Hess Corporation

CEO : Mr. John B. Hess

Quarterly earnings growth(YoY,%)

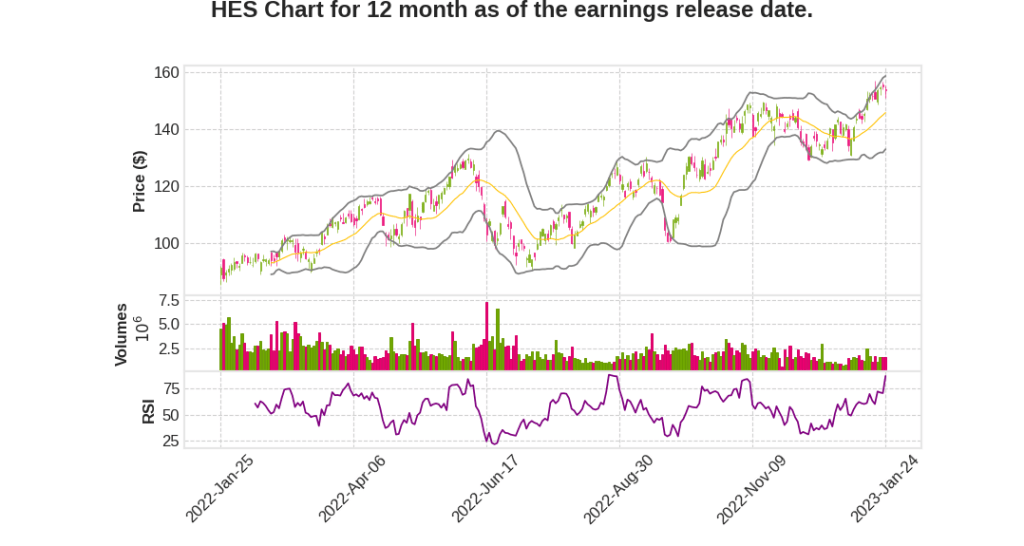

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 31.2% YoY | 30.8% | 138.2% | 2023-01-25 |

John Hess says,

Oil and Gas Investment Challenge

- The world needs 20% more energy by 2050 and also needs to reach net zero emissions.

- IEA estimates a global investment of approximately $500 billion each year for the next 10 years in oil and gas to meet demand growth.

- Annual investment of between $3 trillion and $4 trillion is needed each year for the next 10 years in clean energies.

Corporate Strategy and Financial Results

- The company’s strategy is to grow its resource base, maintain low cost of supply, and generate industry-leading cash flow growth.

- Cash flow is forecast to increase by approximately 25% annually between 2021 and 2026.

- The company plans to return up to 75% of its annual free cash flow to shareholders, while the remainder will strengthen the balance sheet.

- The company decreased its debt by $500 million, increased its regular quarterly dividend by 50%, and completed a $650 million stock repurchase program in 2022.

Exploration and Production

- The Stabroek Block in Guyana is a key component of the company’s strategy, with more than 30 discoveries including a significant new oil discovery at the Fangtooth Southeast-1 well.

- The company has four sanctioned oil developments on the Stabroek Block, with a breakeven Brent oil price of between $25 and $35 per barrel.

- The company plans to continue an active exploration and appraisal program in Guyana with approximately 10 wells planned for the Stabroek Block in 2023.

- The company plans to continue operating a 4-rig program in the Bakken to grow net production to an average of 200,000 barrels of oil equivalent per day in 2025.

- The company plans to invest in drilling and production facilities in Southeast Asia at both the North Malay Basin and joint development area assets.

Sustainability and ESG Performance

- The company announced one of the largest private sector forest preservation agreements in the world to purchase high-quality, independently verified REDD+ carbon credits for a minimum of $750 million between 2022 and 2032 directly from the Government of Guyana.

- The company aims to achieve net zero Scope 1 and Scope 2 greenhouse gas emissions on a net equity basis by 2050.

- The company was recognized as an industry leader in environmental, social, and governance performance and disclosure, earning a place on the Dow Jones Sustainability Index for North America for the 13th consecutive year and achieving leadership status in CDP’s annual global climate analysis for the 14th consecutive year.

Greg Hill says,

Proved Reserves and Production

- Proved reserves at the end of 2022 stood at approximately 1.26 billion barrels of oil equivalent

- Net proved reserve additions of 184 million barrels of oil equivalent were primarily the result of the Yellowtail sanction in Guyana and the Bakken

- In the fourth quarter of 2022, company-wide net production averaged 376,000 barrels of oil equivalent per day, exceeding guidance

- For the full year 2023, Hess forecasts net production to average between 355,000 and 365,000 barrels of oil equivalent per day, reflecting an increase of approximately 10% compared with 2022 production

Bakken Production and Drilling Costs

- Fourth quarter net production of 158,000 barrels of oil equivalent per day in Bakken was below guidance, mainly due to severe winter weather

- In 2023, Hess plans to operate 4 rigs and expects to drill approximately 110 gross operated wells and bring online approximately 110 new wells in Bakken

- Drilling and completion cost per Bakken well averaged $6.4 million in 2022

- Estimated industry inflation will average between 10% and 15%, while Hess forecasts D&C cost to average approximately $6.9 million per well or about 8% above last year

Gulf of Mexico Production and Development

- Net production from the Deepwater Gulf of Mexico averaged 35,000 barrels of oil equivalent per day in the fourth quarter of 2022 and 31,000 barrels of oil equivalent per day for the full year

- In 2023, Hess plans to participate in 4 wells, 1 infrastructure-led exploration well, 1 hub class exploration well, and 2 tieback wells

- The Prosperity FPSO is expected to depart from Singapore in late first quarter and achieve first oil by the end of 2023

Southeast Asia Production and Guyana Exploration and Development

- Net production from the joint development area in North Malay Basin averaged 67,000 barrels of oil equivalent per day in the fourth quarter of 2022 and 64,000 barrels of oil equivalent per day for the full year

- In Guyana, net production averaged 116,000 barrels of oil per day in the fourth quarter of 2022

- Fangtooth Southeast-1 well resulted in a significant new oil discovery and further appraisal activities are underway

- In 2023, Hess plans to drill approximately 10 exploration and appraisal wells that will target a variety of prospects and play types

Major Projects

- The Payara FPSO is expected to achieve first oil by the end of 2023

- Yellowtail is on track for first oil in 2025 and Hess expects to hold production at approximately 200,000 barrels of oil equivalent per day for nearly a decade

- The final development plan for Uaru was submitted in November and awaiting approval by the Government of Guyana

Q & A sessions,

Exploration Update

- The Fangtooth discovery had 164 feet of pay, and the Fangtooth Southeast well had 200 feet of oil-bearing pay.

- Additional prospects like Lancetfish and Basher could lead to potential future oil development.

- The company will continue to appraise and explore the deep in the coming years.

Impact of Severe Weather

- Severe snowfall and wind chill delayed bringing new wells online, resulting in a significant impact on production.

- The company is in recovery mode and expects to recover in Q4 2022.

- The Bakken is on a steady build to reach the 200,000 barrel a day average in 2025, with wells performing as expected.

Return Framework

- The company will prioritize dividend increase and share repurchases to return up to 75% of cash to shareholders.

- The company believes in buying shares in advance of significant cash flow growth and NAV accretion from FPSOs.