Hasbro, Inc.

CEO : Mr. Christian Cocks

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

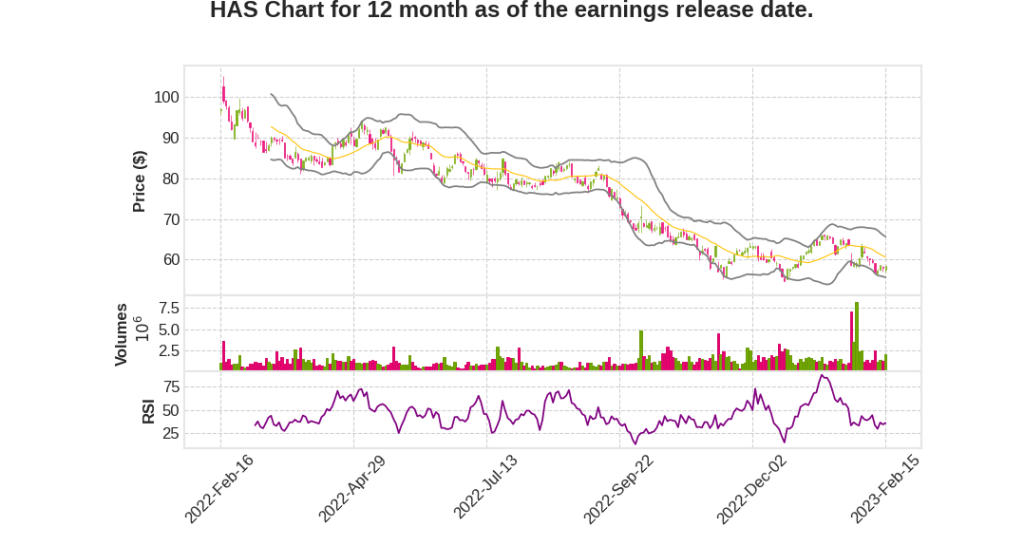

| 2022 Q4 | -16.6% YoY | -187.0% | -257.6% | 2023-02-16 |

Deb Thomas says,

Inventory Management

- Reduced on-hand inventory levels by $168 million from Q3 2022, but up $125 million from last year or 23%, due to early retailer purchases and softer-than-planned Q4 sales

- $135 million of inventory is estimated to be excess toy and game inventory at retail

- First half revenue expected to be down approximately 20% compared to the first half of 2022 with Q1 revenue down approximately 25%

Cost Savings and Margin Improvement

- Increased adjusted operating profit margin by 30 basis points in 2022

- Potential to add an additional 50 basis points to 70 basis points in 2023

- Achieved approximately $50 million in run rate cost savings and actualized $20 million in 2022

- On track for $150 million in annualized run rate cost savings for year-end 2023

- Targeting 20% operating profit margin in 2027, if not sooner

Segment Performance

- Wizards of the Coast and Digital Gaming revenue increased 5% in constant currency

- Consumer Products segment revenue decreased 7%, excluding a negative $117 million impact of foreign exchange

- Entertainment segment revenue decreased 15% in constant currency

Outlook

- First half revenue expected to be impacted by exiting certain third-party licenses, transitioning several Hasbro brands from an in-house to license model, reducing recent inventory at retail, rightsizing certain markets, and continued FX headwinds

- Adjusted operating profit margin improvement of 50 basis points to 70 basis points expected in 2023

- Underlying adjusted tax rate expected to be between 20% to 21% in 2023

- Full year 2023 Consumer Products revenue expected to decline mid-single digits with adjusted operating profit margin improvement of 150 basis points to 200 basis points from the adjusted op margin in 2022

- Full year 2023 entertainment revenue expected to increase low single digits, and adjusted operating profit margin is expected to increase slightly from 8.6% in 2022

Retirement of CEO

- CEO announced plans to retire from Hasbro

- Will stay until successor is in place and there’s an orderly transition

Chris Cocks says,

Cost Savings and Operational Transformation

- Identified $50 million in run rate cost savings in 2022, which improved Q4 earnings by over $20 million

- Anticipates $150 million in run rate savings in 2023 from operational transformation

- The progress in cost savings and operational transformation is expected to drive continued operating margin expansion of 50 basis points to 70 basis points

Growth Initiatives

- Direct business, including MAGIC: Arena, D&D Beyond, Hasbro Pulse, and MAGIC: Secret Liar, was up 15% in 2022

- Hasbro Pulse was the fastest-growing channel, increasing 70% on robust fan demand across premier industry entertainment properties

- Wizards of the Coast and Digital Gaming grew 5% in constant currency, outperforming a games market that, by most measurements, was flat to down, with MAGIC tabletop leading the growth

- Celebrated its first $1 billion brand in MAGIC: THE GATHERING

- Licensing business was up 5% for the year

Challenges

- Supply chain disruptions compressed set release schedules in 2022

- Too aggressive in some pricing assumptions, notably the 30th-anniversary edition of MAGIC, and pulled back on available supply, impacting Q4 results

- Misfired on updating the open game license of D&D, a key vehicle for creators to share or commercialize their D&D inspired content

Revenue and Growth Forecast

- Anticipates revenue for the company to be down low single digits for the year, with consumer products down mid-single digits, Wizards of the Coast and Digital Games up mid-single digits, and entertainment up low single digits

Focus on Category and Inventory Reduction Plans

- Targeted pricing actions on NERF to compete at every price point, expanding the market with the introduction of NERF Jr. to kids 5 to 7 and winning share in the fast-growing JOE segment with all new innovations starting at a segment low of $19.99

- One of the strongest content lineups for action in a decade, including 6 blockbuster films, a host of new streaming series, and some of the strongest new product innovation for Transformers in years, set against the launch of the Rise of The Beasts feature film in June

- Continued global appeal of PEPPA PIG and new line based on the upcoming hit series Young Jedi Adventures from Lucasfilm in preschool category

- Adding all-new innovation in games category like casual AR game, Twister Air, building on the best-selling CLUE: Escape Room series, extending our audiences in MAGIC with our newest universe Universes Beyond based on J.R.R. Tolkien’s Lord the Ring series, Tales of Middle Earth, growing our distribution for MAGIC: Arena with our upcoming launch on Steam

Q & A sessions,

Impact of Q1 and Q2 on Consumer Discretionary Sector

- Difficult Q4 2022 in the consumer discretionary sector expected to continue in Q1 and Q2

- Potential overhang of retail inventory due to slowing consumer demand in Q4

Revenue and Inventory Headwinds

- Expected $300 million headwind spread across business with concentration in Consumer Products

- Exits of licenses and transition of in-house brands to an out-licensing model to impact top line

- Impact of FX, particularly in the first half of the year

- Inventory overhang at retail and holding of inventory by the company to take the full year to move through

Growth Vectors and Product Road Map

- Strategy to grow in five focus categories with plans for each of them

- New products and pricing actions in NERF, PLAY-DOH, and games portfolio

- Exciting release calendar for Q3 in all segments and entertainment in Q2 with possible halo effect into Q3 and Q4

Expectations for Wizards of the Coast and MAGIC in particular

- Expected up Q1 and down Q2, significant up Q3, and fair up Q4 based on release timing

- Release of new sets such as Phyrexia and Lord of The Rings, and new initiative of Universes Beyond expected to attract new fans and engage existing players

Efforts to Drive Top and Bottom Line Performance

- Execution against five focus categories to gain share in a potentially flat to down market

- Responsible management of inventory to not impact bottom line and fund growth initiatives

- Robust demand planning and supply chain management and driving savings goals of $150 million for the year to improve bottom line performance