrics used to determine the credit rating, has underperformed the company’s downgrade threshold for the last several periods.

Q & A sessions,

Virginia Data Centers and Offshore Wind Project

- PJM projects Dominion Zone to have the highest growth rate among all zones within PJM, covering 13 states in the District of Columbia, with 5% annual rate growth driven by data center loads.

- Amazon’s $35 billion investment to establish multiple data center campuses across Virginia will create an estimated 1,000 jobs and expandable capacity to position Amazon for long-term growth in Virginia.

- Filed for a new 500 kV transmission line with the SCC with an expected in-service date of late 2025 with around $700 million of capital investment.

- Offshore wind project cost sharing settlement agreement was approved, which allows the project to continue moving forward on schedule and on budget with expected completion of construction by the end of 2026.

- The Jones Act-compliant turbine installation vessel is currently 65% complete and expected to be in service for the 2024 turbine installation season.

Regulated Decarbonization and Resiliency Strategy

- Several rider-eligible investment programs were approved in Virginia, including offshore wind project, subsequent license renewals of four nuclear units, and new solar and energy storage projects.

- Investments currently under SCC review include high-voltage electric transmission necessary to continue to serve growing customer demand and data center load, and new solar and energy storage projects and our third annual clean energy filing.

- In Gas Distribution segment, we invested over $300 million modernizing infrastructure that is safer, more reliable and better for the environment.

- Increased the number of renewable natural gas projects in operation or under construction to â21.

- Nuclear units produced about 50 million-megawatt hours of low-cost zero-carbon baseload power, roughly 40% of total generation production as a company.

Safety, Reliability, and Affordability

- Employee OSHA injury recordable rate continues to compare favorably with national industry and regional electric utility averages.

- Customers in electric service areas in Virginia, South Carolina, and North Carolina had power 99.9% of the time, excluding major storms.

- Rates continue to be lower than national and regional averages.

Financial Performance

- Delivered 2022 financial results that were in line with guidance range.

- Provided a pathway to 6.5% growth in 2023, assuming all coal-only units are retired by the end of the decade.

- Interest rates up 4%, which takes the interest rate headwind of the first quarter to about $0.30 but expected to ameliorate over time.