Fifth Third Bancorp

CEO : Mr. Timothy N. Spence

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

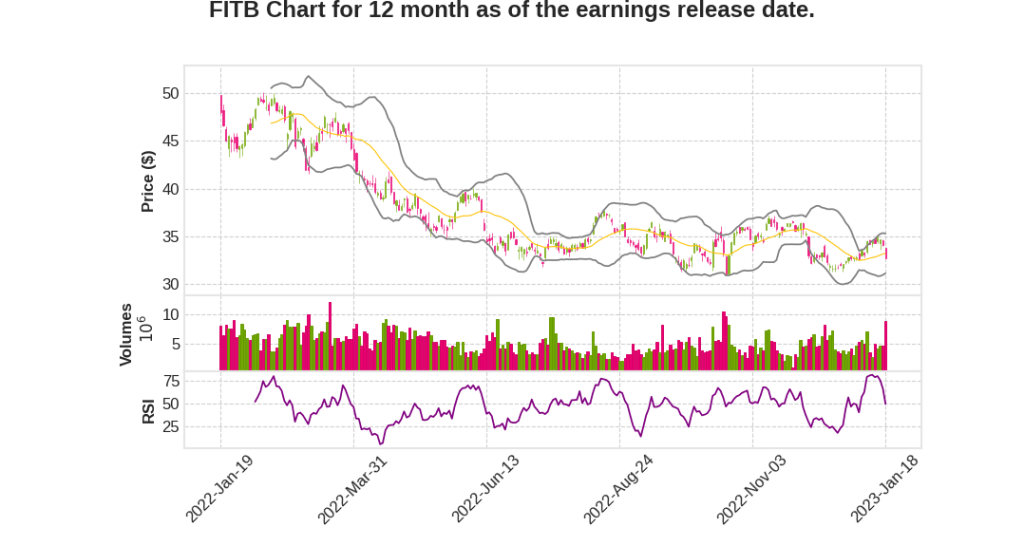

| 2022 Q4 | 13.8% YoY | 52.3% | 5.2% | 2023-01-19 |

James Leonard says,

Loan growth and revenue

- Generated strong loan growth in both commercial and consumer categories and generated record revenue.

- Expect full year average total loan growth between 3% and 4% compared to 2022, with most of the growth coming from the commercial loan portfolio.

- Expect full year NII to increase 13% to 14%, reflecting the benefits of balance sheet management and assuming a cumulative deposit beta by the end of 2023 of around 42%.

Expenses and efficiency ratio

- Adjusted efficiency ratio of 56% for the full year, which improved throughout the year with Q4 adjusted efficiency ratio below 52%.

- Total non-interest expense increased just 1% compared to the year ago quarter, driven by acquisition and continued investments in technology and communications expense.

- Expect full year adjusted non-interest expense to be up 4% to 5% compared to 2022, resulting in a sub 53% efficiency ratio for the full year, a three point improvement from 2022.

Credit and ACL

- Credit trends remain healthy and key credit metrics remain well below normalized levels.

- Maintained low portfolio concentration in non-prime consumer borrowers and in commercial real estate.

- ACL built this quarter was $112 million, primarily reflecting loan growth. Expect a Q1 2023 build to the ACL of approximately $100 million.

Net interest income and margin

- Net interest income of approximately $1.6 billion was a record for the bank and increased 5% sequentially and 32% year-over-year. NIM expanded 13 basis points for the quarter.

- Expect net interest margin to increase five basis points relative to the Q4 2022 NIM, reflecting the future impacts of deposit repricing lag and the dynamics of the loan portfolio.

Adjusted non-interest income

- Adjusted non-interest income expected to be relatively stable in 2023, reflecting continued success taking market share due to investments and talent and capabilities resulting in stronger gross treasury management revenue, capital markets fees, wealth and asset management revenue and mortgage servicing.

- Expect full year adjusted non-interest income to be up 4% to 5% compared to 2022, but TRA revenue to decline from $46 million in 2022 to $22 million in 2023.

Richard Stein says,

Higher Interest Rates Impact on Free Cash Flow and Leverage Lending Portfolio

- Higher interest rates will put pressure on businesses, particularly on the leverage lending portfolio.

- Underwriting includes forward curves plus 200 bps to ensure enough cushion in free cash flow to withstand the pressure of higher rates.

Labor Costs and Availability Impact on Margins

- Cost and availability of labor continue to put pressure on margins, particularly for industries that have a mismatch between revenue and expense management.

- Not-for-profit hospitals have low margins due to the cost to deliver care and service going up dramatically, especially nursing availability and wages.

- Companies must maintain profitability, so quality of balance sheet, liquidity, and liquidity burn rates are crucial.

Ability of Borrowers to Adapt to Higher Rates

- Client selection is understanding the ability of borrowers to adapt and be resilient to higher rates.

- Relationship model and advice with customers to find new ways to finance and endure through the cycle are important.

Q & A sessions,

NII Outlook and NIM Expansion

- Fifth Third has positioned their balance sheet over the years to prepare for a range of outcomes that could still play out given uncertainty

- Total company effort from household growth, new commercial relationships, product innovation, FinTech acquisitions, and sales execution both on loan pricing and deposit generations driving growth in NII during 2023 and expanding NIM

- Fifth Third’s fixed-rate loan businesses, specifically the auto loan business, will generate roughly $6 billion this year and dividends will exceed over $200 million growth in 2023 relative to 2022

Fee Income Outlook

- Mortgage will be the largest growth item for Fifth Third in 2023, increasing fees from $125 million in 2022 to the $160 million area, a growth of almost 30%

- Top line mortgage should be relatively stable off very low levels

- Capital markets are the wildcard in their guide, assuming mid to high single digits growth in the first half of the year and a little bit of additional growth in the back half of the year under the assumption that the capital markets disruption should abate once the Fed reaches its terminal Fed fund level

- Service charges will ultimately be down mid single digits for the year due to environmental headwinds from increasing interest rates

- Consumer overdraft and NSF side will be a little bit softer in the first half of the year as they lap those changes that occurred mid-year 2022

Commercial Real Estate Performance

- Delinquencies at Fifth Third are still zero for commercial real estate

- Office is a small number for Fifth Third, and they are watching it closely as there is some pressure from occupancy attendance and lease rates continuing to fall

- Fifth Third’s office portfolio sits more in suburban markets, where there is less pressure from a lease rate, sublease rate, and tenant perspective

- Multifamily continues to perform well, rental rates continue to accelerate faster than construction costs

- Industrial demand is strong, and lease rates continue to hold

- Hospitality and retail are stable