IDEX Corporation

CEO : Mr. Eric D. Ashleman

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

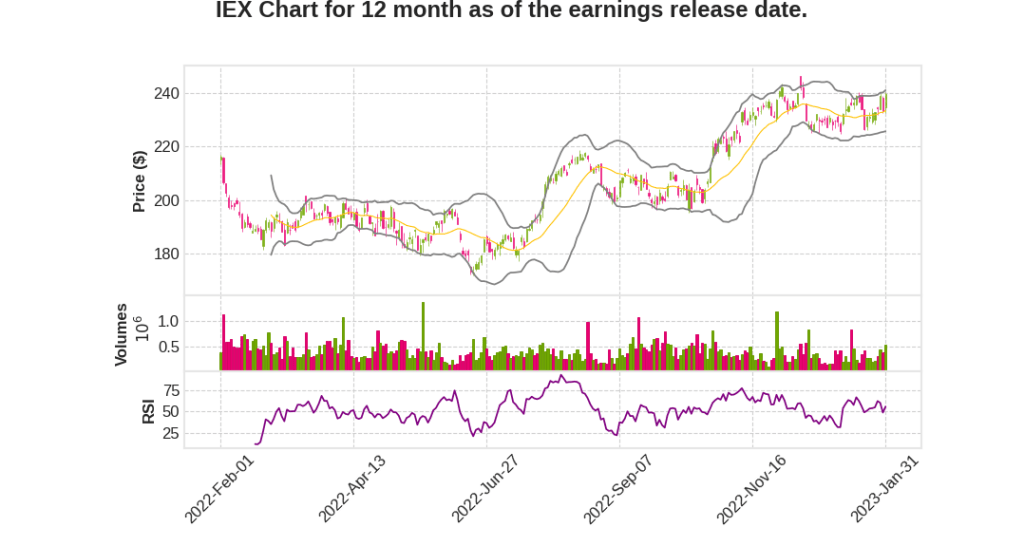

| 2022 Q4 | 13.4% YoY | 9.1% | 10.3% | 2023-02-01 |

Eric Ashleman says,

Record Financial Results in 2022

- Double-digit organic growth every quarter

- All 3 segments achieved record sales levels

- Record profitability driven by solid execution

Capital Deployment

- Record $950 million deployed for acquisitions of Nexsight, KZValve, and Muon Group

- Invested in core business to increase capacity and drive productivity

- Repurchased 795,000 shares of IDEX stock for $148 million

Outlook for 2023

- Strong backlog positions

- Leveraging innovative technologies for targeted growth opportunities

- Healthy price carryover in addition to new price actions

- Opportunity to drive strong productivity through the application of the IDEX operating model

- Uncertain period of transition due to limited visibility and new dynamics around order patterns and customer delivery timing

- Pockets of demand softness expected

M&A and Organic Investment

- Balance sheet has ample capacity to support M&A strategy and organic reinvestment

- Extended M&A and strategy team building conviction around best opportunities

- Funnel is strong and of high quality

- Identified areas for organic investment to expand capacity, capture market share, and drive operational productivity

Overall Positioning

- IDEX is exceptionally well-positioned to outperform as we move forward

- Agility, resiliency, and fundamental ability to execute

Eric Ashleman says,

Factors Affecting Order Patterns in IDEX

- The majority of order patterns are generated automatically with minimal human intervention.

- The two main factors driving order patterns are lead times and volatility.

- Lead times and volatility can impact demand requirements throughout the system.

- Calibration of inventory positions and resources is important to manage the impact of these factors.

Impact on IDEX

- Normalization of lead times and volatility can have an impact on short-cycle businesses like IDEX.

- The impact is expected to be limited as most of the products are customized and do not stock well.

- Monitoring end market demand is crucial to manage the impact on IDEX.

Q & A sessions,

Refocusing on Foundational Practices and Tools

- 2023 focus areas include refocusing on foundational practices and tools

- Exit from intense years of double-digit organic growth within an environment of temporal barriers and obstacles

- Double down on the core execution elements that make us an excellent company

- Optimize process-driven fundamental business practices to best support future growth and outperformance

Growing Talent at a Faster Rate

- Committed to growing talent at an even faster rate to fuel future IDEX growth

- Excellent execution is led by incredible leaders around the world who are committed to our core values

- Diversity, equity and inclusion continues to be an area of focus

- Recent departure of Melissa Aquino as the new leader of the FMT and FSD segments

Deploying Additional Capital in 2023

- Deployed $1.5 billion over the last 2 years on high-quality growth businesses

- Look forward to deploying additional capital in 2023

- M&A team has made tremendous progress identifying compelling portfolio extensions

- Strong operating cash flow and balance sheet put us in a great position to continue to capitalize on those opportunities

Short-term Economic Picture

- No significant impact on IDEX’s business as of Q4 2022

- Temporally affected by exposure in Q4 and some carry into Q1

- Bellwethers on the industrial side have not been affected

- Back half of the year is more of a macro call in terms of the floor and top end of the range for all of IDEX

PE Activity and Valuations

- IDEX is fishing in a high-quality universe with strategic conviction

- Competition with PE for high-quality properties

- Less activity competitively or people that have been able to raise funding and be in the game

- Valuations overall still pretty rich