Deere & Company

CEO : Mr. John C. May II

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

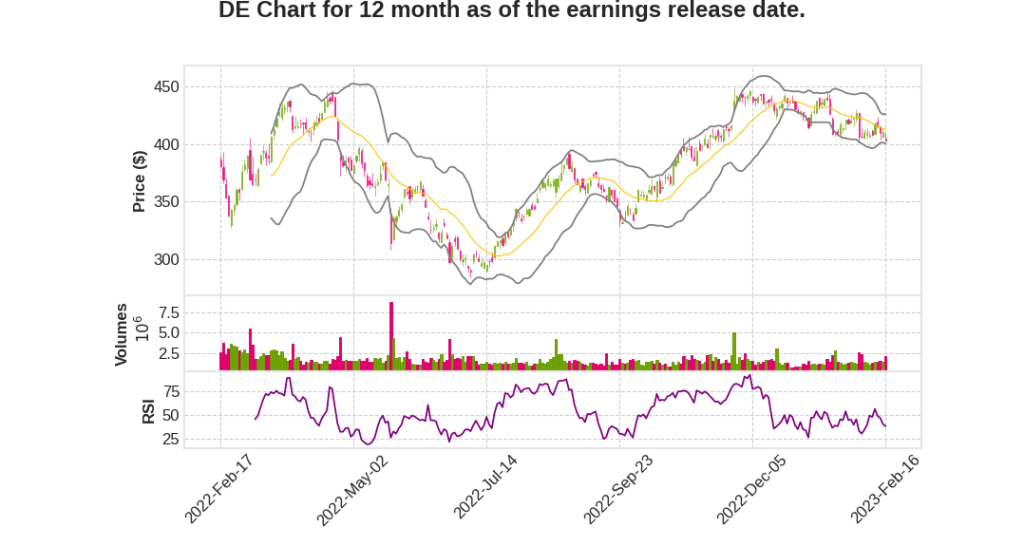

| 2023 Q1 | 32.2% YoY | 158.2% | 123.8% | 2023-02-17 |

Brent Norwood says,

Production Costs

- The factories are running better in Q1 2023 than at any other point in 2022

- Production costs will still run higher YoY for the full year, but at a diminishing rate compared to 2022

- Raw materials were slightly favorable in Q1 and freight was already favorable, expected to continue for the rest of the year

- Higher production costs due to inflation in purchase components from Tier 3 and Tier 2 suppliers, impacting on a lagging basis

- Labor and energy costs will also be higher YoY, contributing to higher production costs on an absolute basis

- The company is actively working with suppliers to reduce inflation linked to raw material and is focused on cost for the rest of the year

Josh Jepsen says,

Impact of Model Year Comparison

- Comparing 2 years of price increases due to the impact of Covid-19 pandemic

- Significant number of tractors shipped in Q1 2022 were model year ’21 machines and model year ’21 pricing

- Most of the model year ’22 tractors were shipped during fiscal ’22

- Most of the tractor shipments in Q1 2023 were model year ’23

Expected Price Comparison Moderation

- Full year forecast contemplates production cost increasing year-over-year due to labor, energy prices and purchase components impact

- Expect a lesser extent of increases in fiscal ’23 than fiscal ’22

- Expected to benefit from improvements in commodity prices, decreased use of premium freight and increased productivity

Historical Average Reversion

- Inflationary pressures expected to subside

- Expect a reversion to historical averages for price increases in the future

Q & A sessions,

Strong Farmer Fundamentals and Positive Guidance for 2023

- Record year in 2022

- Expected slight decline in 2023, but still positive

- Cash receipts down 3%, farmer net income down 16%, but higher than previous cycles

Goal of Achieving 20% Through-Cycle Margins by 2030

- Guidance implies 20% for this year, but still working towards structural through-cycle margin achievement

- Reduction of standard deviation around margins also part of goal

- Recurring revenue goal being addressed with new tech stack in market

Backlog and Inventory Levels

- Backlog at higher level due to increased valuation of machines and strong demand over past years

- Little field inventory and some products expected to remain on allocation in 2024

- Overall inventory below historic averages, with pockets of builds in small compact utility tractors and Brazil small ag

Precision Agriculture Technologies and Future Investments

- Take rates for marquee precision ag technologies increased

- Focus on next generation products like autonomy and See & Spray, as well as retrofit investments

Brazil Market Potential

- Record production and profitability for 2023

- Continued investment in market due to significant need for technology and potential for scale

- Connectivity remains a barrier, but significant unlock expected with deployment of new technology