Hologic, Inc.

CEO : Mr. Stephen P. MacMillan

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

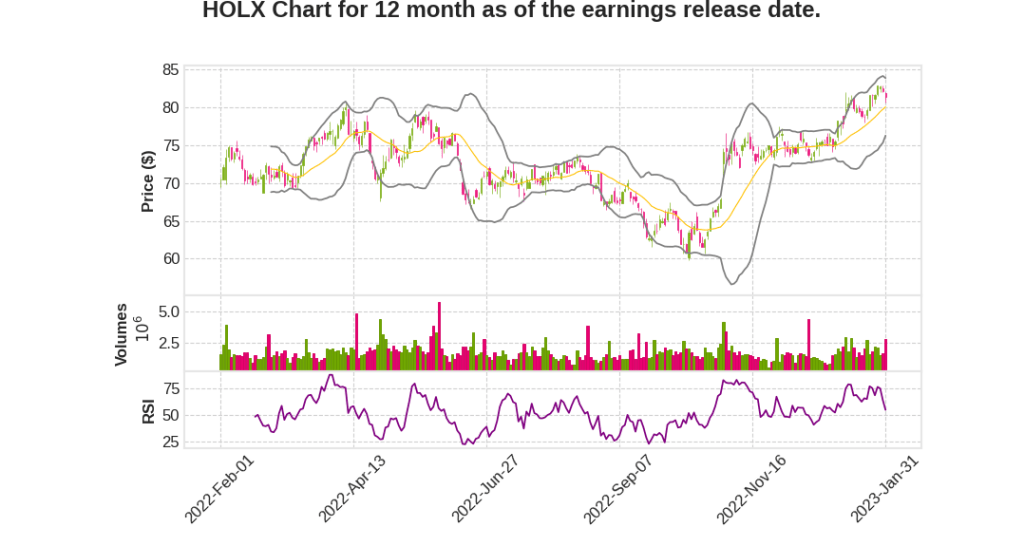

| 2023 Q1 | -27.0% YoY | -58.9% | -61.4% | 2023-02-01 |

Stephen MacMillan says,

Financial Results and Guidance

- Total revenue for Q1 2023 was $1.07 billion, which exceeded the high end of the guidance.

- Non-GAAP earnings per share for Q1 2023 was $1.07, which exceeded the high end of the guidance.

- Hologic repurchased 1.5 million shares of stock for $100 million in Q1 2023.

- For the full year, Hologic expects low double-digit organic growth ex-COVID in all three franchises, exceeding the company’s 5% to 7% long-term growth rate.

Diagnostics Division

- Diagnostics grew 15.8% in Q1 2023, powered by molecular diagnostics which grew 24.5% organically, both figures exclude COVID.

- Hologic has over 3,250 Panthers worldwide, 19 assays, and the Fusion system that enables menu expansion.

- Three acquisitions, Biotheranostics, Diagenode, and Mobidiag, are contributing to Hologic’s growth and are expected to do so further in the future.

Breast Health Division

- Revenue from 3D mammography equipment and related services is the core revenue foundation of the division.

- Growth in the division for fiscal 2023 is primarily driven by the return of chip supply and gantry availability.

- The division is primed for future growth via further portfolio expansion with new markets created and expansion into existing markets.

Surgical Division

- The business has changed dramatically and is now much more diverse.

- NovaSure and core MyoSure still form a strong, durable base of the division.

- Fluent and NovaSure V5 are driving growth through internal R&D efforts.

- Acquisitions, such as Acessa and the Boulder advanced vessel sealing portfolio, are diversifying and elevating the division’s growth trajectory.

International Growth

- International growth rates are expected to be accretive to Hologic’s overall growth rate for years to come.

- In Q1 2023, Diagnostics and Surgical businesses each grew more than 20% ex-COVID internationally.

Karleen Oberton says,

Strong Q1 Performance

- HOLX Q1 results exceeded guidance on both top and bottom lines.

- Revenue of $1.074 billion was more than $100 million higher than the midpoint of guidance.

- Non GAAP EPS was $1.07, more than $0.20 higher than the midpoint of prior guide.

Diagnostics Business

- Total revenue of $559.3 million declined 41.2% compared to the prior year.

- Organic diagnostics revenue increased 15.8% in the quarter, excluding COVID assay revenue, related ancillaries, and a small amount of revenue from discontinued products.

- Molecular diagnostics grew nearly 25% in Q1, excluding the impact of COVID.

- BV/CV/TV had another strong quarter, more than doubling revenue compared to the prior year.

Breast Health Business

- Total revenue of $334.2 million was down 5.2%, better than expected.

- Strong demand for mammography equipment and improving semiconductor chip supply.

- Expect gradual improvement in breast imaging business throughout 2023.

Surgical Business

- First quarter revenue of $154.1 million grew more than 17%.

- Low double digit organic growth for fiscal 2023 will be driven by a combination of MyoSure, the related FluentFluid Management System and our laparoscopic portfolio of Acessa and Boulder.

Updated Financial Guidance

- Organic guidance excludes acquisition revenue until each deal annualizes. Therefore, all deals are part of our organic base starting in Q2, 2023.

- Expect total revenue in the range of $930 million to $980 million for Q2, 2023.

- Expect total revenue of $3.85 billion to $4 billion for the full year fiscal 2023, reflecting low double digit organic growth ex-COVID across each of our divisions.

- Non GAAP EPS expected to be $0.80 to $0.90 in Q2 and $3.55 to $3.85 for the full year.

Q & A sessions,

Holx Q1 2023 Earnings Call Transcript Highlights

- Long-term value creation: The company is focused on long-term value creation from an earnings standpoint rather than just revenue. They are looking for sustained growth and profitability rather than short-term market gains.

- Patience with liquid biopsy: The company is not rushing into liquid biopsy despite the hype that it will be the next big thing in the industry. They are watching the space and waiting for winners to emerge before investing heavily.

- EPS over revenue: Holx is focusing on earnings per share (EPS) rather than just revenue growth, as they believe that companies that generate top-line revenue without bottom-line profitability will not receive the same valuation multiple when combined with a healthy company.

- Prioritizing long-term trajectory: The company is looking for a sustained growth trajectory rather than a short-term revenue gain. They are keeping an eye on the market and trying to identify profitable opportunities in the long-term.

- Letting acquisitions play out: The company is patient with their acquisitions and is letting promising acquisitions develop before making any significant investments. They are looking at long-term value rather than short-term market gains.