Delta Air Lines, Inc.

CEO : Mr. Edward H. Bastian

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

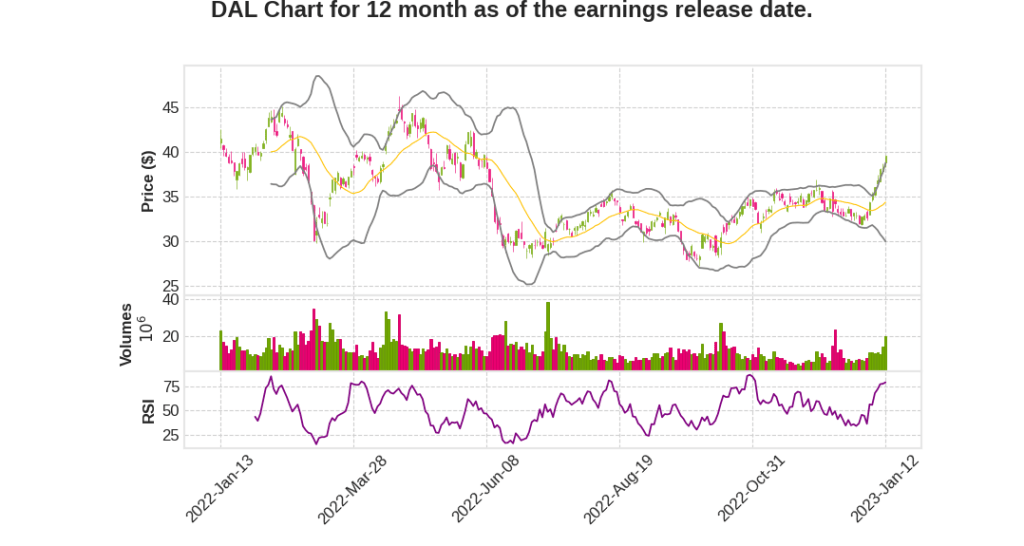

| 2022 Q4 | 41.9% YoY | -621.0% | -303.1% | 2023-01-13 |

Ed Bastian says,

Delta’s Q4 2022 Earnings Results and Full Year Performance

- Delta reported Q4 earnings per share of $1.48 on record revenue up 8% from 2019 levels and generated a 12% operating margin, marking the strength of the company’s recovery.

- The company delivered earnings of $3.20 per share on $46 billion of revenue for the full year, with pre-tax income of $2.7 billion, an improvement of more than $6 billion over 2021.

- Delta’s profitability led the industry and was the seventh highest result in the company’s nearly 100-year history, even with a $1 billion loss in the first quarter.

- Delta reported positive free cash flow for the year, which funded $6 billion of capital invested back into the business, and repaid close to $5 billion in gross debt.

- The company will be paying its employees $550 million in profit sharing.

Delta’s Progress in Restoring Its Financial Foundations

- Delta’s Q4 2022 earnings per share and margins exceeded guidance, marking a strong close to a year where the company made significant progress regarding restoration of its financial foundation.

- Delta’s momentum continues into 2023, with full year 2023 guidance for revenue growth of 15% to 20% year-over-year, earnings of $5 per share to $6 per share, and free cash flow of over $2 billion.

- The company is affirming that guidance and introducing March quarter outlook, which is expected to deliver a 4% to 6% operating margin and improve pre-tax income by more than $1 billion compared to the same period last year.

Delta’s Brand Strength and Competitive Advantages

- Delta’s brand continued to strengthen in 2022, with record performance from the company’s loyalty and co-brand card programs, and customer satisfaction scores consistently perform above pre-pandemic levels.

- Delta fortified its international partnerships in 2022, positioning the company for profitable international growth in the years ahead.

- The company invested in the customer experience at every stage of the travel journey, from the continued refresh of its fleet with next-generation far more fuel-efficient aircraft to airport rebuilds and technology investments.

Delta’s Partnership and Expansion Strategy

- Delta continues to attract and partner with leading brands to grow its SkyMiles ecosystem and further enable customers to use their SkyMiles during travel and beyond.

- Delta unveiled the next phase in its vision to connect the Sky at the Consumer Electronics Show in Las Vegas, starting February 1st, Delta will provide fast, free, unlimited WiFi to all through a free SkyMiles account.

- Delta is partnering with great brands like T-Mobile and Paramount+, as well as building on its longstanding relationship with American Express to bring to life its vision of a more connected and personalized travel experience.

Delta’s Position as Industry Leader and Outlook for the Future

- Delta is well-positioned to build on its momentum in the new year, with strong execution and a proven strategy as the industry leader.

- Delta is confident in its ability to deliver significant improvement in earnings and free cash flow in 2023, consistent with the plan laid out last month, and is on track to deliver its 2024 targets of more than $7 of earnings per share and $4 billion of free cash flow.

- Delta is mindful of macroeconomic trends and demonstrated that it has the tools to effectively manage a changing economic climate.

Glen Hauenstein says,

Revenue and Network Strategy

- The company generated revenue of $46 billion, a $19 billion improvement year-over-year.

- Delta delivered record December quarter and full-year unit revenues, sustaining its revenue premium to the industry of more than 110%.

- The company focused on solidifying its positions in coastal gateways, while protecting its core hub shares.

- Delta secured the leading positions in both Boston and Los Angeles, while increasing local market share in its core hubs.

Premium, Loyalty Program, and Diverse Revenue Streams

- Premium let all-year with paid load factors higher than 2019 and yield growth outpacing Main Cabin.

- Basic economy made up less than 5% of revenue, half of the 2019 levels.

- Delta expanded its Delta Premium Select rollout during the year, and the rollout continues in 2023.

- Record SkyMiles acquisitions in 2022, 42% higher than 2019.

- The Delta partnership with American Express delivered record results with full-year remuneration of $5.5 billion, ahead of the initial target.

Cargo Revenue, Unit Revenues, and Revenue Growth

- Cargo revenue was a record in 2022, and the company expects to grow cargo revenues in 2023.

- The company generated revenue of $12.3 billion in the December quarter, 8% higher than 2019 on 9% less capacity.

- Fourth-quarter unit revenues were 19% higher than 2019, driven by consumer demand throughout the quarter.

- March quarter revenue is expected to be up 14% to 17% higher versus 2019, as consumer demand remains healthy.

- For 2023, the company expects to grow revenue 15% to 20% year-over-year as it fully restores its network and further diversifies its revenue streams.

Regional Revenue Performance

- International revenue continues to be led by the transatlantic, with robust demand across the expanded footprint in Europe.

- Latin America is performing very well, led by Mexico, the Caribbean, and Central America, with a recovery in Deep South America now accelerating.

- Delta expected record first-quarter profits in both Australia and Korea, as its multi-year international transformation delivers on anticipated results.

- Japan is also building momentum, and the company expects a very strong summer there.

- China is indicating its reopening, and the company expects to rebuild capacity in line with demand starting later this year.

Q & A sessions,

Robust Bookings for March and Beyond

- Seeing robust bookings for March and beyond.

- Low periods are non-holiday weeks in November and January and February.

- Summer peak season is expected to be a record-breaker.

Restoration of International Flights

- Transatlantic flights are expected to be bigger than 2019.

- In the Pacific, Delta is more than rebuilt in Australia and Korea and about 75% rebuilt in Japan.

- Delta expects to be somewhere between 75% and 100% rebuilt in Japan depending on slot waivers.

- Latin flights are very close to fully restoring.

- Delta sees international restoration where countries are open at about 80%, except for China which is a big question mark.

Capacity Expectations and Fragility

- Delta is doing its best to get its people in place and through the training bottleneck.

- By summer, Delta hopes to be back at 100% capacity.

- The aviation system remains fragile as the industry continues to return to the skies.