F5, Inc.

CEO : Mr. Francois Locoh-Donou

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

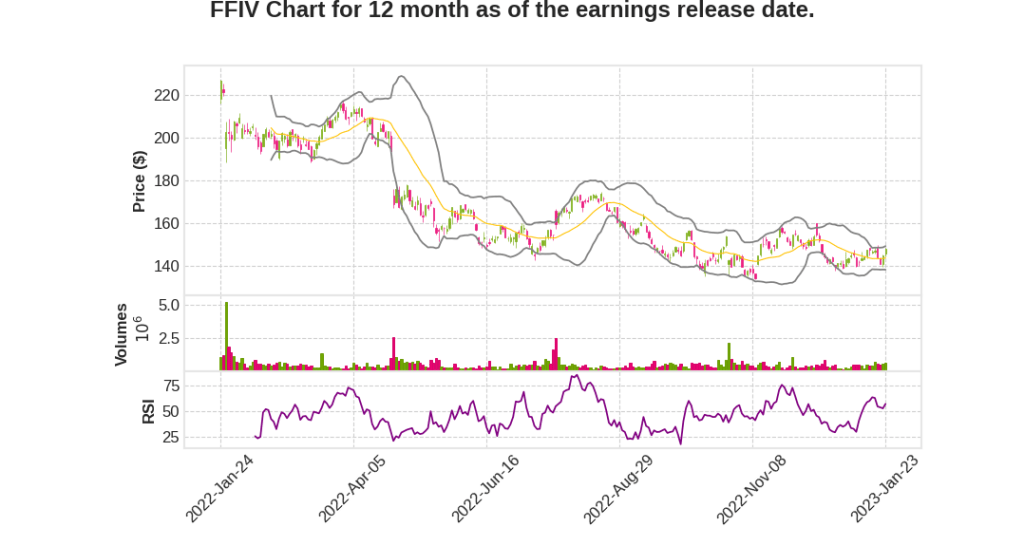

| 2023 Q1 | 1.9% YoY | -18.4% | -22.1% | 2023-01-24 |

François Locoh-Donou says,

Revenue Performance

- First quarter revenue at the midpoint of the guidance range and earnings per share above the high end of the range

- Heightened budget scrutiny and more pervasive deal delays across all geographies affecting larger transformational-type projects

- New multiyear subscriptions down a double-digit percentage year-over-year due to financial decisions resulting from broader economic uncertainty and budget scrutiny

- Software renewals performed largely as expected in the quarter

- Strong Q1 maintenance renewals, which correlates with customers’ sweating assets

- Expect 9% to 11% revenue growth for the year with a different mix than initially forecasted

Revenue Mix and Growth

- Challenging to call revenue mix with precision due to demand trends of the last quarter

- Expect a second half acceleration in systems revenue with supply chain improvements and the benefit of system redesign efforts

- Expect global services revenue to be stronger than initially anticipated for the year based on solid maintenance renewals and Q2 forecast

- Expect the combination of stronger systems revenue and global services revenue to offset software headwinds in the year

Non-GAAP Earnings Growth

- Expect non-GAAP earnings growth in the low to mid-teens for FY ’23

- Remain committed to maintaining double-digit non-GAAP earnings growth this year and on an annual basis going forward

- Continue to evaluate cost base and take further action as needed to achieve this goal

Customer Focus and Product Offerings

- Customers focused on minimizing spend and optimizing existing investments while continuing to drive revenue

- Enterprise spending environment has changed from six months ago

- Broad portfolio of solutions that can simplify, reduce cost of ownership, and make the most of customer budgets

- Good traction with next-generation hardware platforms, rSeries and VELOS, that can reduce customers’ total cost of ownership by offering cloud-like benefits for on-premises systems

Customer Case Studies

- Closed a significant multi-cloud networking win with a Tier 1 North American service provider, resulting in F5 Distributed Cloud Services being selected as the core for the next-generation managed service offering based on the platform’s ability to deliver a scalable, agile, and dynamic infrastructure

- Won a healthcare customer with our managed web application firewall and API protection solution after a proof-of-concept evaluation against both their incumbent CDN provider and a cloud-native solution. The customer selected F5 Distributed Cloud Services because it proved more effective against threats while also being easier to manage, and it met the customer’s stringent regulatory requirements

François Locoh-Donou says,

Softening IT Spending Environment

- The overall IT spending environment has deteriorated significantly over the last six months.

- Soft demand is being witnessed in terms of software growth rate and hardware demand.

- Software projects are being delayed, and there is more scrutiny on deals.

Orders and Cancellations

- No trend in order cancellations has been seen, and it is not expected in the future.

- Backlog orders that have not been delivered are being pressed by customers, and the company is working to improve the supply chain to meet demands.

Q & A sessions,

Soft demand on new software contracts

- First quarter saw significant decrease in new software business compared to last year’s Q1

- Renewal business on existing contracts largely performed as expected

- Most significant impact on Q1 revenue was on multiyear term subscription deals

Improvement in supply chain for hardware

- Significant progress made in improving supply chain to ship all orders in backlog

- Customers consume both hardware and software, but trend towards software-first environment expected to continue

Ramp and growth of rSeries

- Two factors that gated ramp and growth of rSeries: number of use cases and applications and ability to build and ship

- Supply chain constraints still present in Q1, but improvements to be seen in Q2 and beyond

- Number of use cases that rSeries can cover to be at parity with iSeries, if not in June quarter, in September quarter

Resilience of F5’s business and operating model

- Drivers for customers to buy hardware or software still present, including growth in applications and deployment models

- Ability to serve customers with flexibility in consumption and deployment models provides resilience

Long-term view and growth for F5

- Confident in long-term growth due to drivers such as security, modern applications, and multi-cloud environment

- Shift away from F5 due to financial decisions and pressure, rather than architecture perspective

- Upholding 9% to 11% revenue range, with potential upside on hardware and services revenue