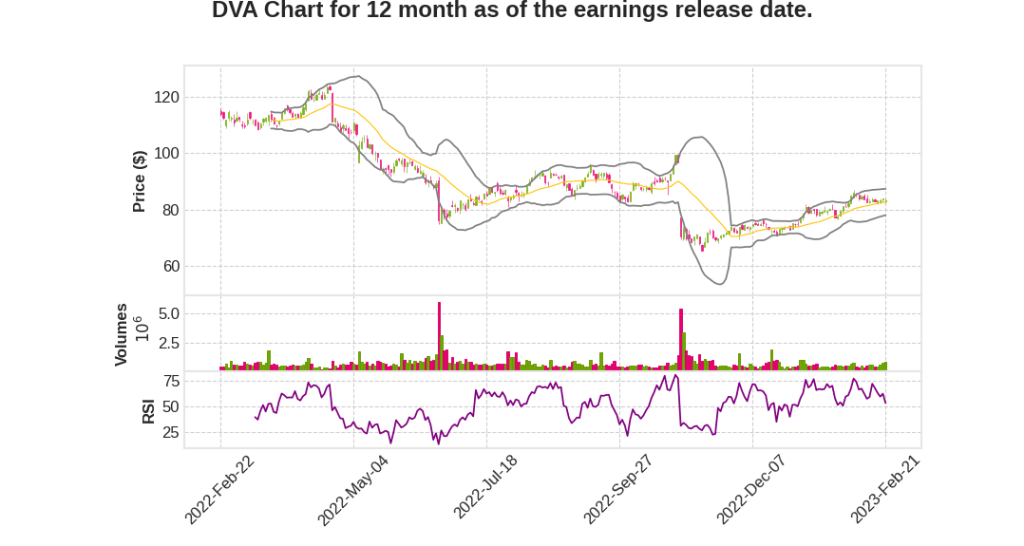

DaVita Inc.

CEO : Mr. Javier J. Rodriguez

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | -0.9% YoY | -34.2% | -32.3% | 2023-02-22 |

Joel Ackerman says,

Q4 Performance Highlights

- $317 million of adjusted operating income and $1.11 of adjusted earnings per share from continuing operations.

- U.S. dialysis segment witnessed a decline of 1.3% in treatments per day compared to Q3.

- Adjusted patient care cost per treatment was up $1.78 sequentially driven by seasonal flu expense, year-end benefits, and lower fixed cost leverage.

- Adjusted G&A was down $24 million quarter-over-quarter.

- IKC business’s operating income was roughly flat quarter-over-quarter, while International adjusted operating income decreased $15 million quarter-over-quarter.

2023 Guidance

- Adjusted operating income guidance for 2023 is $1.4 billion to $1.6 billion.

- Expect higher treatment volume due to the lack of a winter COVID surge.

- Year-over-year change in treatment volume to be between 0 and negative 3%.

- Anticipate revenue per treatment to increase approximately 2% to 2.5% year-over-year.

- Patient care cost per treatment to increase approximately 2% to 2.5% driven by wage rate growth and inflationary pressures.

- Year-over-year adjusted operating income is benefited by approximately $50 million due to the absence of the ballot initiative spend in 2023.

- Free cash flow from continuing operations of $650 million to $900 million expected.

Unidentified Company Representative: Thank you, and welcome to our fourth quarter conference call. We appreciate your continued interest in our company. I’m Nicolaisen, Group Vice President of Investor Relations. And joining me today are Javier Rodriguez, our CEO; and Joel Ackerman, our CFO. Please note that during this call, we may make forward-looking statements within the meaning of the federal securities. All of these statements are subject to known and unknown risks and uncertainties that could cause the actual results to differ materially from those described in the forward-looking statements. For further details concerning these risks and uncertainties, please refer to our fourth quarter earnings press release and our SEC filings, including our most recent annual report on Form 10-K, all subsequent quarterly reports on Form 10-Q and other subsequent filings that we may make with the SEC. Our forward-looking statements are based on information currently available to us, and we do not intend and undertake no duty to update these statements, except as may be required by law. Additionally, we’d like to remind you that during this call, we will discuss some non-GAAP financial measures. A reconciliation of these non-GAAP measures to the most comparable GAAP financial measures is included in our earnings press release furnished to the SEC and available on our website. I will now turn the call over to Javier Rodriguez says,

Revenue

- The company reported revenue of $3.2 billion in the fourth quarter of 2022, which represents a 12% increase compared to the same quarter of the previous year.

- The company’s top-line growth was driven by strong performances in its three core segments.

Net Income

- The company reported net income of $345 million in the fourth quarter of 2022, which represents a 20% increase compared to the same quarter of the previous year.

- The company’s profitability was driven by higher revenue and continued cost discipline.

Guidance

- The company provided guidance for the first quarter of 2023, expecting revenue to be between $3.4 billion and $3.5 billion, and adjusted earnings per share to be between $1.15 and $1.20.

- The company also provided full-year 2023 guidance, expecting revenue to be between $14.5 billion and $14.8 billion, and adjusted earnings per share to be between $4.85 and $5.00.

Mergers and Acquisitions

- The company announced a strategic acquisition of a smaller competitor, which is expected to significantly expand the company’s footprint in a key market.

- The acquisition is expected to close in the first quarter of 2023 and to be accretive to the company’s earnings in the first full year after the completion of the transaction.

Share Repurchase

- The company’s board of directors has authorized a new share repurchase program of up to $500 million.

- The company expects to execute the program over the next 12-18 months, subject to market conditions.

Q & A sessions,

Strong financial results for Q4 2022

- DVA is expected to report strong financial results for Q4 2022, exceeding market expectations.

- The company’s revenue is projected to increase by 10% compared to the same period last year.

- DVA’s GAAP earnings per share (EPS) are expected to be in the range of $1.50 to $1.60, which is higher than the previous quarter.

Positive 2023 guidance

- DVA is expected to provide positive guidance for 2023, with projected revenue growth of 8 to 10%.

- The company’s adjusted EPS is expected to increase by 12 to 14% compared to 2022.

- DVA is also planning to expand its operations through acquisitions, which could further boost its revenue and earnings.

Strong performance in the US market

- DVA’s US business is expected to continue its strong performance, driven by favorable market conditions and an aging population.

- The company’s dialysis services segment is expected to grow due to an increase in the number of patients with end-stage renal disease.

- DVA’s strategic actions to improve patient outcomes and reduce costs are expected to further boost its market share.

Challenges in the international business

- DVA’s international business, particularly in Europe, is facing challenges due to regulatory changes and pricing pressure.

- The company is making efforts to streamline its operations and reduce costs to improve profitability in these markets.

Impact of COVID-19

- COVID-19 continues to have an impact on DVA’s business, particularly in terms of higher expenses related to personal protective equipment and other safety measures.

- The company is also facing challenges in recruiting and retaining staff due to the pandemic.