HCA Healthcare, Inc.

CEO : Mr. Samuel N. Hazen

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

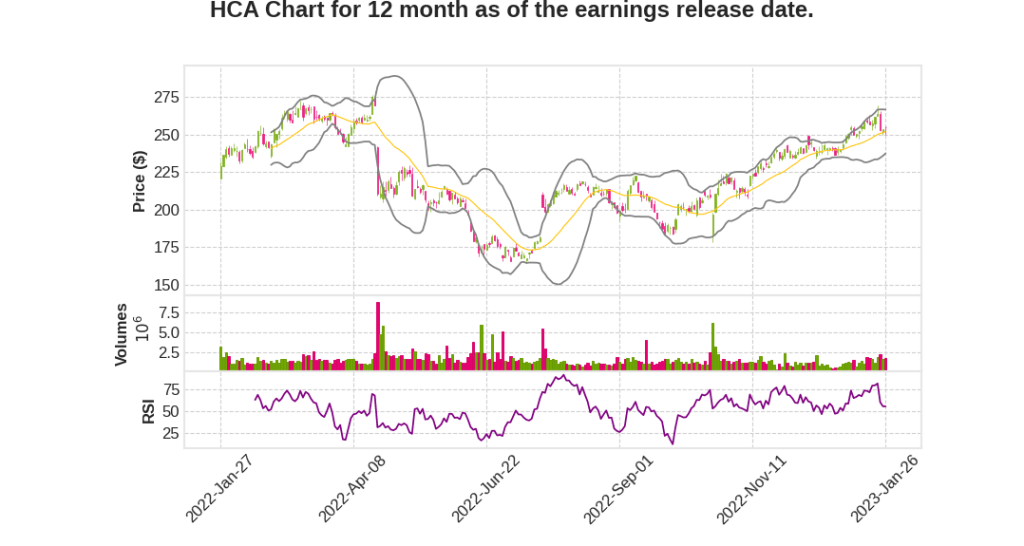

| 2022 Q4 | 2.9% YoY | -100.0% | 20.7% | 2023-01-27 |

Sam Hazen says,

Quarterly Results

- Same-facility volumes were strong, with admissions growing 3% YoY.

- Non-COVID admissions increased in excess of 5% while equivalent admissions were up 5.4%, with impressive growth of 11% in the emergency room.

- The payer mix and acuity levels in the quarter remained at favorable levels, producing revenue growth against a difficult comparison of 3% in the quarter.

- Turnover numbers for registered nurses were down 26% in the fourth quarter as compared to the previous four quartersâ average.

- Employee engagement scores recovered to around pre-pandemic levels.

Portfolio Optimization Plan

- The company closed two joint ventures with strategic partners, one with their Sarah Cannon Research Institute and the second with their CoreTrust purchasing organization.

- These two deals achieved their strategic objectives and connected them with better platforms for success in the future.

- The executives who are part of this transition are all proven HCA executives, they understand and appreciate their culture and they know how to execute.

2023 Agenda

- Overcoming labor and capacity challenges while ensuring high-quality outcomes to patients.

- Countering inflationary pressures.

- Accelerating growth with their winning plays that leverage capital investments in outpatient facilities, clinical equipment for physicians, and service line expansion.

Long-Term Plan

- Advancing their clinical systems and digital capabilities.

- Transforming care models with innovative solutions.

- Expanding their workforce development programs.

- Investing capital in their networks to expand their offerings.

2023 Guidance

- Expected to have a strong operational momentum driving solid volume growth, which should position the company well for 2023.

- They are making significant investments in their long-term plan, which will pressure their results in the current year.

Bill Rutherford says,

Volume Metrics

- Same-facility admissions increased 2.9% YoY in Q4, and were up 0.5% YoY for the full year.

- Same-facility emergency room visits were up 11.4% YoY in Q4 and up 7.6% YoY for the full year, while same-facility outpatient surgeries were up slightly in Q4 from the prior year, but increased 5.6% sequentially compared to Q3, and same-facility inpatient surgeries were basically flat as compared to the prior year.

- COVID admissions accounted for 5.2% of admissions in 2022, versus 7.8% in the prior year.

Financials

- Consolidated adjusted EBITDA margins were 20.5% in Q4 and 20% for the full year.

- For FY 2023, HCA expects revenues to range between $61.5 billion and $63.5 billion and net income attributable to HCA Healthcare to range between $4.525 billion and $4.895 billion.

- HCA expects full-year adjusted EBITDA to range between $11.8 billion and $12.4 billion.

- Full-year diluted earnings per share are expected to range between $16.40 and $17.60.

- Capital spending is projected to approximate $4.3 billion during the year, and cash flow from operations is estimated to range between $8.5 billion and $9 billion.

Policy Changes

- HCA’s 2023 adjusted EBITDA guidance is impacted by several governmental and policy changes, including the removal of COVID support, the Texas directed payment program, and the 340B related payment reductions.

- The midpoint of HCA’s 2023 adjusted EBITDA guidance would be in the middle of the historical 4% to 6% growth expectations.

Capital Allocation

- HCA’s cash flow from operations was $8.5 billion in 2022.

- HCA’s debt to adjusted EBITDA leverage ratio was near the low end of the stated leverage range of 3x to 4x.

- HCA repurchased $7 billion of its outstanding stock during the year and authorized a new $3 billion share repurchase program.

Q & A sessions,

Guidance and Labor Agenda

- The guidance for HCA Q4 2022 is expected to have a range of 2.5% on either side of the midpoint.

- The top side of that range can be achieved if volume and labor agenda perform better than anticipated while the low side of that range could have inflationary pressures and challenges in a tenuous labor market.

- HCA has made significant investments in their people, and they expect to maintain their labor cost as a percent of revenue around the same level as they finished in 2022.

Long-Term Thinking

- HCA believes that they have two sets of opportunities outside and inside the organization.

- They have invested in big data, better clinical system capability, and better analytics to support better care, which can help them capitalize on the economy of opportunities that exist inside the organization.

- HCA focuses on better patient care, but they also use these opportunities to invest in their natural growth in demand and continue to grow market share.

Service Lines Trends

- The emergency room has shown good volume growth during the pandemic, and the demand there is very strong.

- Orthopedic business has grown 6%, even though they have absorbed most of the shift from inpatient to outpatient over the last 3 years during the pandemic.

- HCA has a robust pipeline for their emergency rooms, urgent care center platforms, and ambulatory surgery center platforms.

- They are encouraged by their investments in their ambulatory network, higher service lines, and their strategy to increase the acuity level of their programs.

Supply Cost Portfolio

- HCA expects to keep their supply cost as a percent of revenue flat from where they ran full year 2023, which would imply their supply cost per unit is around the 2% level.

- Their team is doing a nice job of keeping supply cost growth below their revenue growth.

- HCA has a number of initiatives underway that their teams use, including benchmarking initiatives to look at utilization and identify best practices across the organization, and product selection with their clinical teams.

Operational Momentum

- HCA finished 2022 as expected with pre-pandemic seasonality demand norms driving solid volume growth.

- They believe this operational momentum should position them well for 2023.

- Their people have demonstrated an impressive capability in the face of dynamic forces, and they believe HCA Healthcare people are even more special.