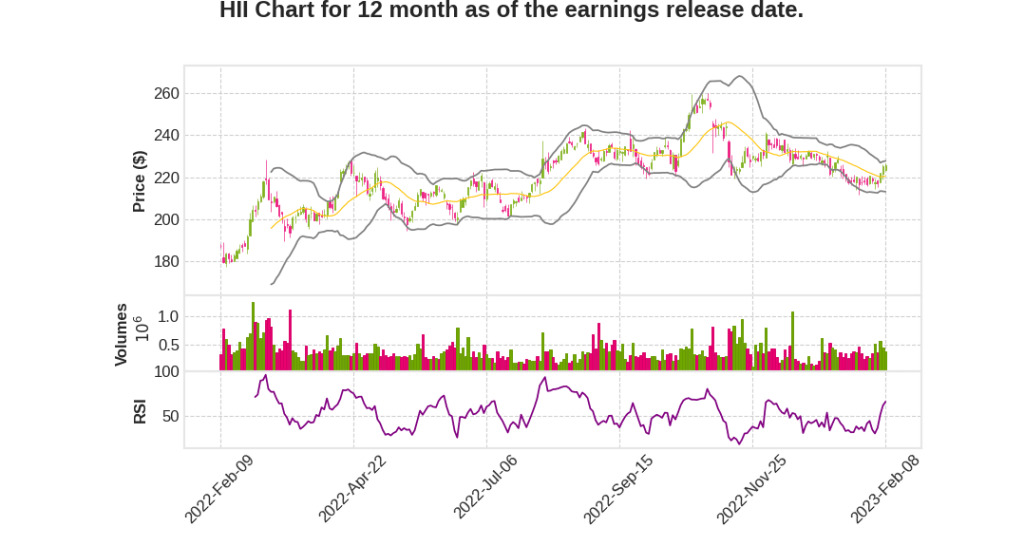

Huntington Ingalls Industries, Inc.

CEO : Mr. Christopher D. Kastner

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 5.0% YoY | -12.5% | 2.7% | 2023-02-09 |

Tom Stiehle says,

Revenue Growth

- Q4 revenues increased by 5% YoY to $2.8 billion, driven by higher revenue across all three segments.

- Full-year revenues were $10.7 billion, up 12.1% YoY, due to year-over-year growth at all three segments.

Operating Income and Margin

- Q4 operating income decreased by $15 million to $105 million, primarily due to lower segment operating income.

- Full-year operating income was $565 million, up from $513 million in 2021, driven by year-over-year improvement at all three segments.

- Q4 operating margin was 3.7% compared to 4.5% in the previous year. Full-year operating margin was 5.3% compared to 5.4% in 2021.

Shipbuilding Segment

- Ingalls 2022 revenues increased by 1.7% from 2021, driven primarily by higher revenues in the LHA and DDG programs.

- Newport News 2022 revenues increased by 3.3% from 2021, primarily due to higher revenues in both aircraft carriers and submarines.

- 2022 Shipbuilding margin of 7.7% was consistent with the performance of 2021, but lower than expected due to labor challenges, inflation impact, and supply chain disruption.

- 2023 Shipbuilding revenue growth of approximately 3% is expected, with the 2023 outlook range of $8.4 billion to $8.6 billion, acknowledging uncertainties around labor challenges.

Mission Technologies Segment

- 2022 revenues increased by 61.7% YoY, primarily driven by the acquisition of Alion in Q3 2021.

- 2023 revenue of approximately $2.5 billion is expected, with organic growth of approximately 5% YoY.

- 2023 operating margins between 2.5% and 3% and EBITDA margins between 8% and 8.5% are expected.

Free Cash Flow

- 2022 cash from operations was $766 million and free cash flow was $494 million.

- 2023 free cash flow expectation impacted by the delay of planned COVID-19 repayment and timing difference, with the first quarter likely to be an outflow of $200 million to $300 million.

- Reaffirming the $2.9 billion target for free cash flow through 2024.

Outlook and Capital Deployment

- 2023 outlook range for Shipbuilding revenue growth is $8.4 billion to $8.6 billion.

- 2023 operating margin expected to be between 7.7% and 8% for Shipbuilding and between 2.5% and 3% for Mission Technologies.

- Capital expenditures for 2023 expected to be approximately 3% of sales.

- Capital allocation priorities focused on debt paydown and returning substantially all free cash flow after planned debt repayment to shareholders through 2024.

Chris Kastner says,

Record Sales and Earnings

- HII reported record sales of $10.7 billion and net earnings of $579 million in 2022.

- Free cash flow for the year was $494 million.

Backlog and Growth

- The demand for HII’s products led to a tremendous backlog of $47 billion.

- Sales and earnings grew across all three segments in 2022, setting a foundation for continued growth in 2023 and beyond.

- 2023 milestones are being maintained, demonstrating growing confidence in ship schedules and providing a solid platform to improve cost performance.

Operational Focus Areas

- Hiring and workforce development remain the top operational priority, with plans for retention and training strategies.

- Inflation has impacted HII across all programs, but they have some installation through contracting terms and conditions.

- The supply chain is stabilizing, and HII has worked closely with customers and suppliers to achieve the best possible schedules.

- With labor and supply chain impacts continuing to stabilize and inflation abating, HII believes they have the opportunity for improved performance over the next few years.

Budget Environment

- The fiscal year 2023 Defense Appropriations and Defense Authorization Bills strongly support Shipbuilding, including funding and authority for additional DDG 51 Flight III ships, Virginia-class attack submarines, Columbia-class ballistic missile submarine program, Ford-class nuclear aircraft carrier programs, and refueling and complex overhaul of CVN 74 John C. Stennis.

- Bipartisan congressional support for HII programs continues, with the Defense Authorization Act requiring a naval fleet of no less than 31 operational amphibious warships, including a minimum of 10 amphibious assault ships.

Q & A sessions,

Impact of Block IV and V on Newport News Portfolio

- Completion of Block IV boats will help minimize portfolio mix at Newport News

- Block V has higher profit potential and will dominate the portfolio mix going forward

Working Capital and Free Cash Flow

- Working capital decreased to 6.1% in 2022 from 10% in the previous year

- Expectation of working capital to be in the mid-6s for 2023

- Free cash flow increased to $494 million in 2022 from an expectation of $300 million to $350 million

- Expected to be around $425 million in 2023 with deliveries and launches

Mission Technologies and HII Family Integration

- Guiding growth year-over-year with expected revenue growth of 4% for Mission Technologies from 2021 to 2022

- Conservative guidance of 8% to 8.5% for EBITDA margin

- Expecting growth with mature pipeline, bids, execution, and performance

Shipbuilding Margin and Revenue Growth

- Incremental improvement in Shipbuilding margin with revenue growth from backlog

- Expectation of at least 3% revenue growth going forward

- Both yards are in good rhythm with several programs underway

Impact of COVID and Labor Shortfall

- Shortfall of labor caused drag on overhead and cost of EACs, resulting in a slightly lower than expected EBITDA margin in Q4

- Newport News team performed well despite challenges of COVID and labor shortfall