Emerson Electric Co.

CEO : Mr. Surendralal Lanca Karsanbhai

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

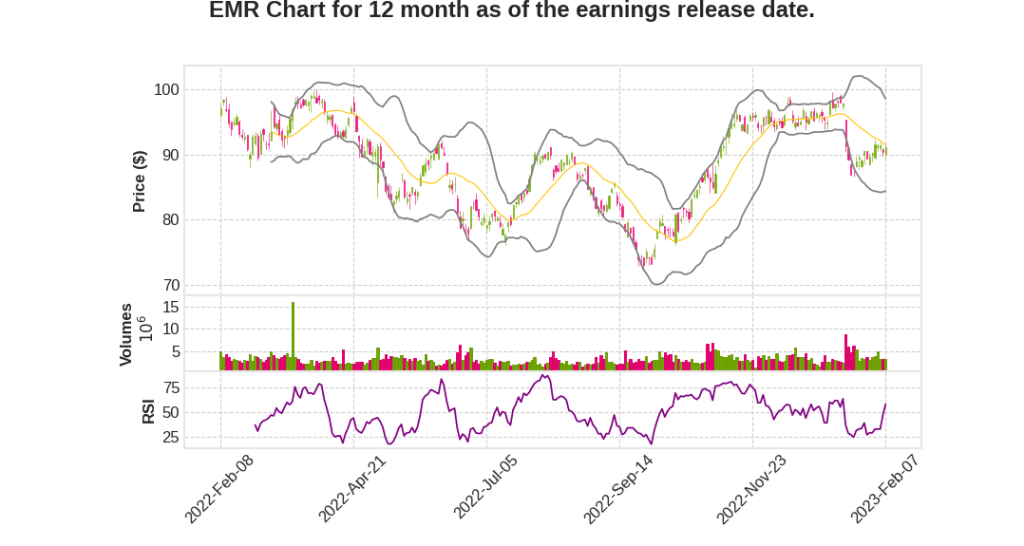

| 2023 Q1 | -24.6% YoY | -31.0% | 164.2% | 2023-02-08 |

Frank Dellaquila says,

Strong Q1 Operational Results

- Underlying sales were within our expectations at 6%, driven by growth in software and control and Intelligent Devices.

- Net sales were up 7% with a four-point drag from currency and a five-point contribution from AspenTech.

- World area growth was led by the Americas, which was up 13%.

Market Performance

- Later cycle markets like energy and chemical are strong.

- Chemical investments and plant modernization and sustainability remain steady in North America and Asia.

- Hybrid sales were up high single-digits, led by continued investments in life sciences reshoring and metals and mining.

- Discrete sales were up mid single-digits as this earlier cycle business starts to lap more difficult comps.

Guidance

- 2023 full-year guidance for underlying sales growth remains at 6.5% to 8.5%.

- Net sales expectations have been increased to 8% to 10%.

- Expected adjusted earnings per share is between $0.95 and $1, a 13% increase at the mid-point of the guide.

- Expectation to cover the unexpected stock comp headwind that we had in the first quarter with excellent operational performance.

Backlog and Margin Expansion

- Backlog grew approximately $700 million during the quarter to $6.6 billion.

- Adjusted segment EBITDA margin improved by 130 basis points.

- North America mix contributed to the margin expansion, and price was accretive to margin in the quarter.

Free Cash Flow

- Free cash flow of $243 million was down 20% year-over-year, mainly due to trade working capital.

- Expectation of 100% free cash flow conversion for the full year.

Lal Karsanbhai says,

Strong Operational Quarter and Outlook

- The first quarter was very strong for Emerson with 5% underlying orders and 6% sequential underlying orders growth.

- Sales met expectations at 6% underlying growth, slightly impacted by shutdowns in China.

- The company’s project funnel continues to grow, exceeding $7 billion at the end of the quarter.

- The company remains confident about the strength of its markets from both a geographic and an industry perspective.

- The outlook for the second quarter and the year is strong.

Operational Excellence

- Emerson is committed to its operational excellence pillars and regionalization strategy.

- The company broke ground on a new state-of-the-art innovation and manufacturing hub in Saudi Arabia to spur innovation for the region and focus on the transition to clean energy segments like hydrogen and clean fuels.

- Emerson and AspenTech continue to succeed with joint customer solutions, providing an expanded differentiated product offering to customers.

- Emerson continues to diversify through life sciences and metals and mining markets.

Proposed Acquisition of National Instruments

- Emerson proposed to acquire National Instruments for $53 per share in cash.

- The company believes its premium all-cash proposal with no financing conditions or anticipated regulatory concerns is compelling and in the best interest of Emerson and NI shareholders.

- Emerson is committed to an acquisition of NI and is participating in the strategic review process.

Adjusted EPS Was Impacted by Below-the-Line Items

- Adjusted EPS was $0.78 for the quarter.

- Stock compensation was a $0.09 headwind versus 2022, driven by a 31% stock price increase throughout the quarter and its subsequent impact on the remaining mark-to-market plan.

- FX was worse than originally expected.

- Despite these headwinds, operations performed above guidance as the business continued to execute.

Completed $2 Billion Share Repurchase

- Emerson completed its committed $2 billion of share repurchase in the first quarter.

Q & A sessions,

Strong Operational Start to 2023

- Underlying sales met expectations at 6%

- Net sales were up 7% with a 4-point drag from currency and a 5-point contribution from AspenTech

- Americas led world area growth, up 13%

- Energy and chemical markets show strength

- Commercial business in safety and productivity experienced weakness, down 10%

Pricing Actions Drive Strong Price Realization

- Pricing actions from 2022 and additional actions taken in 2023 contributed 4 points to price

Backlog Growth and Improved Margins

- Backlog grew approximately $700 million during the quarter to $6.6 billion

- Adjusted segment EBITDA margin improved by 130 basis points

- Software and control margins were up 200 basis points, led by AspenTech

- Intelligent Devices had strong performance with 110 basis points of adjusted EBITDA expansion

2023 Outlook

- Expectation of mid to high-single digit growth in process, hybrid, and discrete markets

- Expected net sales to increase by 8% to 10% due to strength in end markets and robust backlog

- Currency expected to be less of a headwind at 2 points and expected contribution of 3.5 points from AspenTech

- Operating leverage, adjusted EPS, and free cash flow conversion maintained at previous guide

- Commercial exposure within Safety and Productivity expected to improve throughout the year