General Mills, Inc.

CEO : Mr. Jeffrey L. Harmening

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

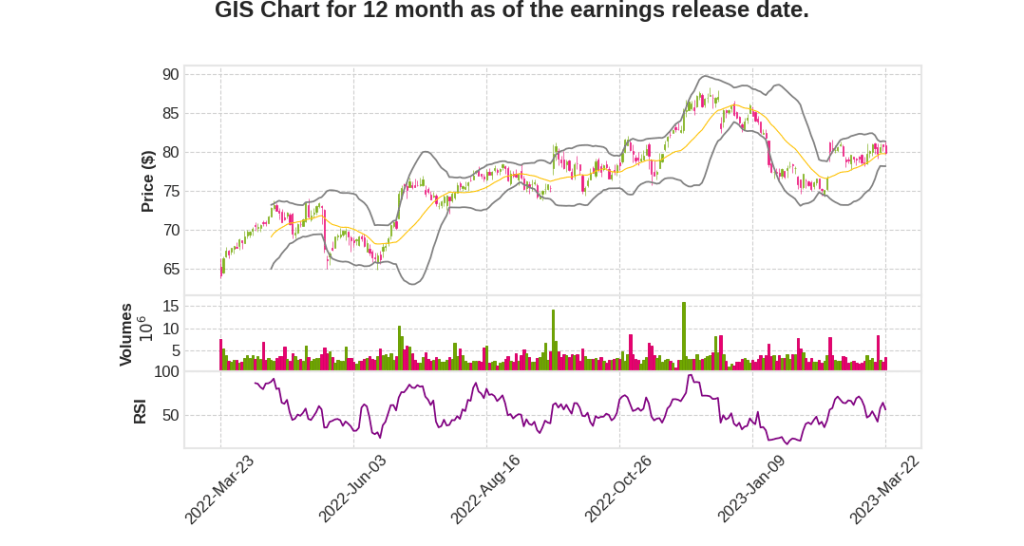

| 2023 Q3 | 13.0% YoY | -10.4% | -98.3% | 2023-03-23 |

Jeff Harmening says,

Third Quarter Sales

- Sales were roughly in line with expectations at 15%.

- Inventory was rebuilt in the third quarter as much as it was lost in the second quarter.

- Inventory and sales out are about the same for the year, with no significant retail inventory build in the third quarter.

Retail Movement

- Dry dog food business performed quite well, with Life Protection Formula up 23% in dollar terms and 9% in pounds.

- Comparisons show more dog and pet food sold in Q3 than in Q2 in terms of pounds and RNS.

Supply Chain and Customer Satisfaction

- Supply chain improved quickly in the third quarter with service levels reaching 90% or higher.

- Rebuilding inventory was possible due to the improved supply chain, and customers were glad to see retail business back in action.

Future Outlook

- Expectations remain for double-digit growth in the back half of the year.

- While there is more work to be done, the third quarter was a good one for the pet business.

- Fourth quarter results are yet to be seen.

Jon Nudi says,

Strategic Revenue Management

- Capabilities in Strategic Revenue Management have been built for 5-6 years, leveraging the entire toolbox.

- List price increases have been taken due to inflation in the past year.

- Focus has been given to promotional optimization.

- Price points were up double digits across categories.

- Sophistication in pricing has increased over the past few years.

Market Changes

- Frequency is coming back from a trade standpoint as services get healthier.

- Price architecture and mix are also being looked at.

- Elasticities have been positively impacted by these moves in the market.

Recessionary Periods

- Private label does well during recessionary periods.

- Historically, the company has held up pretty well during such times.

- Share remains relatively flat with third and fourth tier players in categories getting hit the hardest.

Q & A sessions,

Pet Business

- Category dynamics trending towards humanization with no trade down to private label or lower-priced brands.

- Mobility increase due to people going back to the office resulting in a little bit less treating and more dry dog food.

- Pounds down 2% and trailing categories but improving with services levels and marketing efforts.

Food Service

- Removed convenience stores from food service business and expanded to North America.

- Strong K-12 school business and gaining share in many categories in North America food service.

- Early innings on driving back margin growth into our food service business.

Sales Performance

- Little change in elasticities and consumption of food at home remains stable.

- Double digit marketing spending in the past 4 years resulting in strong brand growth.