Equinix, Inc.

CEO : Mr. Charles J. Meyers

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

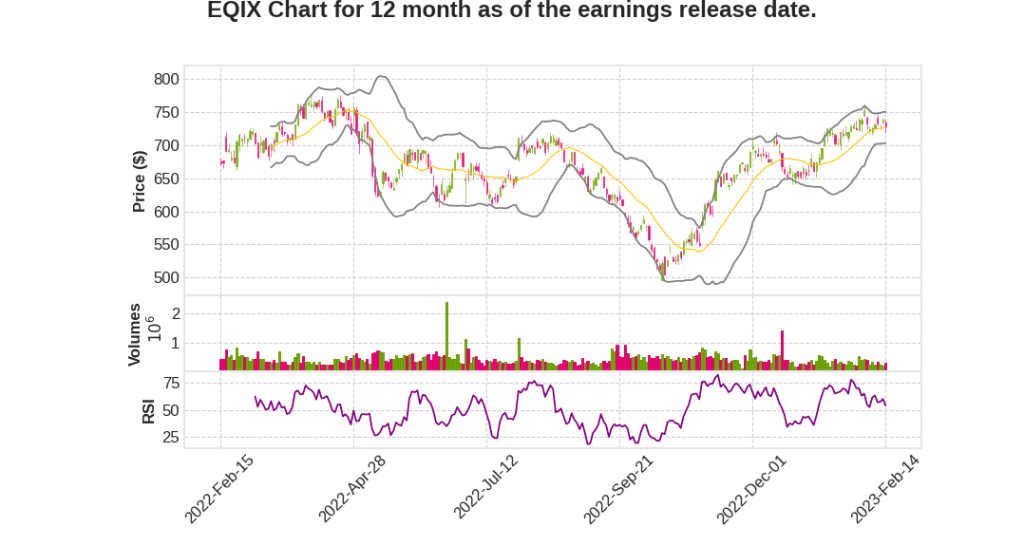

| 2022 Q4 | 9.6% YoY | 13.0% | 1.5% | 2023-02-15 |

Keith Taylor says,

Strong Q4 Performance

- Finished Q4 with healthy bookings, strong pricing, and a solid forward-looking demand pipeline

- Closed over 17,000 deals across more than 6,000 customers in 2022

- FX has shifted from a meaningful headwind to a tailwind

- Expect significant step-up in Q1 recurring revenues

Power Price Increases

- Initiated efforts to enhance customer communications regarding power costs

- Raised power prices primarily in the EMEA region to recover increasing costs

- Expect power price increases to generate approximately $350 million of incremental revenues and costs in 2023

- Cumulative power price increases are expected to increase revenue growth by approximately 500 basis points

Regional Highlights

- APAC was the fastest revenue-growing region on a year-over-year normalized basis at 17%

- Americas had another quarter of strong gross bookings, lower MRR churn and continued favorable pricing trends

- EMEA delivered a strong quarter with continued healthy pricing trends and an attractive retail mix

2023 Guidance

- Expect top line revenues will step up by nearly $1 billion, representing a year-over-year growth rate of 14% to 15%

- Excluding power price pass-throughs, expect top line revenue growth to range between 9% and 10%

- Expect adjusted EBITDA margins of approximately 45%, excluding integration costs

- Expect AFFO to grow between 9% and 12% compared to the previous year

- Expect CapEx to range between $2.7 billion and $2.9 billion, including approximately $150 million of on-balance sheet xScale spend

- Increasing the annual growth rate of cash dividend on a per share basis to 10%

Charles Meyers says,

Strong Q4 2022 Performance

- Delivered one of the best booking performances in history.

- Revenue for the full year was $7.3 billion, up 11% YoY.

- AFFO per share grew 11% YoY.

- Completed 80 consecutive quarters of revenue growth, an amazing 20 years of continuous growth.

Secular Tailwinds of Digital Transformation Remain Strong

- IDC estimates spending on digital technology by organizations will grow 8x faster than the broader economy in 2023.

- Digital transformation is seen as a critical driver of competitive differentiation, accelerating time to market and enabling product set evolution.

- Equinix is uniquely positioned to support customers’ digital infrastructure needs.

Global Expansion

- 49 major projects underway across 35 metros in 23 countries, including nine xScale projects representing over 34,000 cabinets of retail and over 75 megawatts of xScale capacity.

- New data center builds in Istanbul, Seoul, Tokyo, Johannesburg, and Johor.

- Unparalleled global footprint will span 75 metros and 35 countries.

Interconnection and Cloud on-Ramps

- Revenues for the quarter grew 13% YoY on a normalized and constant currency basis.

- Over 446,000 total interconnections on the platform.

- Equinix Fabric saw continued growth and is now operating at a $200 million revenue run rate.

- Won four new cloud on-ramps, including one in Mumbai, making it the 12th metro on Platform Equinix enabled with native cloud on-ramps from all five of the leading cloud providers.

Digital Services Portfolio

- Equinix Metal and Network Edge drove attractive pull-through to Fabric.

- Channel program delivered its seventh consecutive record quarter, accounting for nearly 40% of bookings and nearly 60% of new logos.

- Wins were across a wide range of industry verticals and digital first-use cases with hybrid multi-cloud as the clear architecture of choice.

Power

- Multiyear hedging efforts continue to create visibility and predictability for Equinix and its customers in the coming year.

- Effective January 1, raised pricing, passing on the full impact of additional power costs to customers, increasing costs but giving customers much-needed budget certainty and, in most cases, leaving them with rates below the prevailing spot market.

Q & A sessions,

Business Performance

- Equinix had strong and consistent operating performance in 2022, and the leadership team has outlined clear priorities for the coming year.

- The company intends to press their advantage in their interconnected colo franchise and expand their market leadership while enriching their platform value proposition by accelerating their digital services growth.

- The company is committed to cultivating a culture that remains firmly people-first.

- Despite a challenging macroeconomic and sociopolitical environment, digital transformation remains a clear priority across all industries, and Equinix is well positioned to be a key partner in this transformation.

Demand Profile and Pricing

- Overall, Equinix remains optimistic about the demand profile in their pipeline despite customers being appropriately cautious due to the macro environment, which would dictate that.

- Equinix is confident in the full recovery of the power price pass-through and expects strong pricing to continue to contribute to their top line.

- The colo business remains strong, unit volumes on colo interconnection growing at 13%, and Digital Services had a strong quarter in 2022.

- Equinix is increasing list pricing and having good success with it.

Development Pipeline

- Equinix is experiencing strong fill rates, which is informing the continued investment in their development pipeline.

- The company expects and anticipates and manages towards increases in pricing to maintain a consistent return profile.

- Equinix has stabilized a lot of the risks on the supply chain side, but labor is tight still in some markets.

- Equinix feels good about their ability to perform to their underwriting despite the challenges faced in the development pipeline.

Interconnection Business

- Equinix had 13% growth in their interconnection business and is making adjustments to interconnection pricing alongside broader list prices.

- Q4 is seasonally a bit weaker, but this Q4 is weaker than prior Q4s and there is some consolidation.

- The company is confident in their pricing power and will continue to monitor the behavior of their customers towards underutilized interconnections.

Analyst Day

- Equinix will update on their momentum in a number of areas and their continued investment in the development of the company and the platform.

- The company will focus on being the infrastructure platform of choice for customers as they implement hybrid and multi-cloud as the architecture of choice.

- Equinix will update on the evolution of the strategy, investments made, and long-term outlook.