Corning Incorporated

CEO : Mr. Wendell P. Weeks

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

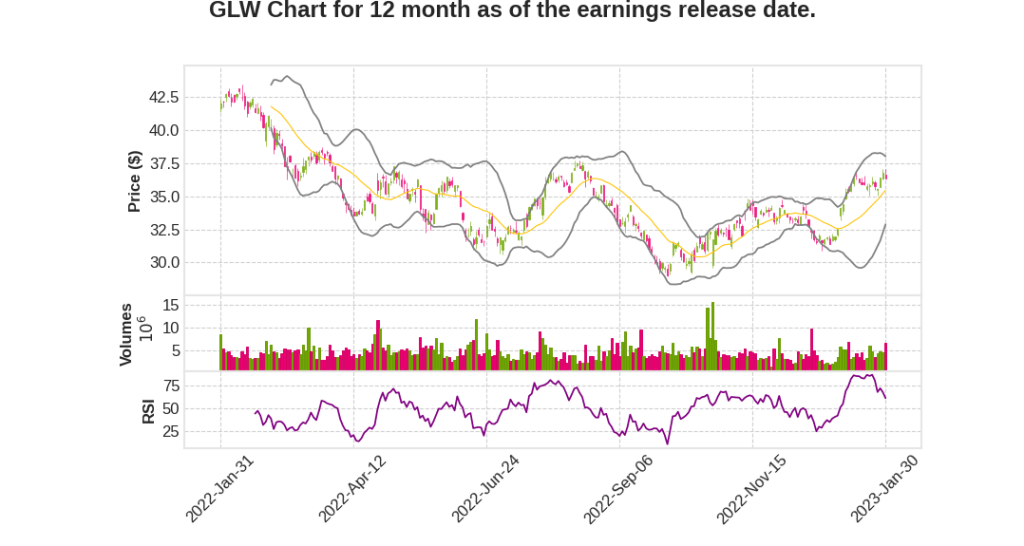

| 2022 Q4 | -7.3% YoY | -86.7% | -105.6% | 2023-01-31 |

Ed Schlesinger says,

Summary of GLW Q4 2022 Earnings Report

- Full year sales grew 5% to $14.8 billion and EPS grew 1% to $2.09.

- Profitability and cash flow lagged sales growth.

- Actions taken to address this include raising prices in Optical Communications and Life Sciences, adjusting productivity ratios and reducing inventory.

- Sales in Q4 were $3.6 billion and EPS was $0.47, both at the high end of guidance.

- The Display industry recovery has been delayed by at least a quarter due to COVID outbreaks in China affecting panel maker utilization levels.

- First quarter sales expected to decline 6% to 11% sequentially due to COVID-related consumer sentiment and labor availability issues in China.

- Core sales expected to be in the range of $3.2 billion to $3.4 billion with EPS in the range of $0.35 to $0.42.

- Currency exchange exposure is actively hedged with most of 2023 and 2024 hedged and core rate at 1-0-7 through the end of 2024.

- Long-term growth drivers remain intact, including capturing growth in optical and solar.

- First quarter sales expected to grow sequentially in the second quarter.

Wendell Weeks says,

GLW’s Significant Opportunities in Bendable and Augmented Reality

- GLW has 2 significant opportunities in the bendable market- mother glass and cover material for display manufacturing.

- GLW has invested in innovation for bendable devices to make it mainstream rather than just a novelty.

- GLW plans to continue innovation in bendables and introduce new products in that space in the next few years.

- GLW has significant efforts in the embryonic industry of augmented reality.

- GLW creates the material and waveguides to create the digital light field in front of your eyes for augmented reality.

Q & A sessions,

Improvement in Operations

- The company erred on the side of serving their customers during the pandemic and raised prices to offset inflation.

- Improvements in yields, staffing levels, and realignment of capacity have allowed the company to reach benchmark productivity metrics, improving cost and gross margin.

Panel Maker Utilization

- Panel maker utilization saw a significant increase in October and November, indicating the recovery was underway.

- However, utilization levelled off in December and returned to October levels in January, delaying the recovery by a quarter, adjusting for seasonality.

Retail Market Recovery

- The company expects to see the retail market recover as the year goes on, with even a relatively flattish set demand year-over-year resulting in significant growth for the company at the glass level, considering the state of panel maker utilization.