The Estée Lauder Companies Inc.

CEO : Mr. Fabrizio Freda

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

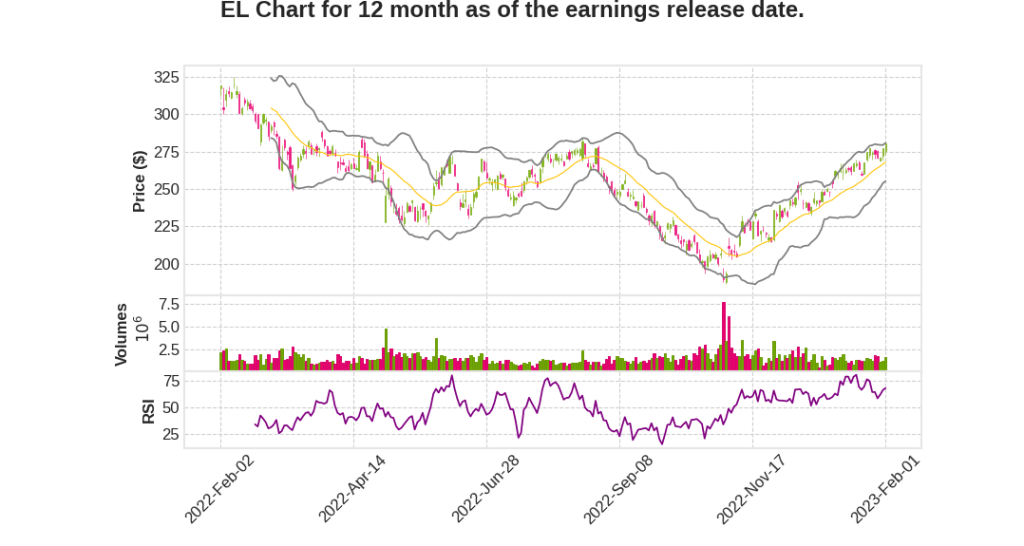

| 2023 Q2 | -16.6% YoY | -61.1% | -63.6% | 2023-02-02 |

Fabrizio Freda says,

Organic Sales and EPS Results

- Organic sales fell 11% in Q2 FY 2023, within the company’s outlook, due to COVID-19 resurgence in China

- Adjusted EPS fell 45%, but was better than expected due to disciplined expense management

Outlook for FY 2023

- Outlook for organic sales growth and adjusted diluted EPS lowered due to elevated inventory levels in China and potential rollback of COVID-related measures in Korea Duty Free

- Return to growth shifted from Q3 to Q4

Growth Engines

- Fragrance category extended its double-digit organic sales growth streak, with portfolios ideally positioned for consumer trends

- Makeup grew organically in the Americas, EMEA, and across Southeast Asia

- Brands in hair care and skin care extended category organic sales growth streaks

- Many emerging markets globally posted strong double-digit organic sales growth

Geographies

- US and domestic China were challenged in Q2, but optimistic for growth in second half

- Online channel fueled by many brands, led by La Mer double-digit growth

- Outstanding organic sales growth in many large developed and emerging markets around the world

Strategic Deal

- Acquisition of Tom Ford expected to achieve $1 billion in net sales annually over next couple of years

- Agreements with luxury companies ZenyaGroup and Marcolin to license fashion and eyewear businesses, respectively

Fabrizio Freda says,

China Market Performance

- Net sales were negative single digits and retail was negative double digits, but market share was gained in every category during the quarter.

- La Mer in skincare gained the best market share, and Jo Malone London in fragrance led the share gain.

- 11/11 net sales were up 10.9%, and retail sales were up 11.9%.

- The reopening of Hainan and Chinese consumers starting to travel internationally will have a positive impact on the retail channel.

- Skin care is expected to accelerate for the company, generating a substantial improvement in margin mix.

Market Performance in Other Regions

- Strong market share gains in most European markets, Japan, and Australia.

- Excluding travel retail impacts, Korea also progressed well.

- North America continues to lose share, but there has been progress in top-line sales acceleration in retail.

Plans for Future Growth

- Accelerating plan of share recovery in North America with an even stronger plan in the next 6 months.

- Strong acceleration of innovation and important distribution improvement in the U.S.

- Improvements in digital marketing, supply chain, R&D, and distribution capabilities make the company ready for future reacceleration.

Q & A sessions,

Normalization of Margins and Volume

- Normalization of margins will depend on the volume of business, particularly in travel retail in China where skin care tends to have higher margins.

- The normalization trends will evolve and take time to restart the normal algorithm.

Key Dynamics in Travel Retail

- Hainan is now established, and the international charter is coming back.

- Korea, Hong Kong, Macau, and Japan were all important travel retail businesses that will improve.

- Travel retail acceleration in the future will carry skin care and high-end fragrance categories.

- Strong acceleration of the fragrance category, particularly the high-end fragrance category.

- Increased traffic and conversion of travelers in Asia, particularly linked to Hainan.

- Increase in mix of Chinese travelers is good news for global travel retail.

Reopening of China and Sales Online

- Reopening of brick-and-mortar will be positively impacted by the reopening of China.

- Half of the business in China will increase dramatically on traffic when people will be free of COVID as a disease.

- Skin care will be the biggest beneficiary, followed by fragrance, makeup, and luxury hair care.