Freeport-McMoRan Inc.

CEO : Mr. Richard C. Adkerson

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | -6.6% YoY | -33.6% | -36.8% | 2023-01-25 |

Richard Adkerson says,

Strong Fourth Quarter Results

- Reflects the performance of the global team

- Remarkable performance in challenging mining industry

Two Major Segments

- Indonesia: large volumes, low cost, largest gold mine, net unit cost of $0.06 a pound

- Americas: low grades, more material to be processed, challenged by low copper prices and inflation, large future brownfield opportunities

Indonesia Operations

- Largest underground mining operation in the world for the past 25 years

- Completed mining the Grasberg open pit, which has been the bulk of the operations since the discovery of the ore body in the late 1980s

Americas Operations

- Dealing with inflation and low copper prices

- Challenges in getting workers for operations

- Managed well through COVID and political situation in Peru

Long-term Focus

- Prepared to deal with market risks in the short run

- Focused on long-term success, measured by copper’s positive long-run outlook based on demand and supply fundamentals

Kathleen Quirk says,

FCX Q4 2022 Earnings Call Highlights:

- Fourth quarter 2022 operating and financial results were reported.

- A copy of the press release and slides are available on fcx.com

- Forward-looking statements were made, and actual results may differ materially.

- The full management team was present during the call.

Unfortunately, there were no specific details or numbers given during the opening remarks, so it is difficult to provide a more detailed summary of what to expect regarding FCX’s stock movement based on this call alone.

Q & A sessions,

Leaching Projects

- FCX is aggressively pursuing leaching projects on multiple fronts with outside vendors, joint ventures, and self-funded projects.

- These projects are expected to add production at low capital cost and with low carbon.

- The company sees it as a great opportunity to invest in, and there are no constraints on the projects.

Major Capital Projects

- FCX has a pipeline of major capital projects that are multiyear large capital requirements.

- The uncertainties in the market have led the company to wait until they become clearer.

- The project in Chile is dependent on the direction the country goes in with its laws and constitution, and it is on hold until that becomes clear.

2022 Performance Summary

- FCX achieved another year of growth in 2022, with 11% higher copper sales volumes and a 34% increase in gold volumes.

- They generated $9.5 billion in adjusted EBITDA, and their operating cash flows for the year were net of $1.5 billion in working capital requirements in excess of their capital investments in operations.

- The company nearly tripled their cash return to shareholders, pursuant to their performance-based payout policy.

Market Overview

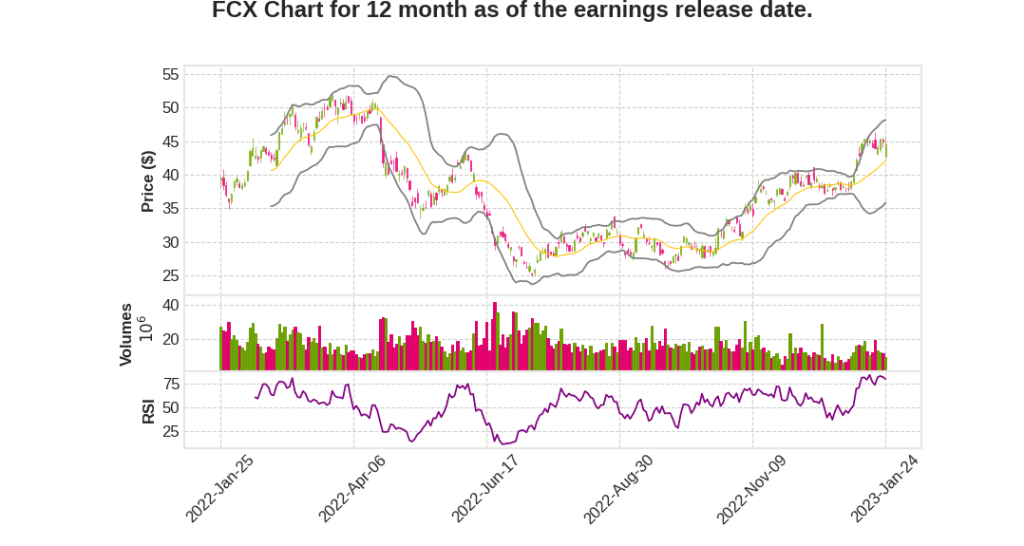

- FCX experienced significant volatility in copper prices during 2022.

- Physical markets for copper remained tight, even during a period of weaker economic data coming out of China, demonstrated by low levels of available copper inventories throughout the year.

- Copper’s importance in the economy continues to grow due to its use in clean energy applications and global electrification.

- Market deficits in the future signal the industry’s challenges in meeting the growing demand for copper, and higher long-term prices are needed to incentivize new supplies.

Reserve Position

- FCX benefits from a geographically diverse holding of reserves in the Americas and Indonesia.