General Dynamics Corporation

CEO : Ms. Phebe N. Novakovic

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 5.4% YoY | 18.1% | 3.5% | 2023-01-25 |

Jason Aiken says,

Strong Order Activity and Backlog

- 1.2:1 book-to-bill ratio in Q4 and 1.1 times for the full year

- Marine and Aerospace groups led the way in order activity

- Total backlog at an all time high of $91.1 billion and total estimated contract value of nearly $128 billion

- Foreign exchange rate fluctuations reduced year-end backlog by nearly $600 million

Solid Cash Performance

- Operating cash flow of $669 million in Q4 and $4.6 billion for the year

- Free cash flow for the year was nearly $3.5 billion, a cash conversion rate of 102%

- Gulfstream and Technologies Group delivered outstanding cash performance

Potential Constraints to Cash in Q4

- Congress did not act to remedy the requirement to capitalize R&D costs

- No payments received from the UK, but payments expected to resume in Q1

- Capital investments were in fact elevated, consistent with expectations

Free Cash Flow Growth

- Free cash flow per share has grown at a 22% compound annual growth rate from 2019 through 2022

Phebe Novakovic says,

Q4 2022 Earnings Report Highlights

- Revenue of $10,850 million, up 5.4% YoY

- Operating earnings of $1,230 million, up 3.5% YoY

- Net earnings of $992 million, up 4.2% YoY

- Earnings per share of $3.58, up 5.6% YoY

Sequential Results

- Revenue up 8.8% from previous quarter

- Operating earnings up 11.7% from previous quarter

- Net earnings up 10% from previous quarter

- Earnings per share up 9.8% from previous quarter

Full Year Results

- Revenue of $39.4 billion, up 2.4%

- Net earnings of $3.4 billion, up 4.1%

- Earnings per fully diluted share of $12.19, up 5.5%

Order Activity and Backlog

- Overall order activity strong

- Very strong backlog

Cash Performance

- Healthy cash performance for the quarter and the year

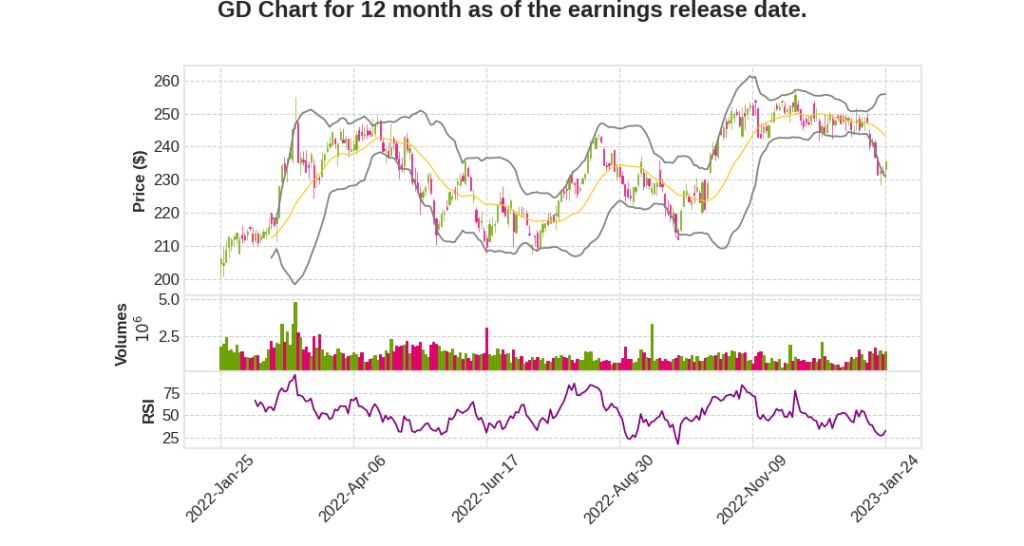

Based on the Q4 2022 earnings report, it is expected that the stock’s movement will be positively impacted due to the increase in revenue, net earnings, and earnings per share. The strong order activity, very strong backlog, and healthy cash performance are also positive indicators for the company’s future growth.

Q & A sessions,

ubheadings:

Q4 2022 Financial Performance

- Revenue in the quarter of $3.25 billion was up 9.3% YoY and up 6% sequentially.

- Operating earnings of $340 million were up about 2% over the Q4 2021.

- Earnings for the year of $1.23 billion were down 3.8% on a 40 basis point contraction in margin to 9.8%.

Technologies Group Performance

- GDIT received over $11 billion in awards during the year, almost 20% higher than 2021.

- Mission Systems finished the year with a 1.1 times book-to-bill and a capture rate in excess of 80%.

- Mission Systems’ supply chain issues impacted the business, but the team has taken corrective actions that are expected to yield results in the second half of 2023.

Capital Deployment and Debt

- Full year capital expenditures were slightly higher than expected at $1.1 billion, but are expected to trend towards historic levels in 2023.

- The company paid $345 million in dividends and repurchased approximately 440,000 shares of stock in Q4 2022.

- The net debt position decreased by approximately $600 million from last year to $9.3 billion.

Operating Forecast for 2023

- Aerospace revenue expected to be around $10.4 billion, up between $1.8 billion and $1.9 billion.

- Margin expected to be up 140 basis points to 14.6%

- Gulfstream deliveries expected to be around 145, up a little over 20%.

- No significant M&A activity planned.

Other Key Points

- GDIT and Mission Systems are in a well-balanced and comprehensive set of offerings that many peer companies are trying to get to.

- GDIT had the highest margin as a business since the CSRA acquisition and the highest earnings contribution to the company ever.