Fox Corporation

CEO : Mr. Lachlan Keith Murdoch

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

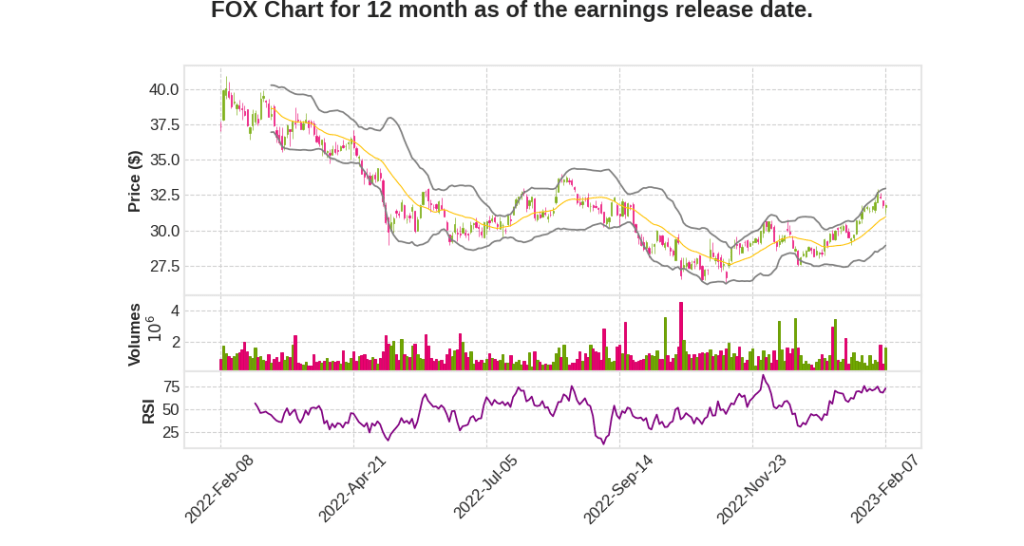

| 2023 Q2 | 3.7% YoY | -100.0% | -486.7% | 2023-02-08 |

Lachlan Murdoch says,

Financial Performance

- 4% increase in top line and advertising revenue growth in Q2 2023.

- 71% growth in EBITDA due to strong advertising results from sports and political, and the impact of exiting Thursday Night Football.

- The television segment had a truly stellar performance, with the station’s group posting another record political midterm cycle, with approximately $250 million booked during the first half of the fiscal year.

FOX Sports

- FOX Sports was a key growth driver in Q2 2023, with solid advertising pricing and demand on the back of viewership records for the NFL and for the World Cup.

- FOX Sports is the industry leader in live events for the fourth straight calendar year, with some notable achievements such as America’s Game of the Week averaging just over 24 million viewers.

- The 2022 Men’s World Cup exceeded expectations with average viewership up 30% from the 2018 matches, and the Women’s World Cup is expected to generate significant revenue this summer.

Tubi and FOX Entertainment

- Tubi had another strong quarter, with ad revenues growing by 25% over last year and significant increases in almost every major KPI.

- FOX Entertainment launched two of the season’s biggest hits: Accused and Special Forces: World’s Toughest Test, and recently renewed their content licensing agreement with Hulu, providing Hulu with a key point of differentiation in the crowded streaming world.

FOX News Media and FOX Nation

- FOX News channel ended Q2 2023 as the most watched cable network in total day and in primetime, maintaining its lead as the most watched cable news network, beating CNN and MSNBC combined in both total viewers and demo.

- FOX Business Network ended Q2 2023 as the most watched business cable network, beating CNBC in total viewers during the business day and market hours for the third consecutive quarter.

- FOX Nation had the best quarter ever for engagement in terms of hours viewed, driven by brilliant fresh content like Yellowstone: One Fifty.

Long-Term Rights and Digital Investments

- FOX has the best sports rights out there, with the vast majority of them locked up for the foreseeable future, providing the necessary flexibility to plan their businesses and pursue growth opportunities moving forward.

- FOX has made calculated investments in areas where they believe they can add significant value, such as sports wagering and advertising video-on-demand, with a firm footing in the sports gambling space, cementing their leadership in this rapidly evolving and high growth sector.

- Tubi leads their streaming strategy and has consistently grown in the healthy double-digit range since FOX acquired it almost three years ago.

Steve Tomsic says,

Revenue Growth and EBITDA

- 4% increase in total company revenue growth

- 71% growth in EBITDA

- Quarterly adjusted EBITDA was $531 million, up $220 million over the prior year

- Net income attributable to stockholders was $330 million, or $0.58 per share

Advertising Revenues

- 4% increase in advertising revenues

- Strength in political advertising of the stations

- Sports advertising was supported by a full roster of marquee events

- Advertising revenue growth at Tubi was up 25% in the quarter and exceeded $200 million on the back of record levels of engagement

Affiliate Revenues

- 1% increase in affiliate revenues

- Trailing 12 months subscriber losses remaining consistent at approximately 7%

- Television affiliate fee revenues were up 6%

- Cable affiliate fee revenues were broadly flat coming in at $1.03 billion

Cash Flow and Capital Deployment

- Recorded a free cash flow deficit of $610 million in the quarter

- Repurchased $550 million by our share buyback program

- Declared a $0.25 semiannual dividend

- Announced an incremental buyback authorization of $3 billion, taking our total authorization to $7 billion

Segment Information

- Television segment delivered 6% revenue growth

- Cable segment saw revenues generally in line with the prior year

- EBITDA in our television segment was up $529 million to $256 million

- EBITDA in our cable segment was $353 million compared to the $668 million reported last year

Q & A sessions,

Advertising Market

- Despite talks of a soft advertising market, Fox is achieving revenue targets with money coming in later than usual.

- Relative strength in advertising is due to being a leader in news and sports.

- Sold out Super Bowl with a record of $600 million revenue.

- Auto, health, pharmaceuticals, and travel categories are back in robust growth, offset by categories like crypto money exchanges being down 97%.

Tubi

- KPIs are at record highs, and revenue is up 25%.

- Total viewing time and engagement are up, which bodes well for future revenue growth as the market strengthens.

- Tubi has the biggest television movie library in streaming anywhere in the world.

Wagering Market

- FOX Sports is well-positioned to capture revenue from the wagering operators, as they battle for supremacy in each of their markets.

- FOX is the best-positioned media brand to partner with wagering partners, particularly with FanDuel.

FOX Sports

- FOX Sports had a truly stellar performance with a 4% increase in top-line and 71% growth in EBITDA.

- Station group posted a record political midterm cycle, with approximately $250 million booked during the first half of the fiscal year.

- FOX Sports is the industry leader in live events for the fourth straight calendar year.

- FOX Sports has had impressive achievements including the current NFL regular season, America’s Game of the Week, the annual Ohio State-Michigan rivalry, and the 2022 Men’s World Cup.

- The strength of FOX Sports portfolio is on full display during Thanksgiving generating just shy of $250 million over the long weekend.

- The current quarter has also been strong on the back of exciting player football and a record sold-out Super Bowl.

Tubi

- Ad revenues grew by 25% over last year, and almost every major KPI of Tubi has seen increases.

- Tubi had its highest quarterly viewership in this fiscal second quarter, with total viewing time up 41% year-on-year, while December alone was the highest TVT and highest user month ever.