EOG Resources, Inc.

CEO : Mr. Ezra Y. Yacob

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

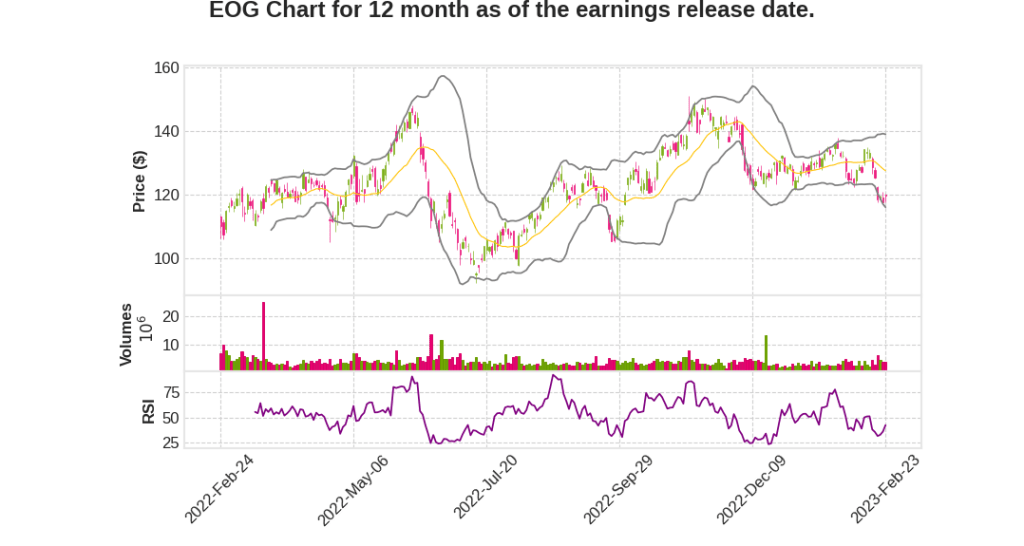

| 2022 Q4 | 9.9% YoY | 10.3% | 14.0% | 2023-02-24 |

Billy Helms says,

Key Points from EOG Q4 2022 Earnings Call Transcript

- Inflation was a challenge in 2022, but EOG was able to offset most of it through efficiency gains and capital management with well cost increases limited to just 7%.

- New completion designs in the Delaware Basin are seeing positive improvements in well performance, with up to an 18% uplift and estimated ultimate recovery.

- 2023 plan includes a $6 billion capital program to deliver 3% oil volume growth and 9% total production growth.

- Line of sight to efficiencies that limit additional inflation pressure on well cost to just 10% versus last year by staggering agreements for a consistent base of services.

- 2023 capital program includes additional infrastructure investment, with funding for facilities and other infrastructure projects comprising 20% of the CapEx budget.

- First CCS project has begun injection and EOG will continue to explore opportunities to enhance its leadership position in environmentally prudent operations.

Ezra Yacob says,

Financial Performance

- Record return on capital employed of 34%

- Record adjusted net income of $8.1 billion

- Generated $7.6 billion of free cash flow

- Record cash return to shareholders of $5.1 billion

- Increased regular dividend rate 10%

- Paid four special dividends

Operational Performance

- Production volumes, CapEx, and per unit operating costs were within guidance set at the start of the year

- Offset persistent inflationary pressures to limit well cost increases to just 7%

- Uncovered a new premium play, the Ohio Utica combo, and advanced two emerging plays

- Expanded LNG agreement, currently estimated to take effect in 2026 to 720,000 MMBtu per day

- Reduced GHG intensity and methane emissions percentage, achieving 2025 targets

- Initiated expanded deployment of new continuous methane leak detection system called iSense

Organizational Structure

- Seven teams in North America and one international team operates 16 plays across nine basins

- Decentralized structure empowers each operating team to make decisions in real time at the asset level to maximize value

- Multi-basin portfolio provides numerous high-return investment opportunities

Disciplined Investment

- Premium well strategy, in which wells must generate a minimum of 30% direct after-tax rate of return at a flat $40 oil and $2.50 natural gas price for the life of the well

- Invest at a pace that allows each asset to improve year-over-year, lowering the cost and expanding the margins generated by each asset

- Lowering the operating cost of resources to generate full cycle returns competitive with the broad market

Outlook

- EOG is in a better position than ever to deliver value for shareholders and play a significant role in the long-term future of energy

- Ability to reinvest in the business, deliver disciplined growth, lower emissions intensity, earn high returns, raise regular dividend, and return significant cash to shareholders

Q & A sessions,

Natural Gas

- The company is seeing recent volatility in natural gas late 2022 and currently associated with the LNG outages and the warm winter that are being experienced.

- The company is expecting about 240 million cubic feet per day growth next year, with half of it coming out of the associated gas from the Delaware Basin and the other half coming out of the Dorado play.

- The long-term strategy at Dorado remains the same, investing at a pace where the asset improves each year, giving us the ability to drive down both upfront well costs and long-term operating costs, delivering low cost of supply.

Capital Expenditure

- Maintenance CapEx is not a number that the company looks at.

- The company expects breakevens on its capital program this year to be up a little bit year-over-year, at $44 WTI price with a $3.25 gas price due to inflation and investment opportunities in the multi-basin portfolio.

Balance Sheet

- The company has a net cash position, which gives it a lot of optionality at different times.

- The company doesn’t have a specific target for its net cash position but will use it to be strategic and opportunistic.

- Last year, the company returned approximately 67% of its free cash flow to shareholders.

Inflation

- Tubulars casing cost is one of the biggest drivers of inflation in the last year.

- The company hasn’t seen any manifested impact due to inflation on the service side, but rig counts have been flat since September.

- The company has the advantage of operating in multiple basins to shift activity to other basins, enabling them to take advantage of more available equipment and capacity to add services at favorable rates.

Capital Program Increase

- The increase in capital expenditure is due to inflation in well cost, infrastructure, and ESG projects, and additional wells in various plays.

- The company has seen efficiency gains driven through its completion teams, and continuous pumping operation is being tied mostly to its electric frac fleets.