Henry Schein, Inc.

CEO : Mr. Stanley M. Bergman

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 1.2% YoY | -3.8% | -67.0% | 2023-02-16 |

Stanley Bergman says,

Financial Results

- Strong growth in earnings for Q4 2022 and the full year of 2022

- 5% internal growth in local currencies, excluding PPE products and COVID-19 test kits

- Overcame significant headwinds from lower sales of PPE products and COVID-19 test kits

BOLD+1 Strategic Plan

- Advanced one distribution strategy to enhance customer experience and improve operational efficiency

- Created North American distribution group and international distribution group

- Strengthened dental position with national DSOs and expanded medical position with IDNs and large group practices

- Created global digital team and made progress designing and building global e-commerce platform

Mergers and Acquisitions

- Acquired Midway Dental in the U.S. and Condor Dental in Switzerland

- Acquired majority stake in Unitas and announced plans to acquire majority stake in Biotech Dental

Guidance for 2023

- Operating income growth in high single digits to low double-digit percentage range when excluding contributions from PPE products and COVID-19 test kits

- Anticipate impact of lower selling prices of PPE products and reduced demand from COVID-19 test kits will largely be offset by earnings momentum in underlying core businesses

Dental Distribution Business

- Merchandise sales in North America grew slightly when excluding sales of PPE and taking out sales from 53rd week

- Global dental consumable merchandise growth impacted by high incidence of flu and COVID-19 cases

- Demand for dental equipment in North America remains healthy, and North American equipment order book is stable

Ronald South says,

LCI Sales Growth

- Fourth quarter global LCI sales decreased by 1.8% versus the prior year, but when excluding sales of PPE products and COVID-19 test kits, our LCI sales grew 5%.

- LCI growth figures will exclude the estimated extra week of sales to facilitate more meaningful comparisons.

Operating Margin

- GAAP operating margin for the fourth quarter of 2022 was 2.15%, a 387 basis point decline compared with the prior year GAAP operating margin.

- Non-GAAP operating margin for Q4 was 6.74%, a 56 basis point improvement compared with the prior year non-GAAP operating margin.

Net Income

- Fourth quarter 2022 GAAP net income was $47 million or $0.34 per diluted share compared with prior year GAAP net income of $147 million or $1.05 per diluted share.

- Fourth quarter 2022 non-GAAP net income was $165 million or $1.21 per diluted share compared with prior year non-GAAP net income of $151 million or $1.07 per diluted share.

Share Repurchase

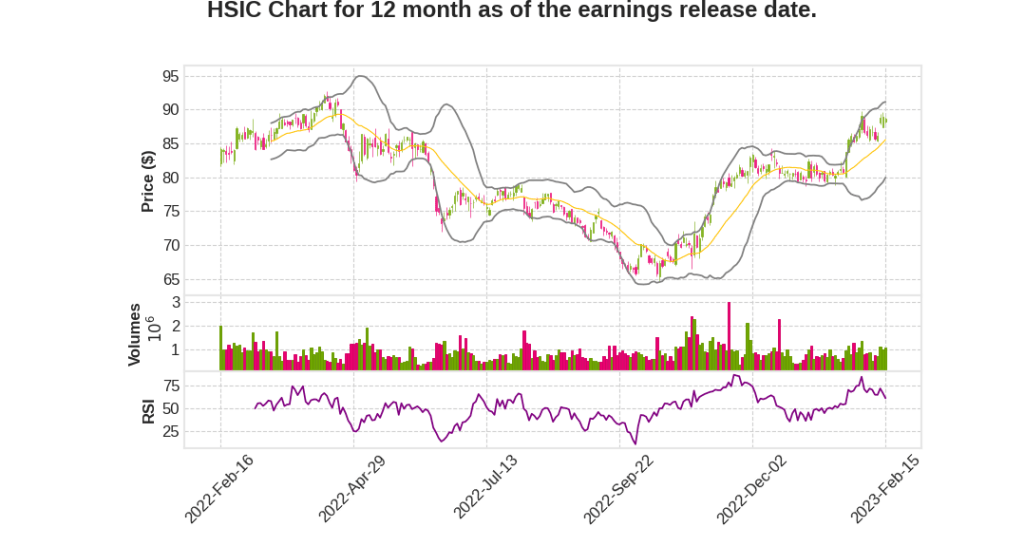

- Henry Schein, Inc. repurchased approximately 3.6 million shares of common stock in the open market during the fourth quarter, buying at an average price of $79.55 per share for a total of $285 million.

- For the full year, the company spent $485 million to repurchase 6.1 million shares.

2023 Financial Guidance

- Henry Schein, Inc. expects non-GAAP diluted EPS attributable to be in the range of $5.25 to $5.42 per share, reflecting growth of negative 2% to positive 1% compared with 2022 non-GAAP diluted EPS of $5.38.

- 2023 guidance assumes total sales growth of approximately 1% to 3% over 2022, with sales of COVID-19 test kits declining approximately 35% to 40% from sales in 2022.

- In the aggregate, revenues of PPE products and COVID-19 test kits are expected to decrease approximately 30% to 35% from 2022.

- For 2023, Henry Schein, Inc. expects non-GAAP operating margin to be 10 to 15 basis points below our 2022 non-GAAP operating margin of 8.2%.

Q & A sessions,

Impact of Dental and Medical Visits

- Dental visits experienced a dip in Q4 2022 in the US and Europe, but there has been a recovery in January.

- Medical visits increased due to flu tests, but overall visits have returned to pre-flu levels in the first quarter of 2022.

Dental Market Stability

- The dental market in the developed world is stable.

- Specialty products are stable, but there are seasonal adjustments due to flu tests.

- The consumable markets in the developed world are relatively stable.

- Traditional equipment is stable, but there are ups and downs in the digital area, specifically in the scanner market.

- The mill market has come to a halt, and dentists are now looking into 3D printing.

Medical Market Migration

- There is a migration from the acute care setting to same-day procedures, and HSIC is benefiting from this trend.

Scanner Market Mix Change

- There is a mix to lower-priced scanner products rather than deflation of a particular manufacturer’s existing products, although there could be some of that.

- We estimate that about 20% to 25% of people in the developed world have one of these scanner devices, and we think that’s going to be standard of care within the next couple of years.

Backlogs and Equipment

- Backlogs are good in both North America and internationally, and the traditional equipment market seems to be quite strong.

- The mill market has significantly come down due to dentists exploring 3D printing options.

- The lab mills market seems to be relatively strong, and HSIC is the largest provider of products to dental laboratories.