Garmin Ltd.

CEO : Mr. Clifton Albert Pemble

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

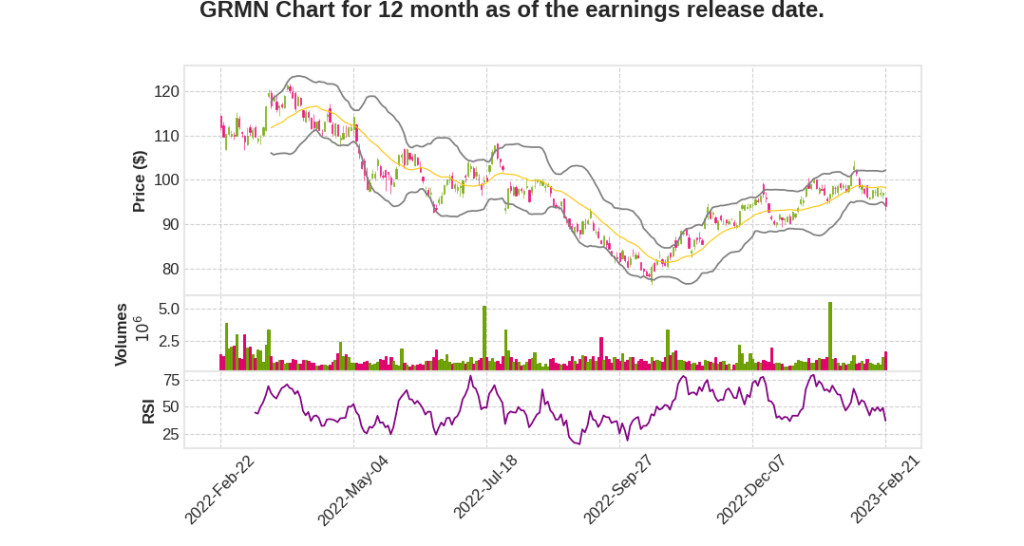

| 2022 Q4 | -6.1% YoY | -15.2% | 2.7% | 2023-02-22 |

Clifton Pemble says,

Consolidated Revenue and Gross Margin Performance

- Consolidated fourth quarter revenue came in at $1.3 billion, down 6% from the prior year, impacted by several factors such as the year-over-year strengthening of the U.S. dollar, macroeconomic and geopolitical concerns affecting Europe, and the performance of retailers who focused on inventory control.

- Gross margin performance improved 150 basis points over the prior year and exceeded expectations as the company benefited from lower freight costs.

- For the year, revenue was $4.86 billion, a 2% decline year-over-year. Excluding the impact of the strengthening of the U.S. dollar, revenue would have increased about 2% over the prior year.

- Gross margin performance was strong at 57.7% for the year, and operating margin exceeded 21%.

Performance and Outlook for Each Business Segment

- Fitness segment revenue decreased 28% for the year with declines across all categories. However, Garmin received U.S. FDA approval for a clinically validated ECG app for the Venu 2 Plus smartwatch and launched its first LTE-connected kids smartwatch, Bounce. For 2023, revenue is expected to be down approximately 5% in the segment.

- Outdoor segment full year revenue increased 17% resulting in record revenue of nearly $1.5 billion for the year. Garmin launched the second-generation MARQ luxury smartwatch and expanded the Instinct product line with the new Crossover. For 2023, Garmin expects the Outdoor segment to grow by approximately 2%.

- Aviation segment full year revenue increased 11%, and 2022 was a record year for the segment. The Aviation segment continues to benefit from strong demand for both aftermarket products and new aircraft equipped with integrated cockpit systems. Garmin expects these trends to drive revenue growth of approximately 5% for the year.

- Marine segment delivered its 10th consecutive year of revenue growth, and for 2022, revenue increased 3% with growth across multiple categories. Garmin anticipates revenue from the Marine segment to increase approximately 5% for the year.

- Auto segment full year revenue decreased 4%, and Garmin recently combined the product categories of Consumer Auto with Outdoor. For fiscal year 2023, Garmin will report auto OEM as a standalone segment. During 2022, Auto OEM revenue increased 11% to $284 million, and Garmin expects Auto OEM revenue to increase 30% in 2023.

Dividend

- Garmin is proposing a dividend of $2.92, consistent with the prior year, which will be considered by shareholders at the upcoming Annual General Meeting.

Outlook

- Garmin is cautiously optimistic about its performance in 2023 and anticipates consolidated revenue will increase approximately 3% to $5 billion for the year.

- Garmin expects to return to growth starting in the second quarter as it benefits from planned new product introductions.

Doug Boessen says,

Q4 2022 Financial Results

- Revenue decreased by 6% YoY to over $1.3 billion

- Gross margin increased to 57%, primarily due to lower freight costs

- Operating expense as a percentage of sales increased by 370 basis points to 36.5%

- Operating income decreased by 15% YoY to $267 million

- GAAP EPS was $1.53, and pro forma EPS was $1.35, a 13% decrease from the prior year pro forma EPS

Full Year 2022 Results

- Revenue decreased by 2% YoY to $4.860 billion

- Gross margin decreased to 57.7%

- Operating expense as a percentage of sales increased by 300 basis points to 36.6%

- Operating income decreased by 16% YoY to $1.028 billion

- GAAP EPS was $5.04, pro forma EPS was $5.13, 12% decrease from the prior year pro forma EPS

Revenue by Segment and Geography

- Growth in the Aviation, Marine, and Outdoor segments was more than offset by declines in the Fitness and Auto segments

- 4% growth in Americas was more than offset by a 17% decline in EMEA and a 9% decline in APAC, which was negatively impacted by foreign exchange rates during the quarter

Operating Expenses

- Fourth quarter operating expenses increased by $21 million or 5%

- Research and development increased approximately $11 million YoY, primarily due to engineering personnel costs

- SG&A increased approximately $13 million compared to prior year quarter, primarily due to increases in personnel-related expenses, formation, technology costs

- Advertising expense decreased approximately $3 million due to lower co-op advertising

Guidance for 2023

- Anticipate revenue of approximately $5 billion, an increase of approximately 3% YoY

- Expect gross margin to be approximately 57.5%

- Expect an operating margin of approximately 20.3%

- Expect a pro forma effective tax rate of approximately 8% resulting in expected pro forma EPS of approximately $5.15

Q & A sessions,

Strong Market Positions in Marine and Aviation

- Top marine electronics and consumer electronics provider by sales

- Market share leader in aftermarket and integrated cockpit systems in midsized business jets down through piston aircraft

Challenges in Fitness Segment

- Normalized sales levels in cycling and indoor cycling area

- Advanced wearables face strong competition from bigger players in the market

Favorable Factors for 2023 Earnings

- Favorability in freight costs due to the larger percentage of products being shipped on ocean

- Segment mix, with Auto OEM business having lower gross margin but becoming a larger piece of the total

Expected Operating Expenses

- Advertising expenses to be lower due to the larger piece of Auto OEM business in the total

- R&D expenses to be up around 30 basis points for continuing investments in innovation

- SG&A expenses to be up around 40 basis points for building infrastructure to support growth