Fortive Corporation

CEO : Mr. James A. Lico

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

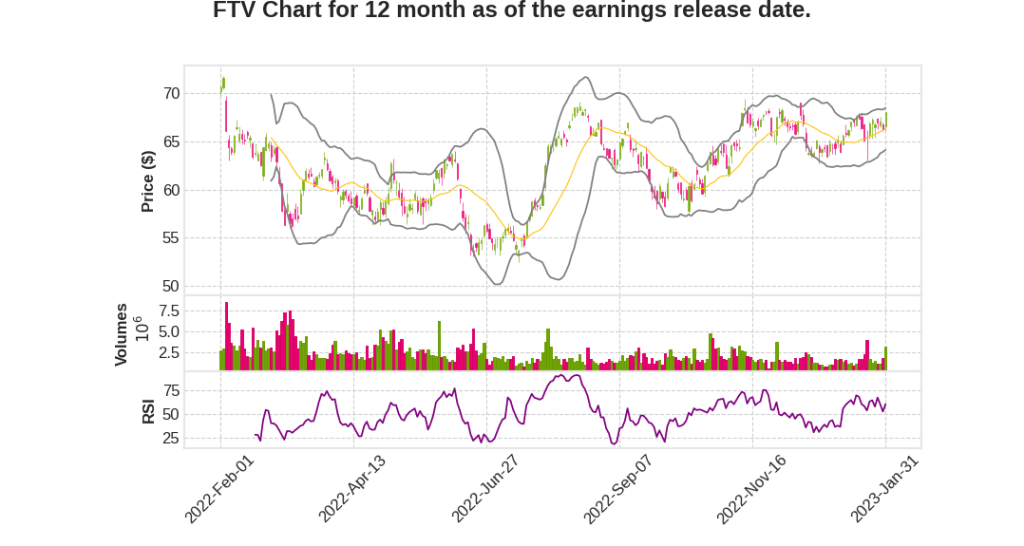

| 2022 Q4 | 11.2% YoY | 43.5% | 39.1% | 2023-02-01 |

Jim Lico says,

Strong Q4 Results

- 14% core revenue growth

- 50 and 110 basis points of adjusted gross and operating margin expansion, respectively

- 11% adjusted earnings per share growth

- 62% free cash flow growth

- Performance driven by team members’ dedication and the Fortive Business System

Portfolio Transformation

- Core growth of 10% and 20% on a two-year stack basis

- 1,000 basis points of gross margin expansion since 2016

- Free cash flow growth of $1.2 billion, with margins approaching 21%

Intelligent Operating Solutions

- 13% core revenue growth and 330 basis points of core operating margin expansion

- Double-digit growth in every workflow

- EMEA SaaS revenue grew by high teens with strong contributions from both Industrial Scientific and Intelex

Precision Technologies

- 20% core revenue growth driven by high teens growth in North America and >20% growth in Western Europe and China

- 240 basis points of adjusted operating margin expansion

- Record quarterly revenues and operating profit at Tektronix

Advanced Healthcare Solutions

- 5% revenue growth driven by broad improvement across all healthcare operating companies

- Margins impacted by higher inflation, partially offset by favorable M&A

- Provations contributed $0.10 to earnings in 2022

Fortive Business System

- Significant improvements in growth, margin, free cash flow, and breakthrough innovations across four operating companies

- Kaizen activity accelerating in 2023

Chuck McLaughlin says,

Revenue Growth and Geographical Performance

- Year-over-year core revenue growth was 14%, with acquisitions net of divestitures contributing 1.5 points of growth and FX headwinds of approximately four points.

- North America revenue was up low double-digits with broad-based strength across businesses, Western Europe revenue grew mid-teens, Asia revenue increased high-teens, and high-growth markets with mid-teens core growth.

Operating Performance Highlights

- Adjusted gross margins increased by 50 basis points to 58.3%, and adjusted operating profit margins expanded 110 basis points to 25.5%, up 230 basis points on a two-year stack basis.

- Adjusted earnings per share increased 11% to $0.88, reflecting a strong fall-through on higher volumes and productivity, partially offset by higher interest and tax expense.

- Free cash flow was $428 million in the quarter, taking the full year to $1.2 billion.

2023 Outlook

- Expecting 2023 to be another year of growth and margin expansion, with double-digit SaaS and license revenue growth, derisked moderating demand, above-trend pricing realization, increased sourcing and value engineering savings contributing to gross margin expansion, and strong productivity initiatives yielding incremental operating margins.

2023 Guidance

- Expecting core revenue growth of 3% to 5.5% for the full year, with foreign exchange headwind of just under 1% on revenue.

- Adjusted operating profit to increase 5% to 10%, with margins in the range of 25% to 25.5%.

- Adjusted diluted net EPS guidance of $3.25 to $3.40, up 3% to 8%, which includes higher interest and tax expense.

- Free cash flow expected to be approximately $1.25 billion, representing conversion in the range of 100% to 105% of adjusted net income and a 21% free cash flow margin.

Q & A sessions,

Expectation for slowing growth in 2023

- Anticipation for slowing growth as customer demand normalizes after two years of robust double-digit hardware product orders.

- Expect orders to be around the same in the first half relative to those product businesses.

- Backlog in and around where it was thought it would be from an ending year.

Benefits of investment in accelerating strategy and software revenue

- Outlook reflects benefits of investments made to accelerate strategy, strengthen market position, scale software revenues and develop new innovations.

- Investments helping to solve customers’ toughest safety, quality and productivity challenges.

- Continuous improvement culture and Fortive Business System delivering more profitable growth and strong free cash flow, allowing for disciplined capital deployment.

AHS margin improvement in 2023

- Expect North America to be good and resilient for AHS.

- More price realization in the fourth and into the year.

- Leadership team has adopted FBS and embraced actions to drive productivity.

Regional outlook for customer demand in 2023

- North America expected to be resilient; most software businesses have the predominance of their revenue streams in North America.

- Western Europe and Europe more broadly expected to be weaker.

- China expected to be good all year; healthcare will be weak in China in the first quarter but should continue to improve throughout the year.

Expectation for moderation in order growth

- Moderation or normalization back to mid-single-digit growth after 40% order growth over the last couple of years.

- Expect orders to slow a little bit, but some of that is just the big heavy comps that have been experienced over the last couple of years.